- Hong Kong

- /

- Energy Services

- /

- SEHK:196

If You Had Bought Honghua Group's (HKG:196) Shares Three Years Ago You Would Be Down 68%

If you love investing in stocks you're bound to buy some losers. But long term Honghua Group Limited (HKG:196) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 68% in that time. The silver lining is that the stock is up 1.6% in about a week.

View our latest analysis for Honghua Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Honghua Group became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Revenue is actually up 16% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Honghua Group further; while we may be missing something on this analysis, there might also be an opportunity.

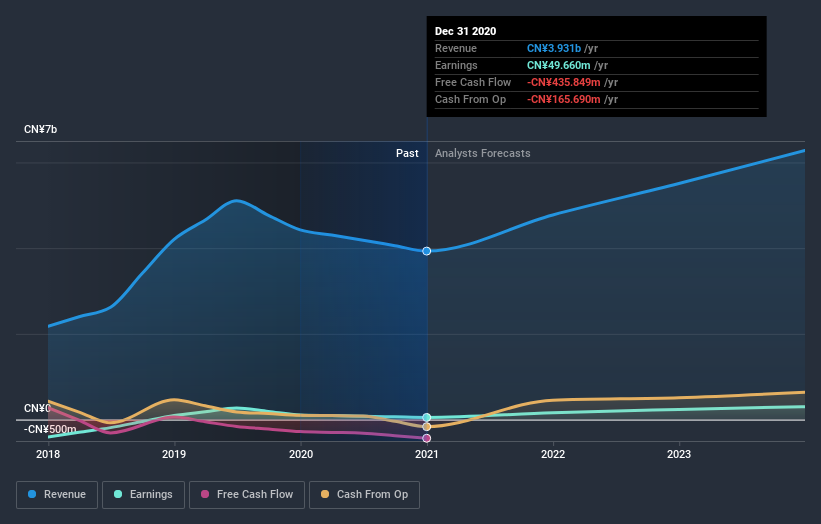

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Honghua Group has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Honghua Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Honghua Group provided a TSR of 14% over the last twelve months. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 6% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Honghua Group better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Honghua Group (of which 1 makes us a bit uncomfortable!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Honghua Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Honghua Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:196

Honghua Group

An investment holding company, engages in the research, design, manufacture, setting, and sale of land rigs, and related parts and components.

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives