- Hong Kong

- /

- Oil and Gas

- /

- SEHK:857

PetroChina (SEHK:857): Evaluating Valuation After Q3 Results and Governance Reshuffle

Reviewed by Simply Wall St

PetroChina (SEHK:857) just posted its third quarter earnings, revealing small drops in net income and sales from last year. At the same time, governance shake-ups are underway with changes to the articles of association and the abolition of the supervisory committee.

See our latest analysis for PetroChina.

Recent governance changes and the latest earnings update have put PetroChina in the spotlight, but all eyes are really on its share price momentum. With a year-to-date share price return of over 40% and a standout 55% total shareholder return over twelve months, investors are taking greater notice of both upside potential and shifting risk factors. The momentum has clearly been building, with shares up 18.7% in the past month alone.

If PetroChina’s surge has you curious about what else is on a roll, now is a great time to broaden your search and check out fast growing stocks with high insider ownership.

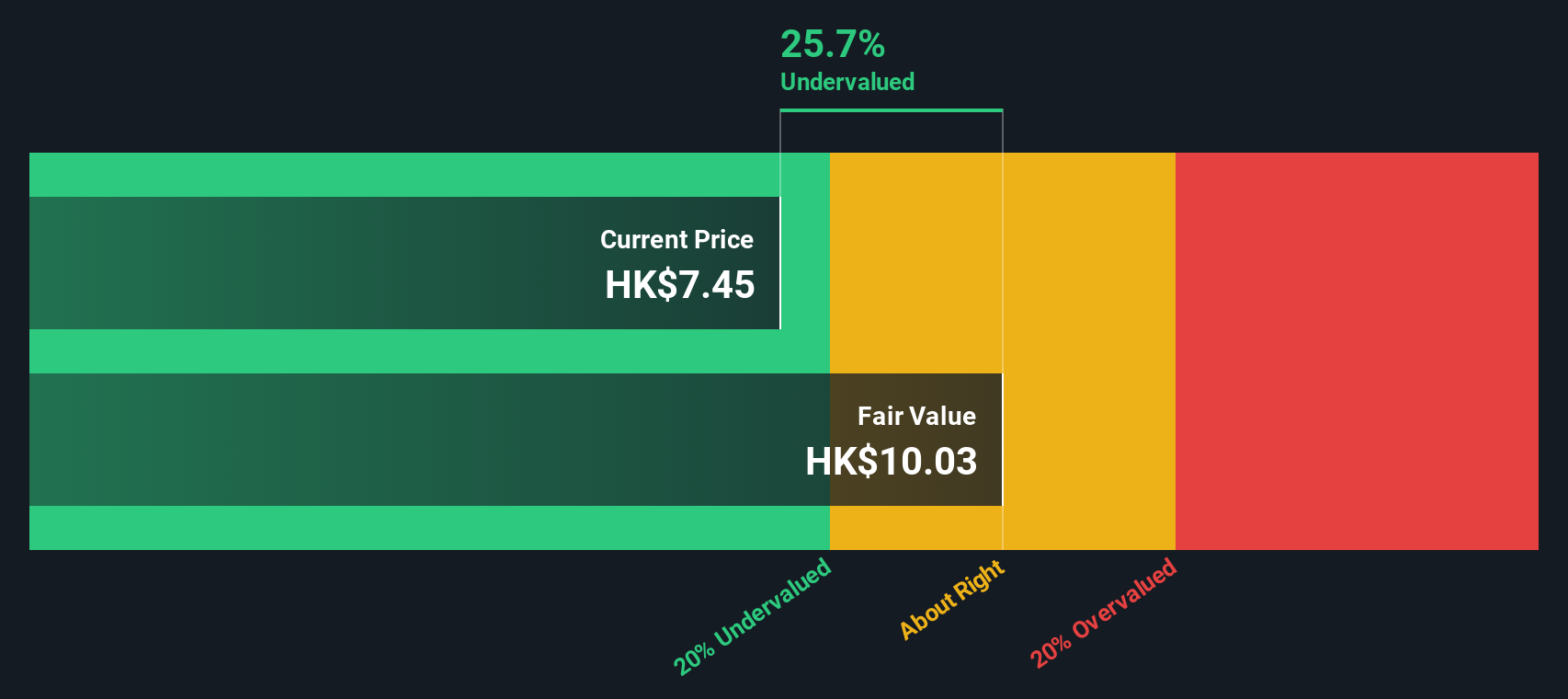

While PetroChina’s recent governance overhaul and steady financial results have made waves, the key question remains: are shares still trading at an attractive valuation, or is market optimism fully pricing in future growth?

Price-to-Earnings of 9x: Is it justified?

PetroChina’s shares trade at a price-to-earnings ratio of 9x, noticeably lower than both peer and industry averages. This enhances its perceived value at the current closing price of HK$8.45.

The price-to-earnings ratio (P/E) measures how much investors are willing to pay per dollar of earnings. For energy companies like PetroChina, it serves as a crucial gauge of market confidence in future profitability in a sector known for cyclical swings.

This multiple suggests the market may be undervaluing PetroChina’s current earnings strength or underestimating its capacity for profit. Given that its profits have grown at a strong pace over five years, the low P/E points to the market not fully pricing in consistent financial performance.

Against the Hong Kong Oil and Gas industry’s average P/E of 9.8x, PetroChina stands out as good value. Relative to the calculated fair P/E of 12.8x, there is even more headroom if the market adjusts its view upward.

Explore the SWS fair ratio for PetroChina

Result: Price-to-Earnings of 9x (UNDERVALUED)

However, unpredictable energy prices and slowing revenue growth could quickly shift investor sentiment. This may occur despite recent momentum and valuation tailwinds.

Find out about the key risks to this PetroChina narrative.

Another View: What Does the SWS DCF Model Say?

Looking at PetroChina through the lens of our DCF model provides an even more striking picture. The shares are trading about 28% below the DCF fair value estimate, which implies further undervaluation than the P/E ratio suggests. Does the market fully appreciate PetroChina’s longer-term earnings potential, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PetroChina for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PetroChina Narrative

If you want to dig into the numbers yourself or shape your own perspective, it only takes a few minutes to craft your own view. Do it your way.

A great starting point for your PetroChina research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the market curve by pinpointing high-potential stocks with tailored screens on Simply Wall Street. You’ll regret missing out on these sector trends and opportunities.

- Unlock potential future leaders by scanning these 25 AI penny stocks, which are pushing the boundaries in machine learning, robotics, and automation every day.

- Secure reliable income streams, even as markets fluctuate, by sorting through these 17 dividend stocks with yields > 3%, which boast attractive yields above 3%.

- Get early access to emerging technology by targeting these 28 quantum computing stocks, which are pioneering new frontiers in computing and information security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:857

PetroChina

Engages in a range of petroleum related products, services, and activities in Mainland China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives