- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1263

Sinopharm Group And 2 More SEHK Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As the Hong Kong market experiences a notable upswing, buoyed by China's recent stimulus measures, investors are increasingly looking towards dividend stocks for stable returns amidst this renewed economic optimism. In such an environment, selecting stocks that consistently deliver dividends can be a strategic move to enhance portfolio resilience and capitalize on potential growth opportunities.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Consun Pharmaceutical Group (SEHK:1681) | 8.03% | ★★★★★☆ |

| China Hongqiao Group (SEHK:1378) | 8.76% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.65% | ★★★★★☆ |

| Lion Rock Group (SEHK:1127) | 8.09% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.10% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.94% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.33% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 6.85% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.33% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.08% | ★★★★★☆ |

Click here to see the full list of 86 stocks from our Top SEHK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Sinopharm Group (SEHK:1099)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinopharm Group Co. Ltd., along with its subsidiaries, operates in the wholesale and retail sectors for pharmaceuticals, medical devices, and healthcare products in China, with a market cap of HK$68.50 billion.

Operations: Sinopharm Group's revenue segments include Pharmaceutical Distribution at CN¥442.11 billion, Medical Devices at CN¥125.75 billion, and Retail Pharmacy at CN¥34.55 billion.

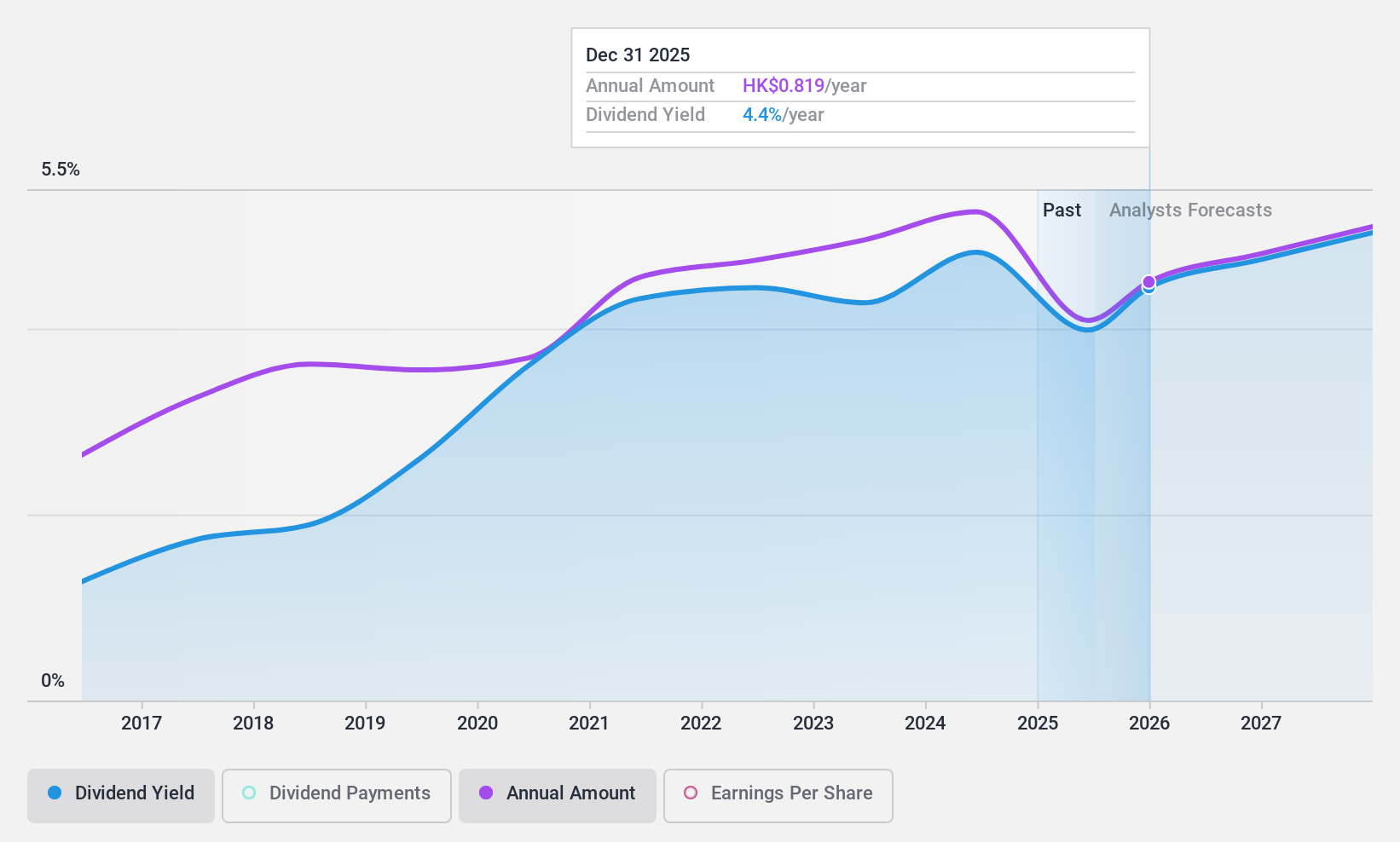

Dividend Yield: 4.3%

Sinopharm Group offers a stable dividend with a yield of 4.33%, supported by a low payout ratio of 31.4% and cash payout ratio of 16%, indicating sustainability. Despite its high debt level, the company's dividends have been reliable and growing over the past decade. Recent executive changes, including appointing Mr. Lian Wanyong as President, may impact future strategic directions but do not currently affect its dividend reliability or coverage by earnings and cash flows.

- Click here to discover the nuances of Sinopharm Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Sinopharm Group is trading behind its estimated value.

PC Partner Group (SEHK:1263)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PC Partner Group Limited is an investment holding company that designs, develops, manufactures, and sells computer electronics with a market cap of HK$1.86 billion.

Operations: The company's revenue primarily comes from the design, manufacturing, and trading of electronics and PC parts and accessories, amounting to HK$9.94 billion.

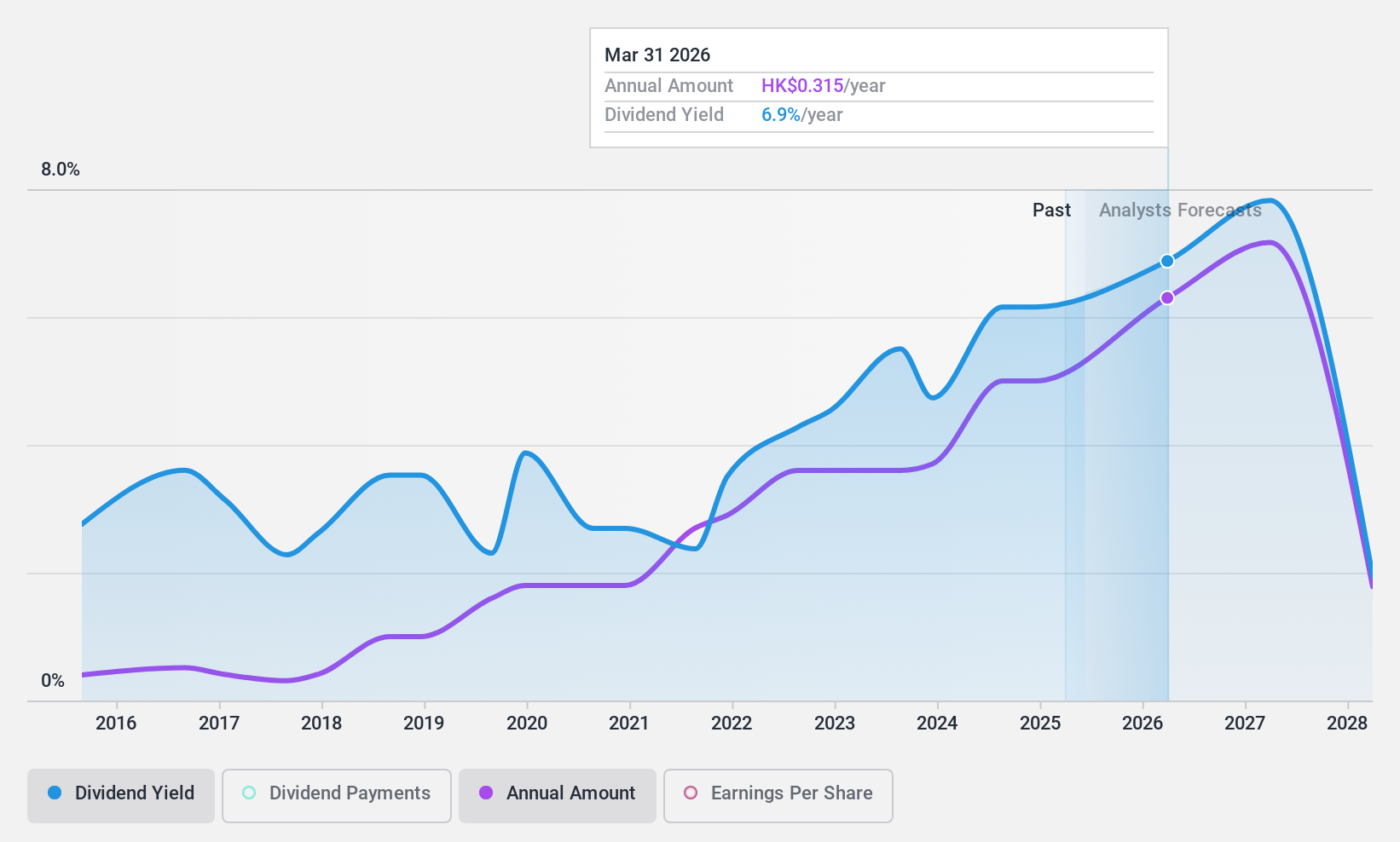

Dividend Yield: 8.3%

PC Partner Group's dividend yield of 8.33% ranks in the top 25% among Hong Kong payers, with dividends covered by earnings (66.1%) and cash flows (7.8%). Despite a volatile and unreliable dividend history over the past decade, recent earnings growth supports sustainability. The company announced an interim dividend of HK$0.2 per share for H1 2024, reflecting improved financial performance with net income rising to HK$194.06 million from HK$20.1 million year-on-year, though it was recently dropped from the S&P Global BMI Index.

- Take a closer look at PC Partner Group's potential here in our dividend report.

- Our valuation report unveils the possibility PC Partner Group's shares may be trading at a discount.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bosideng International Holdings Limited operates in the apparel industry within the People’s Republic of China, with a market cap of approximately HK$50.61 billion.

Operations: Bosideng International Holdings Limited generates its revenue from several segments: Down Apparels (CN¥19.54 billion), Ladieswear Apparels (CN¥819.80 million), Diversified Apparels (CN¥235.33 million), and Original Equipment Manufacturing Management (CN¥2.70 billion).

Dividend Yield: 5.4%

Bosideng International Holdings' dividend payments have grown over the past decade but remain volatile and unreliable. The company recently approved a final dividend of 20 HK cents per share. Despite trading below fair value, its 5.38% yield is lower than top-tier Hong Kong payers. Dividends are covered by earnings (80.4% payout ratio) and cash flows (36.4% cash payout ratio), supported by strong earnings growth of 43.7% last year, enhancing sustainability prospects despite past instability.

- Dive into the specifics of Bosideng International Holdings here with our thorough dividend report.

- According our valuation report, there's an indication that Bosideng International Holdings' share price might be on the cheaper side.

Seize The Opportunity

- Unlock our comprehensive list of 86 Top SEHK Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1263

PC Partner Group

An investment holding company, designs, develops, manufactures, and sells computer electronics.

Flawless balance sheet established dividend payer.