Stock Analysis

- Hong Kong

- /

- Capital Markets

- /

- SEHK:1456

The 30% return delivered to Guolian Securities' (HKG:1456) shareholders actually lagged YoY earnings growth

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term Guolian Securities Co., Ltd. (HKG:1456) shareholders have enjoyed a 19% share price rise over the last half decade, well in excess of the market decline of around 23% (not including dividends).

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Guolian Securities

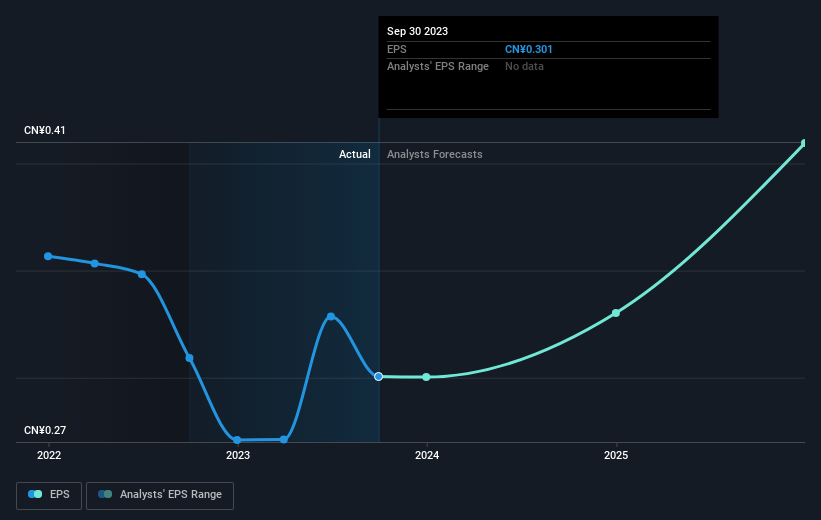

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Guolian Securities managed to grow its earnings per share at 30% a year. This EPS growth is higher than the 4% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 10.97 also suggests market apprehension.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Guolian Securities' key metrics by checking this interactive graph of Guolian Securities's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Guolian Securities' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Guolian Securities' TSR of 30% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

The total return of 8.9% received by Guolian Securities shareholders over the last year isn't far from the market return of -8.5%. The silver lining is that longer term investors would have made a total return of 5% per year over half a decade. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. Before deciding if you like the current share price, check how Guolian Securities scores on these 3 valuation metrics.

Of course Guolian Securities may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Guolian Securities is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1456

Guolian Securities

Guolian Securities Co., Ltd., together with its subsidiaries, provides various financial products and services in the People’s Republic of China.

Mediocre balance sheet second-rate dividend payer.