- Hong Kong

- /

- Specialty Stores

- /

- SEHK:709

Tibet Water Resources And 2 Other Asian Penny Stocks To Watch

Reviewed by Simply Wall St

As Asian markets continue to navigate a landscape of economic shifts and policy changes, investors are increasingly looking for opportunities that offer both growth and stability. Penny stocks, while often considered speculative, can still present compelling investment prospects when backed by robust financials. In this article, we will examine three such Asian penny stocks that demonstrate potential through their financial health and growth prospects.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.84 | THB3.79B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.00 | HK$2.44B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.56 | HK$964.89M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.67 | SGD271.54M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.76 | THB2.86B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.10 | SGD12.2B | ✅ 5 ⚠️ 1 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.70 | THB9.5B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD4.04 | SGD1.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.46 | SGD172.33M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 969 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Tibet Water Resources (SEHK:1115)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tibet Water Resources Ltd., with a market cap of HK$2.64 billion, is an investment holding company involved in producing and selling water and beer products in the People’s Republic of China.

Operations: The company's revenue is derived from its beer segment, which generated CN¥104.01 million, and its water segment, contributing CN¥151.36 million.

Market Cap: HK$2.64B

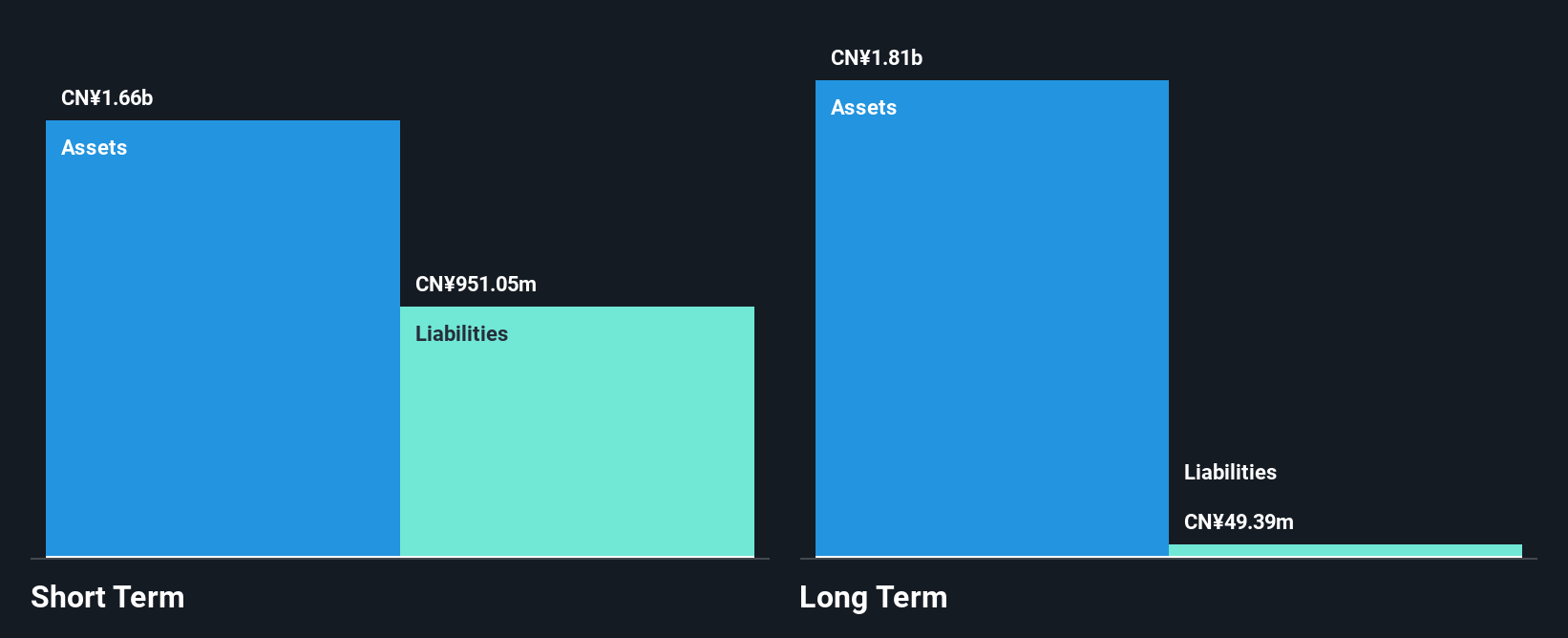

Tibet Water Resources Ltd. has shown promising growth, with half-year sales rising to CN¥168.51 million from CN¥138.82 million the previous year, and net income increasing significantly to CN¥36.19 million. Despite being unprofitable with a negative return on equity of -22.17%, the company maintains a strong cash position, having more cash than total debt and covering both short- and long-term liabilities comfortably with its assets totaling CN¥1.7 billion against liabilities of CN¥951 million short term and CN¥49.4 million long term. Recent leadership changes could influence strategic direction positively given Mr. Chen Di's extensive financial experience.

- Unlock comprehensive insights into our analysis of Tibet Water Resources stock in this financial health report.

- Learn about Tibet Water Resources' historical performance here.

Giordano International (SEHK:709)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Giordano International Limited is an investment holding company involved in the retail and distribution of fashion apparel and accessories for men, women, and children across various regions including Mainland China, Hong Kong, Macau, Taiwan, Southeast Asia and Australia, Gulf Cooperation Council countries as well as internationally; it has a market capitalization of approximately HK$2.60 billion.

Operations: The company's revenue is primarily derived from its operations in Southeast Asia and Australia (HK$1.46 billion), followed by the Gulf Cooperation Council (HK$703 million), Mainland China (HK$698 million), Taiwan (HK$424 million), Hong Kong and Macau (HK$361 million), and wholesale activities to overseas franchisees amounting to HK$307 million.

Market Cap: HK$2.6B

Giordano International's financial stability is underscored by its substantial cash reserves exceeding total debt, and a solid asset base covering both short- and long-term liabilities. Despite a recent dip in net profit margins from 7.2% to 5.5%, the company remains profitable with HK$1,934 million in sales for the first half of 2025, slightly up from last year. Earnings growth has been sluggish over the past year, but Giordano's operating cash flow significantly covers its debt obligations. The dividend yield of 7.45% is not well supported by earnings, suggesting caution for income-focused investors.

- Get an in-depth perspective on Giordano International's performance by reading our balance sheet health report here.

- Understand Giordano International's earnings outlook by examining our growth report.

Yangzijiang Financial Holding (SGX:YF8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yangzijiang Financial Holding Ltd. is an investment holding company involved in investment-related activities in China and Singapore, with a market capitalization of SGD3.79 billion.

Operations: The company's revenue is primarily derived from its Investment Business, which generated SGD288.47 million.

Market Cap: SGD3.79B

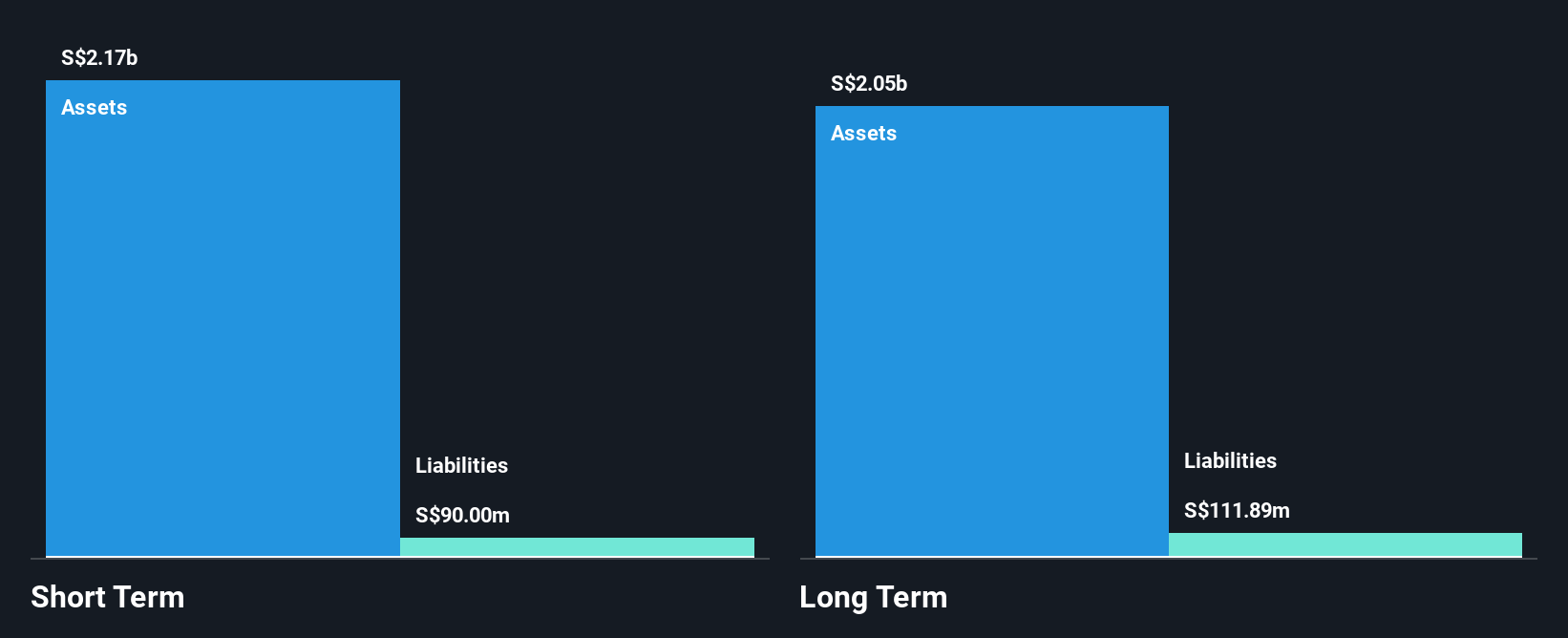

Yangzijiang Financial Holding demonstrates financial robustness with short-term assets of SGD2.2 billion comfortably covering both its short- and long-term liabilities. The company is debt-free, eliminating concerns over interest payments. Its recent earnings growth has been substantial, notably surpassing industry averages, while net profit margins have improved to 48.3%. Despite a low return on equity at 8.5%, the firm trades at a favorable price-to-earnings ratio of 11.3x compared to the broader Singapore market. Recent developments include the spin-off of its maritime investments into Yangzijiang Maritime Development Pte., which may influence future strategic directions without affecting current financial metrics significantly.

- Jump into the full analysis health report here for a deeper understanding of Yangzijiang Financial Holding.

- Assess Yangzijiang Financial Holding's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Get an in-depth perspective on all 969 Asian Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:709

Giordano International

An investment holding company, engages in the retail and distribution of men’s, women’s, and children’s fashion apparel and accessories in Mainland China, Hong Kong, Macau, Taiwan, Southeast Asia and Australia, Gulf Cooperation Council, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives