Earnings Not Telling The Story For Nongfu Spring Co., Ltd. (HKG:9633)

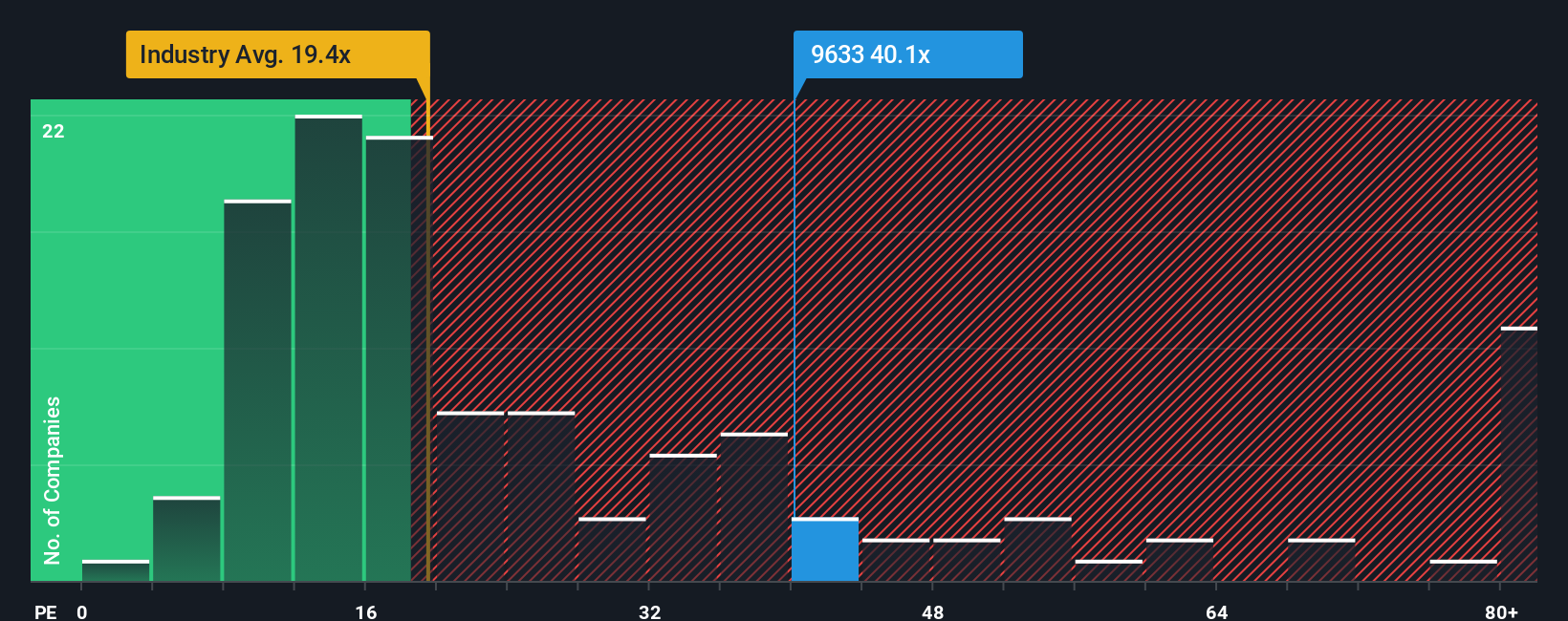

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 12x, you may consider Nongfu Spring Co., Ltd. (HKG:9633) as a stock to avoid entirely with its 40.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Nongfu Spring has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Nongfu Spring

How Is Nongfu Spring's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Nongfu Spring's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 7.7%. Pleasingly, EPS has also lifted 74% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 15% each year, which is not materially different.

In light of this, it's curious that Nongfu Spring's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Nongfu Spring's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Nongfu Spring, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nongfu Spring might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9633

Nongfu Spring

Produces and sells packaged drinking water and beverage products primarily in Mainland China.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives