Investors in Nongfu Spring (HKG:9633) have unfortunately lost 8.4% over the last year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Nongfu Spring Co., Ltd. (HKG:9633) share price slid 10% over twelve months. That contrasts poorly with the market decline of 4.0%. Nongfu Spring hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Nongfu Spring

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Nongfu Spring share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

With a low yield of 1.8% we doubt that the dividend influences the share price much. Nongfu Spring's revenue is actually up 12% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

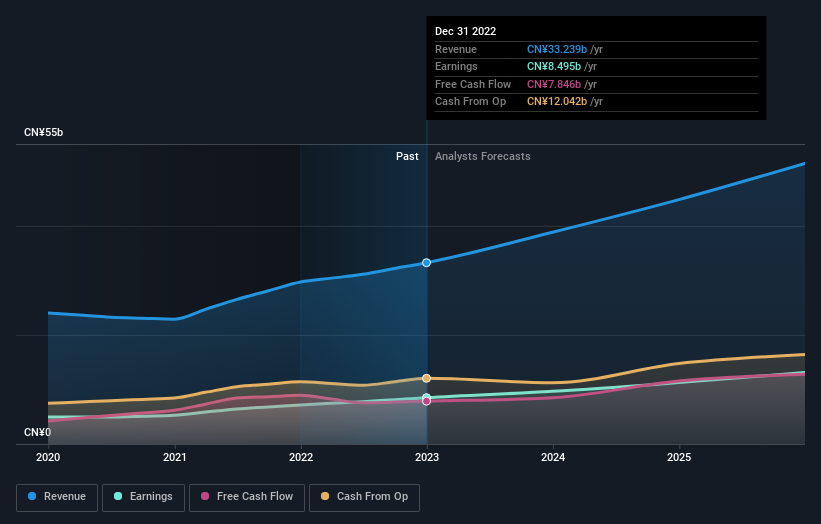

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Nongfu Spring

A Different Perspective

Nongfu Spring shareholders are down 8.4% for the year (even including dividends), even worse than the market loss of 4.0%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 1.0% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Before spending more time on Nongfu Spring it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nongfu Spring might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9633

Nongfu Spring

Researches, develops, produces, and markets packaged drinking water and beverage products primarily in Mainland China.

Outstanding track record with excellent balance sheet.