- Hong Kong

- /

- Healthcare Services

- /

- SEHK:3689

Guangdong Kanghua Healthcare (HKG:3689) sheds HK$104m, company earnings and investor returns have been trending downwards for past five years

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Guangdong Kanghua Healthcare Co., Ltd. (HKG:3689) during the five years that saw its share price drop a whopping 72%. The last week also saw the share price slip down another 14%.

If the past week is anything to go by, investor sentiment for Guangdong Kanghua Healthcare isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Guangdong Kanghua Healthcare

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Guangdong Kanghua Healthcare became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 3.4% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

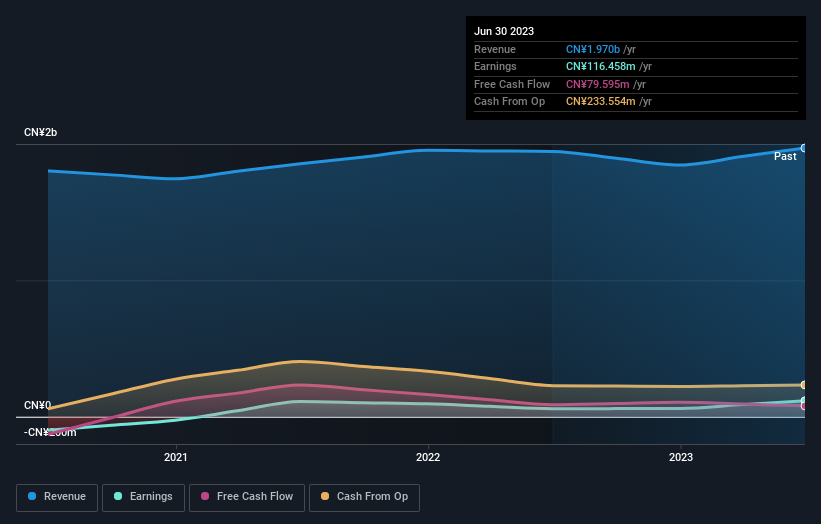

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Guangdong Kanghua Healthcare's financial health with this free report on its balance sheet.

A Different Perspective

Although it hurts that Guangdong Kanghua Healthcare returned a loss of 5.5% in the last twelve months, the broader market was actually worse, returning a loss of 12%. Of far more concern is the 11% p.a. loss served to shareholders over the last five years. While the losses are slowing we doubt many shareholders are happy with the stock. It's always interesting to track share price performance over the longer term. But to understand Guangdong Kanghua Healthcare better, we need to consider many other factors. Even so, be aware that Guangdong Kanghua Healthcare is showing 2 warning signs in our investment analysis , and 1 of those is significant...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3689

Guangdong Kanghua Healthcare

An investment holding company, primarily operates private hospitals in the People’s Republic of China.

Solid track record with excellent balance sheet.