- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1277

3 Undervalued Small Caps In Hong Kong With Insider Buying

Reviewed by Simply Wall St

The Hong Kong market has seen a mix of volatility and recovery, with the Hang Seng Index recently gaining 0.85% despite broader concerns about deflationary pressures in China. Amid these fluctuating conditions, small-cap stocks can offer unique opportunities for investors looking to capitalize on undervalued assets. In this environment, identifying small-cap stocks with strong fundamentals and insider buying activity can be particularly promising.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ever Sunshine Services Group | 5.5x | 0.4x | 37.36% | ★★★★★☆ |

| Lee & Man Paper Manufacturing | 6.7x | 0.4x | 35.77% | ★★★★★☆ |

| Nissin Foods | 13.1x | 1.2x | 43.73% | ★★★★☆☆ |

| Kinetic Development Group | 4.4x | 1.9x | 22.84% | ★★★★☆☆ |

| FriendTimes | NA | 0.9x | 14.68% | ★★★★☆☆ |

| Comba Telecom Systems Holdings | 348.6x | 0.4x | 46.50% | ★★★★☆☆ |

| Wasion Holdings | 11.5x | 0.8x | 39.86% | ★★★☆☆☆ |

| Skyworth Group | 5.3x | 0.1x | -239.12% | ★★★☆☆☆ |

| China Leon Inspection Holding | 9.6x | 0.7x | 37.33% | ★★★☆☆☆ |

| Truly International Holdings | 11.5x | 0.2x | 42.39% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

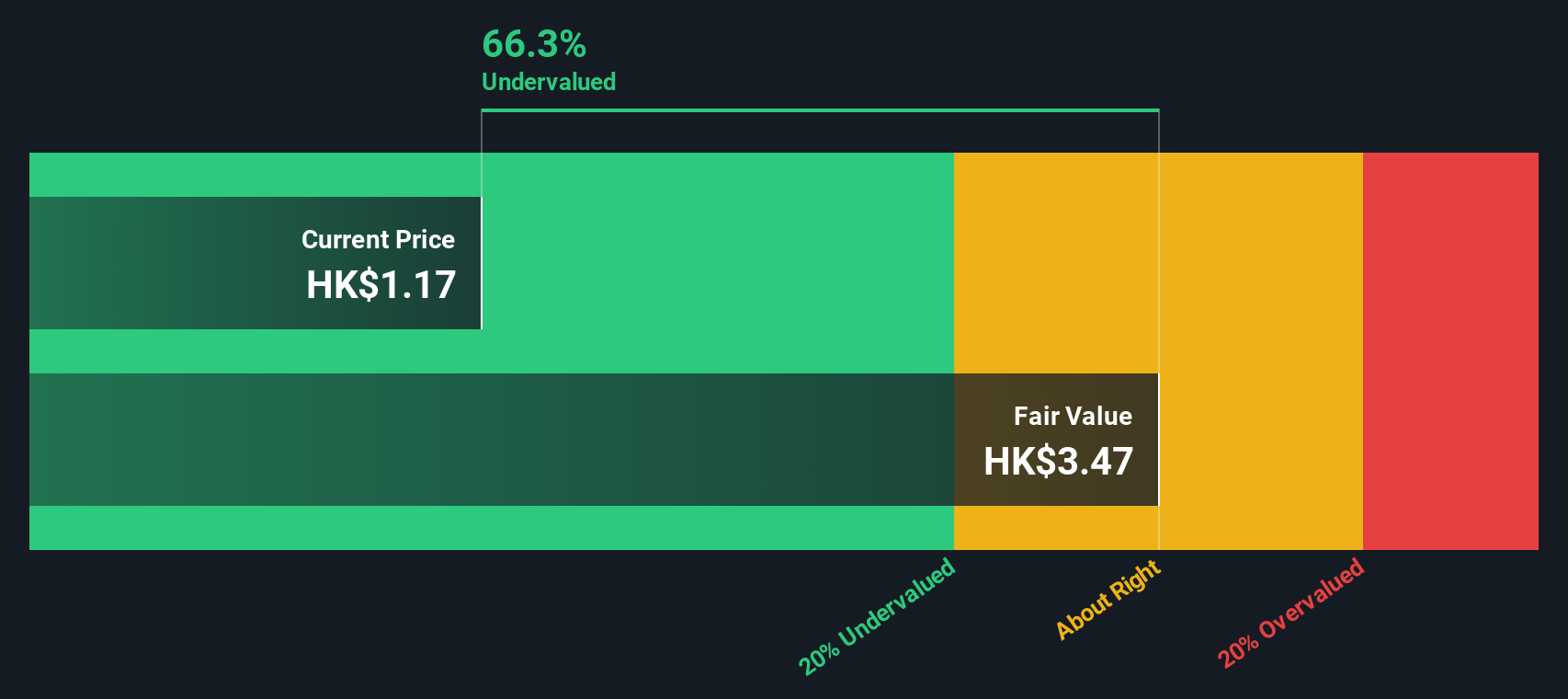

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kinetic Development Group is engaged in property development, investment, and management with a market cap of CN¥2.56 billion.

Operations: Kinetic Development Group's revenue streams are primarily derived from its core operations, with a notable gross profit margin reaching 67.35% as of March 2022. The company has experienced fluctuations in net income, peaking at CN¥2.91 billion in June 2022. Operating expenses have varied but were recorded at CN¥294.71 million by December 2023, while non-operating expenses showed a significant reduction to CN¥430.50 million in the same period.

PE: 4.4x

Kinetic Development Group, a small cap in Hong Kong, shows potential for growth despite its higher-risk funding structure reliant on external borrowing. Insider confidence is evident with significant share purchases in Q2 2024. A recent board meeting on July 31 discussed approving a special dividend, reflecting strong cash flow management. Investors may find this company appealing due to its proactive financial strategies and insider confidence, though they should remain cautious of the funding risks involved.

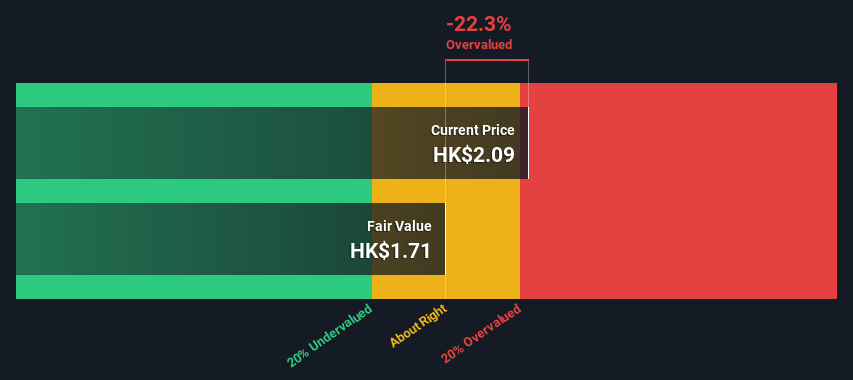

Lee & Man Paper Manufacturing (SEHK:2314)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lee & Man Paper Manufacturing is a company involved in the production of pulp, tissue paper, and packaging paper with a market cap of HK$16.52 billion.

Operations: Lee & Man Paper Manufacturing generates revenue from pulp, tissue paper, and packaging paper, with the latter being the largest contributor. The company's gross profit margin peaked at 29.08% in Q4 2017 but has seen a decline to 12.49% by Q2 2024. Operating expenses primarily include general and administrative costs along with sales and marketing expenses.

PE: 6.7x

Lee & Man Paper Manufacturing, a small cap in Hong Kong, has shown strong insider confidence with significant share purchases since June 2024. The company reported sales of HK$12.51 billion and net income of HK$805.69 million for the first half of 2024, up from last year’s figures. They also declared an interim dividend of HK$0.062 per share with payment on September 5, 2024. With a focus on enhancing net asset value through repurchases, Lee & Man demonstrates promising potential despite its reliance on external borrowing for funding.

- Dive into the specifics of Lee & Man Paper Manufacturing here with our thorough valuation report.

Understand Lee & Man Paper Manufacturing's track record by examining our Past report.

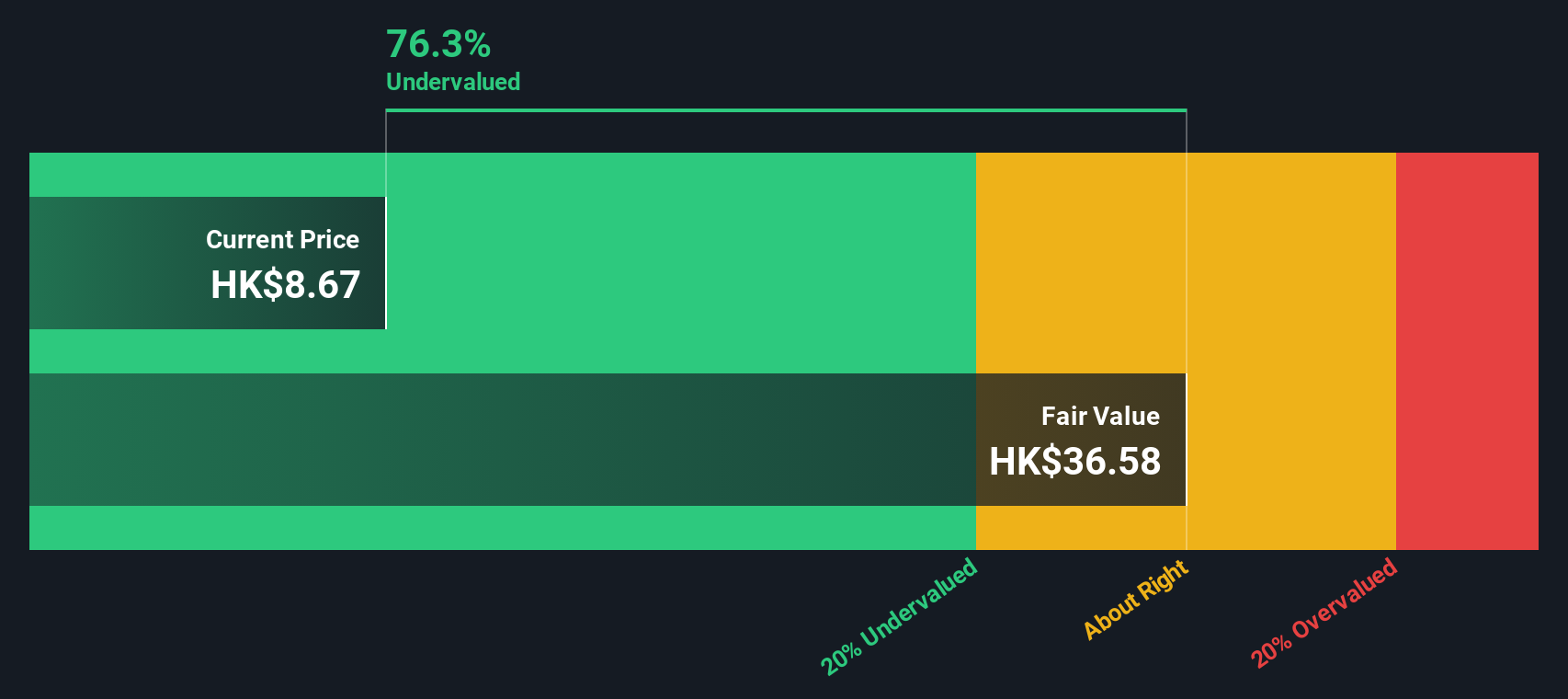

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wasion Holdings specializes in the development and manufacturing of advanced metering infrastructure and distribution operations, with a market cap of approximately CN¥3.82 billion.

Operations: The company generates revenue from three main segments: Advanced Distribution Operations, Power Advanced Metering Infrastructure, and Communication and Fluid Advanced Metering Infrastructure. Its gross profit margin has shown an upward trend recently, reaching 35.59% in the latest period.

PE: 11.5x

Wasion Holdings has recently secured significant contracts worth EUR 31.62 million in Hungary and USD 15.16 million across Singapore and Malaysia, reflecting its growing international presence. Founder and Executive Chairman Wei Ji's purchase of 500,000 shares for HKD 3.17 million in July shows insider confidence in the company's future prospects. Despite relying solely on external borrowing, Wasion's earnings are projected to grow by 25.8% annually, highlighting its potential as an undervalued small cap stock in Hong Kong.

- Unlock comprehensive insights into our analysis of Wasion Holdings stock in this valuation report.

Gain insights into Wasion Holdings' historical performance by reviewing our past performance report.

Summing It All Up

- Click through to start exploring the rest of the 10 Undervalued SEHK Small Caps With Insider Buying now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetic Development Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1277

Kinetic Development Group

An investment holding company, engages in the extraction and sale of coal products in the People’s Republic of China.

Excellent balance sheet and good value.