What You Need To Know About Tianyun International Holdings Limited's (HKG:6836) Investor Composition

The big shareholder groups in Tianyun International Holdings Limited (HKG:6836) have power over the company. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

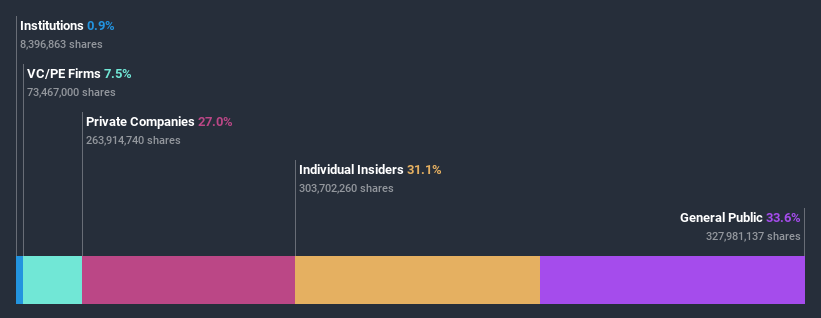

Tianyun International Holdings is a smaller company with a market capitalization of HK$1.5b, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutions don't own many shares in the company. We can zoom in on the different ownership groups, to learn more about Tianyun International Holdings.

View our latest analysis for Tianyun International Holdings

What Does The Lack Of Institutional Ownership Tell Us About Tianyun International Holdings?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

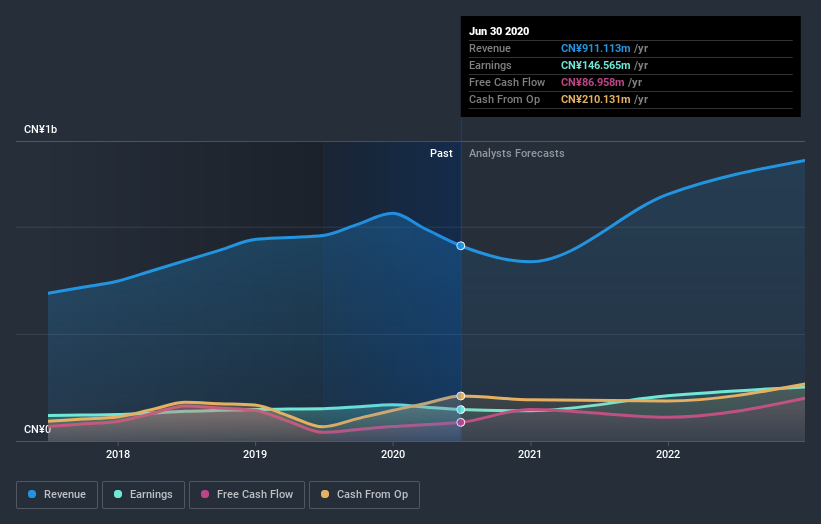

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. Alternatively, there might be something about the company that has kept institutional investors away. Tianyun International Holdings' earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Tianyun International Holdings is not owned by hedge funds. The company's largest shareholder is Sichuan Development Holding Co., Ltd, with ownership of 27%. With 20% and 11% of the shares outstanding respectively, Ziyuan Yang and Xingyu Sun are the second and third largest shareholders. Interestingly, the bottom two of the top three shareholders also hold the title of Chief Executive Officer and Member of the Board of Directors, respectively, suggesting that these insiders have a personal stake in the company.

To make our study more interesting, we found that the top 3 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Tianyun International Holdings

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of Tianyun International Holdings Limited. Insiders own HK$474m worth of shares in the HK$1.5b company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public holds a 34% stake in Tianyun International Holdings. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Equity Ownership

With an ownership of 7.5%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Private Company Ownership

It seems that Private Companies own 27%, of the Tianyun International Holdings stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Tianyun International Holdings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Tianyun International Holdings you should know about.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Tianyun International Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tianyun International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6836

Tianyun International Holdings

An investment holding company, engages in the manufacture and sells processed fruit and beverage products in the People’s Republic of China.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026