3 Asian Stocks That May Be Priced Below Their True Value In October 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious monetary policies and fluctuating economic indicators, Asia's stock markets present intriguing opportunities for investors. In this context, identifying stocks that may be undervalued involves assessing companies with strong fundamentals that are not fully reflected in their current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥84.05 | CN¥165.09 | 49.1% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.88 | 49.8% |

| Takara Bio (TSE:4974) | ¥932.00 | ¥1829.46 | 49.1% |

| Taiwan Union Technology (TPEX:6274) | NT$316.50 | NT$621.45 | 49.1% |

| Meitu (SEHK:1357) | HK$9.27 | HK$18.06 | 48.7% |

| Malee Group (SET:MALEE) | THB5.60 | THB11.01 | 49.1% |

| Devsisters (KOSDAQ:A194480) | ₩48700.00 | ₩95419.63 | 49% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥47.21 | CN¥93.18 | 49.3% |

| Cosmax (KOSE:A192820) | ₩209000.00 | ₩412986.93 | 49.4% |

| Chanjet Information Technology (SEHK:1588) | HK$10.87 | HK$21.51 | 49.5% |

Let's uncover some gems from our specialized screener.

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company that designs, develops, manufactures, and sells skin treatment products featuring recombinant collagen in China, with a market cap of HK$60.51 billion.

Operations: The company generates revenue primarily from its Personal Products segment, which accounts for CN¥6.11 billion.

Estimated Discount To Fair Value: 38.5%

Giant Biogene Holding is trading at HK$56.5, significantly below its estimated fair value of HK$91.85, indicating it is highly undervalued based on discounted cash flows. The company's earnings grew by 27.9% over the past year and are expected to continue growing at 17.3% annually, outpacing the Hong Kong market's average growth rate of 12.7%. Recent half-year results showed sales increased to CNY 3.11 billion from CNY 2.54 billion a year ago, with net income rising to CNY 1.18 billion from CNY 983 million, reflecting strong financial performance despite executive changes in their Nomination Committee.

- Upon reviewing our latest growth report, Giant Biogene Holding's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Giant Biogene Holding's balance sheet by reading our health report here.

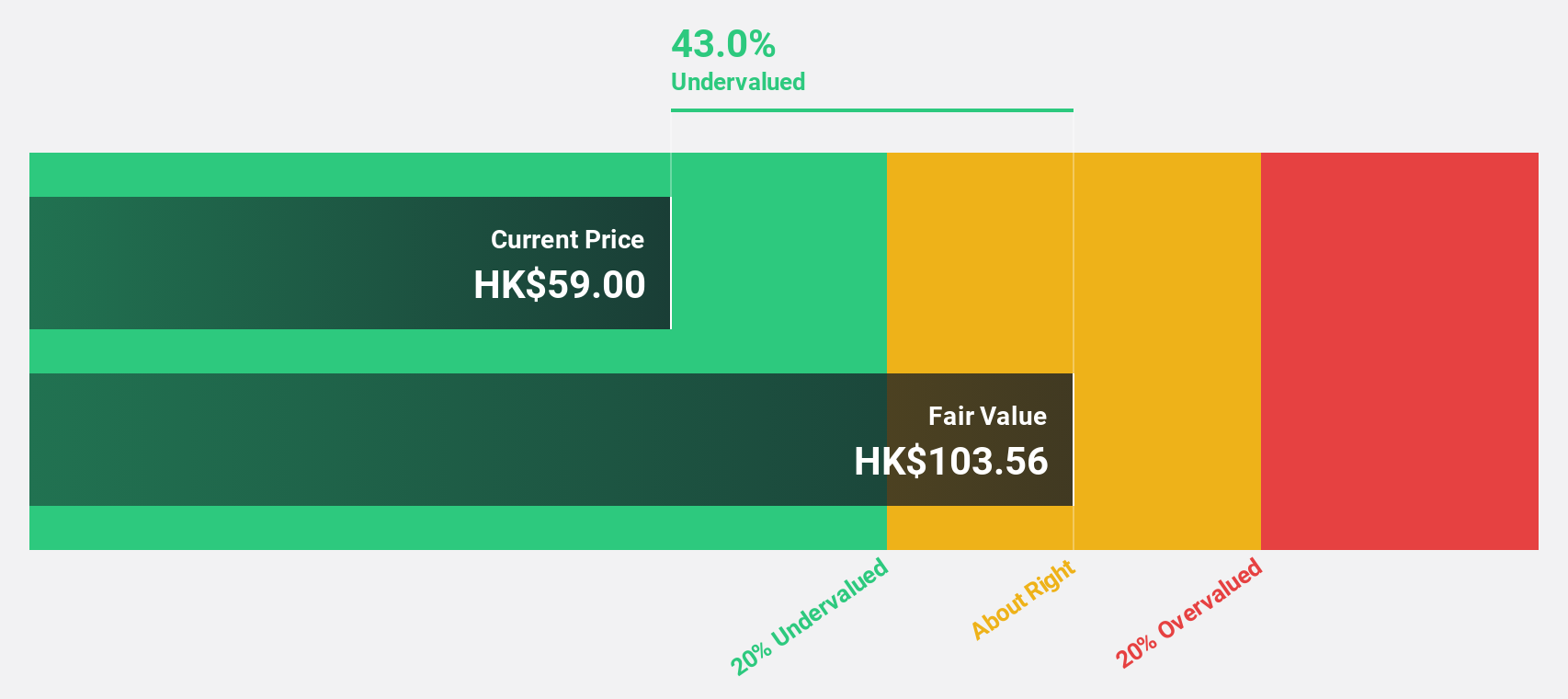

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs in oncology and immunology both in China and internationally, with a market cap of approximately HK$119.86 billion.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, amounting to approximately CN¥1.50 billion.

Estimated Discount To Fair Value: 26%

Sichuan Kelun-Biotech Biopharmaceutical is trading at HK$514, substantially below its estimated fair value of HK$694.37, suggesting it is undervalued based on cash flows. Despite recent financial setbacks with a net loss of CNY 145.18 million for H1 2025, the company shows promise with expected revenue growth of 35.1% annually and anticipated profitability within three years. Recent NDA acceptance for A400/EP0031 reinforces potential future cash flow improvements through innovative drug development in oncology treatments.

- The analysis detailed in our Sichuan Kelun-Biotech Biopharmaceutical growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Sichuan Kelun-Biotech Biopharmaceutical.

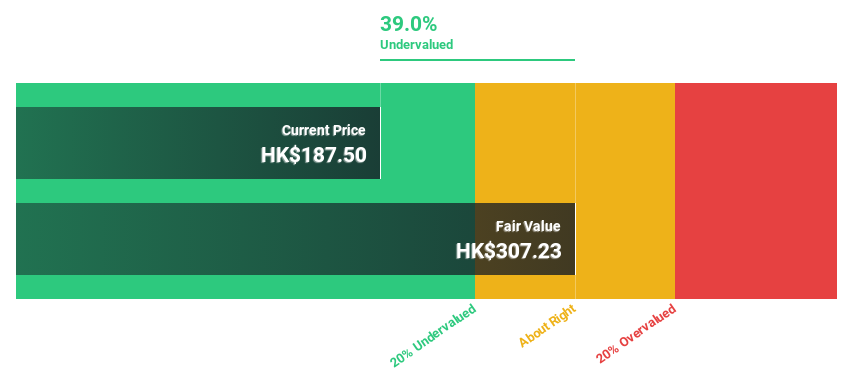

Phison Electronics (TPEX:8299)

Overview: Phison Electronics Corp. designs, manufactures, and sells flash memory controllers and peripheral system applications globally, with a market cap of NT$149.60 billion.

Operations: The company's revenue primarily comes from its Flash Memory Control Chip Design segment, generating NT$58.24 billion.

Estimated Discount To Fair Value: 46.8%

Phison Electronics, trading at NT$724, is significantly undervalued based on discounted cash flow analysis with an estimated fair value of NT$1361.76. Despite a decline in net income to NT$744.58 million for Q2 2025 from the previous year, Phison's strategic partnerships are enhancing its market position and product offerings in high-performance storage solutions. Forecasted earnings growth of 25.3% per year surpasses the Taiwan market average, underscoring potential future cash flow strength despite current profitability challenges.

- In light of our recent growth report, it seems possible that Phison Electronics' financial performance will exceed current levels.

- Take a closer look at Phison Electronics' balance sheet health here in our report.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 291 more companies for you to explore.Click here to unveil our expertly curated list of 294 Undervalued Asian Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6990

Sichuan Kelun-Biotech Biopharmaceutical

A biopharmaceutical company, engages in the research and development, manufacturing, and commercialization of novel drugs in oncology, immunology, and other therapeutic areas in the People’s Republic of China and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives