- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1171

Yankuang Energy Group (SEHK:1171): Evaluating Valuation After Weaker Nine-Month Financial Results

Reviewed by Simply Wall St

Yankuang Energy Group (SEHK:1171) just released its earnings for the nine months ended September 2025. The company reported declines in both sales and net income compared to the same period last year, setting the tone for investor reaction.

See our latest analysis for Yankuang Energy Group.

Despite the softer results for the latest nine-month period, Yankuang Energy Group’s share price has been moving with conviction, climbing 33% year-to-date. While these gains suggest renewed optimism from investors, the 1-year total shareholder return of 21% also highlights that long-term holders have benefited from strong momentum.

If Yankuang’s ongoing rally has you scanning for more opportunities, it might be time to broaden your perspective and discover fast growing stocks with high insider ownership.

Given the company’s weaker nine-month financials but surging share price, investors now face an important question: Is this rally justified, or is there still unrecognized value left? Could this be a buying opportunity, or is future growth already factored in?

Price-to-Earnings of 10.7x: Is it justified?

Currently, Yankuang Energy Group is trading at a price-to-earnings (P/E) ratio of 10.7x, factoring in a closing price of HK$11.61. This figure places the stock below the peer group average and well under our fair value estimate, suggesting a potentially attractive entry point for value-oriented investors.

The P/E ratio reflects how much investors are willing to pay for every dollar of the company’s earnings. For a major player in the energy sector like Yankuang, this multiple provides a snapshot of market sentiment toward both its recent earnings history and future prospects.

Yankuang’s P/E sits significantly lower than the peer average of 27.2x, implying the market is not fully pricing in its earning power. Compared to the estimated fair P/E of 11.5x, the current ratio suggests further room for the market to catch up if sentiment shifts.

Result: Price-to-Earnings of 10.7x (UNDERVALUED)

Explore the SWS fair ratio for Yankuang Energy Group

However, risks such as missing revenue targets or a reversal in recent share price momentum could quickly challenge the current optimism around Yankuang Energy Group.

Find out about the key risks to this Yankuang Energy Group narrative.

Another View: Discounted Cash Flow Perspective

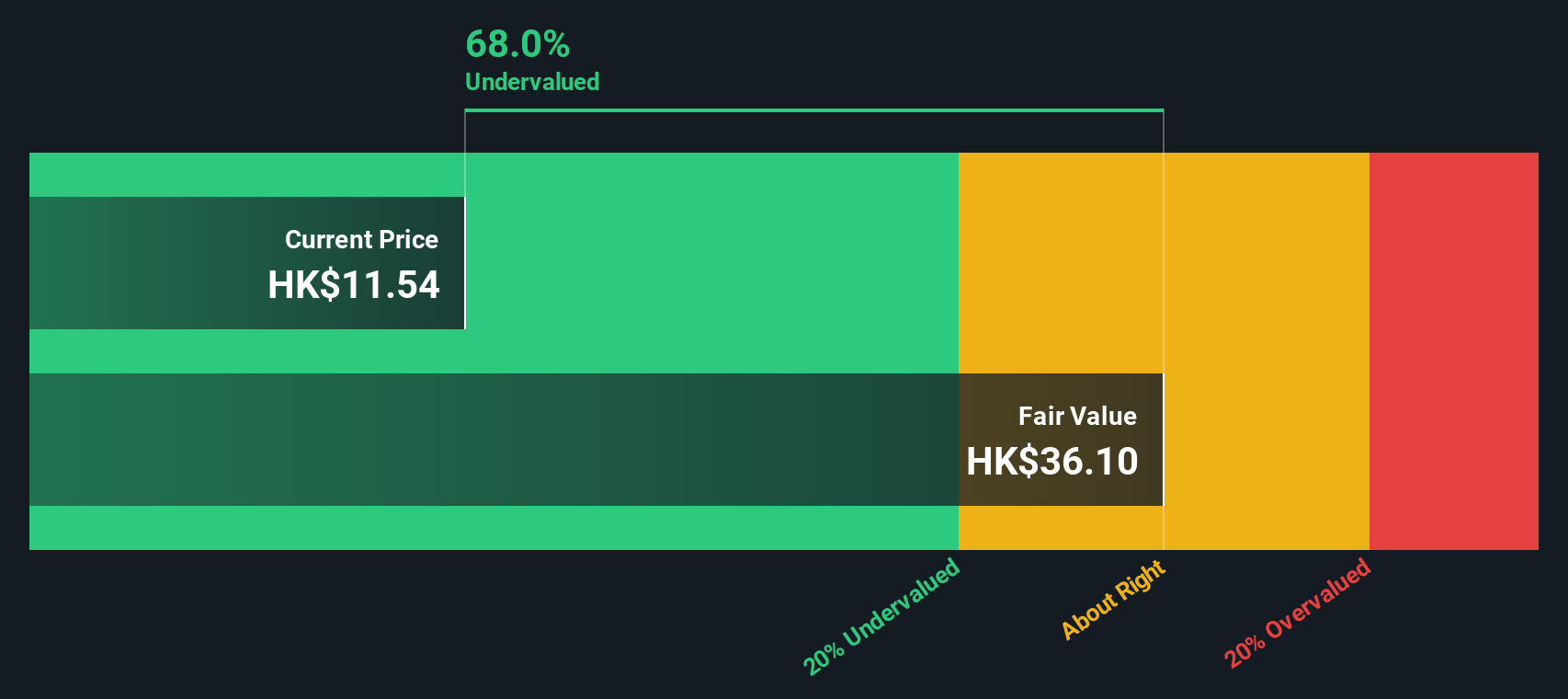

On the other hand, our SWS DCF model produces a much higher fair value estimate for Yankuang Energy Group, suggesting it may be trading significantly below its intrinsic value. While the P/E ratio points to an undervalued stock, the DCF view implies an even greater margin of safety. Which view will ultimately prove right as market conditions change?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yankuang Energy Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yankuang Energy Group Narrative

If you want to test these numbers or reach your own conclusions, you can pull together your own analysis in just a few minutes. Do it your way.

A great starting point for your Yankuang Energy Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities like Yankuang Energy Group show how quickly things can change. Don’t let another breakout story or undervalued stock pass you by. Take the next step below and put your money to work with confidence.

- Snap up income potential by checking out these 17 dividend stocks with yields > 3% offering yields above 3% and rewarding long-term holders.

- Step confidently into the AI revolution with these 25 AI penny stocks powering innovation across industries and shaping tomorrow’s technology landscape.

- Boost your portfolio's future with these 28 quantum computing stocks leading advances in quantum computing and helping define the next wave of growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1171

Yankuang Energy Group

Engages in the mining, preparation, and sale of coal in China, Australia, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives