- Hong Kong

- /

- Metals and Mining

- /

- SEHK:323

Investors in Maanshan Iron & Steel (HKG:323) from five years ago are still down 55%, even after 6.0% gain this past week

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the Maanshan Iron & Steel Company Limited (HKG:323) share price is a whole 69% lower. That's not a lot of fun for true believers. And some of the more recent buyers are probably worried, too, with the stock falling 37% in the last year. On the other hand, we note it's up 9.8% in about a month. But this could be related to good market conditions, with stocks up around 5.4% during the period.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Maanshan Iron & Steel

Given that Maanshan Iron & Steel didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Maanshan Iron & Steel grew its revenue at 7.0% per year. That's a fairly respectable growth rate. The share price return isn't so respectable with an annual loss of 11% over the period. That suggests the market is disappointed with the current growth rate. A pessimistic market can create opportunities.

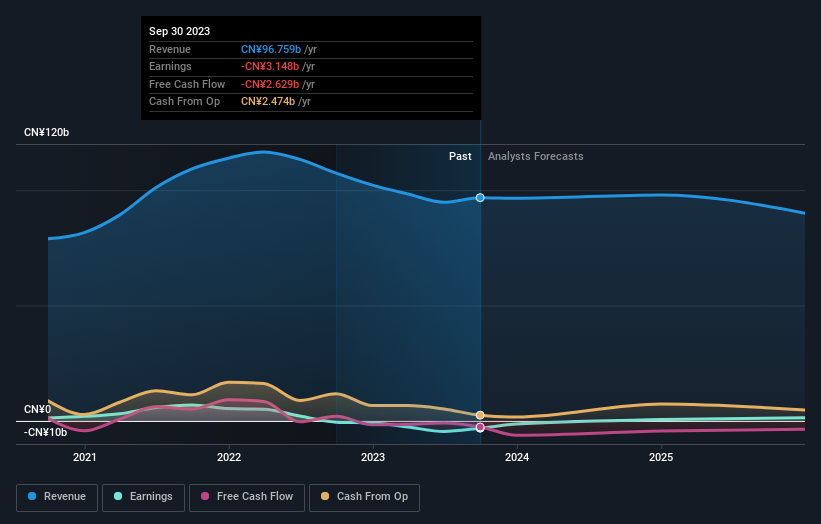

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Maanshan Iron & Steel in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Maanshan Iron & Steel, it has a TSR of -55% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Maanshan Iron & Steel shareholders are down 36% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 14%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. You could get a better understanding of Maanshan Iron & Steel's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:323

Maanshan Iron & Steel

Manufactures and sells iron and steel products, and related by-products in Mainland China, Hong Kong, and internationally.

Fair value with moderate growth potential.