Huaxi Holdings (HKG:1689 investor three-year losses grow to 60% as the stock sheds HK$112m this past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Huaxi Holdings Company Limited (HKG:1689) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 61% in that time. The more recent news is of little comfort, with the share price down 39% in a year. The falls have accelerated recently, with the share price down 28% in the last three months.

Since Huaxi Holdings has shed HK$112m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Huaxi Holdings

Huaxi Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

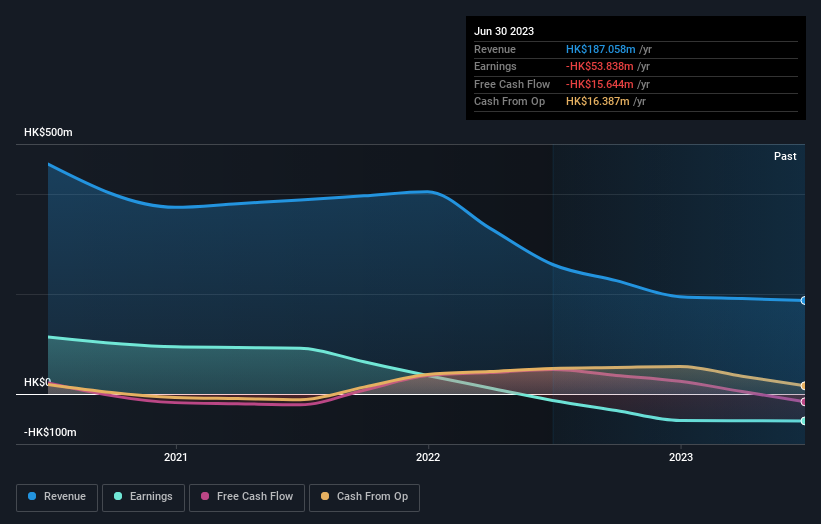

In the last three years Huaxi Holdings saw its revenue shrink by 31% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 17% per year over that time. When revenue is dropping, and losses are still costing, and the share price sinking fast, it's fair to ask if something is remiss. It could be a while before the company repays long suffering shareholders with share price gains.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Huaxi Holdings' earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 7.6% in the twelve months, Huaxi Holdings shareholders did even worse, losing 39%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Huaxi Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Huaxi Holdings (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Huaxi Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1689

Huaxi Holdings

An investment holding company, designs, manufactures, prints, and sells cigarette-related packaging materials in the People’s Republic of China.

Adequate balance sheet low.