- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Undiscovered Gems in Hong Kong for August 2024

Reviewed by Simply Wall St

As global markets experience heightened volatility and economic indicators show mixed signals, the Hong Kong market remains a focal point for investors seeking opportunities in small-cap stocks. Despite the recent pullback in indices like the Russell 2000, discerning investors understand that a good stock often combines strong fundamentals with resilience to broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited (SEHK:1277) is an investment holding company that focuses on the extraction and sale of coal products in the People’s Republic of China, with a market cap of HK$9.02 billion.

Operations: Kinetic Development Group Limited derives its revenue primarily from the extraction and sale of coal products in the People’s Republic of China. The company has a market cap of HK$9.02 billion.

Kinetic Development Group, a small-cap player in Hong Kong's oil and gas sector, has seen its net debt to equity ratio improve from 26.6% to 17.6% over the past five years. Despite negative earnings growth of -22% last year, it trades at 29.3% below fair value estimates and boasts high-quality earnings. Additionally, interest payments are well covered by EBIT with a coverage ratio of 55.7x, indicating strong financial health amidst challenging industry conditions.

Central China Securities (SEHK:1375)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Central China Securities Co., Ltd. is a securities company involved in brokerage, credit, futures, proprietary trading, investment banking and management with a market cap of HK$14.66 billion.

Operations: Central China Securities generates revenue from brokerage, credit, futures, proprietary trading, investment banking, and management services. The company's net profit margin stands at 12.34%.

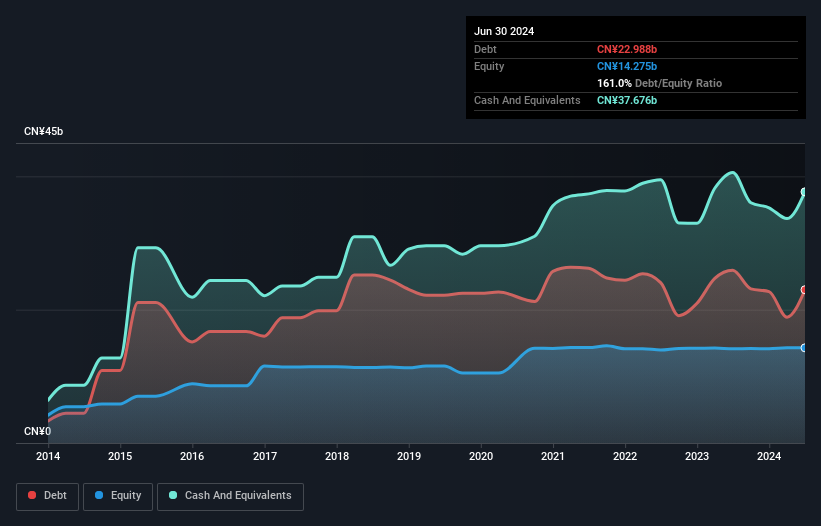

Central China Securities has shown robust growth, with earnings surging 71.4% over the past year, outpacing the Capital Markets industry average of -28.3%. The company repurchased shares in 2024 and approved a final ordinary cash dividend of RMB 0.14 per 10 shares for FY2023. Additionally, its debt to equity ratio improved from 191.8% to 132.2% over five years, indicating better financial management and stability moving forward.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$8.68 billion.

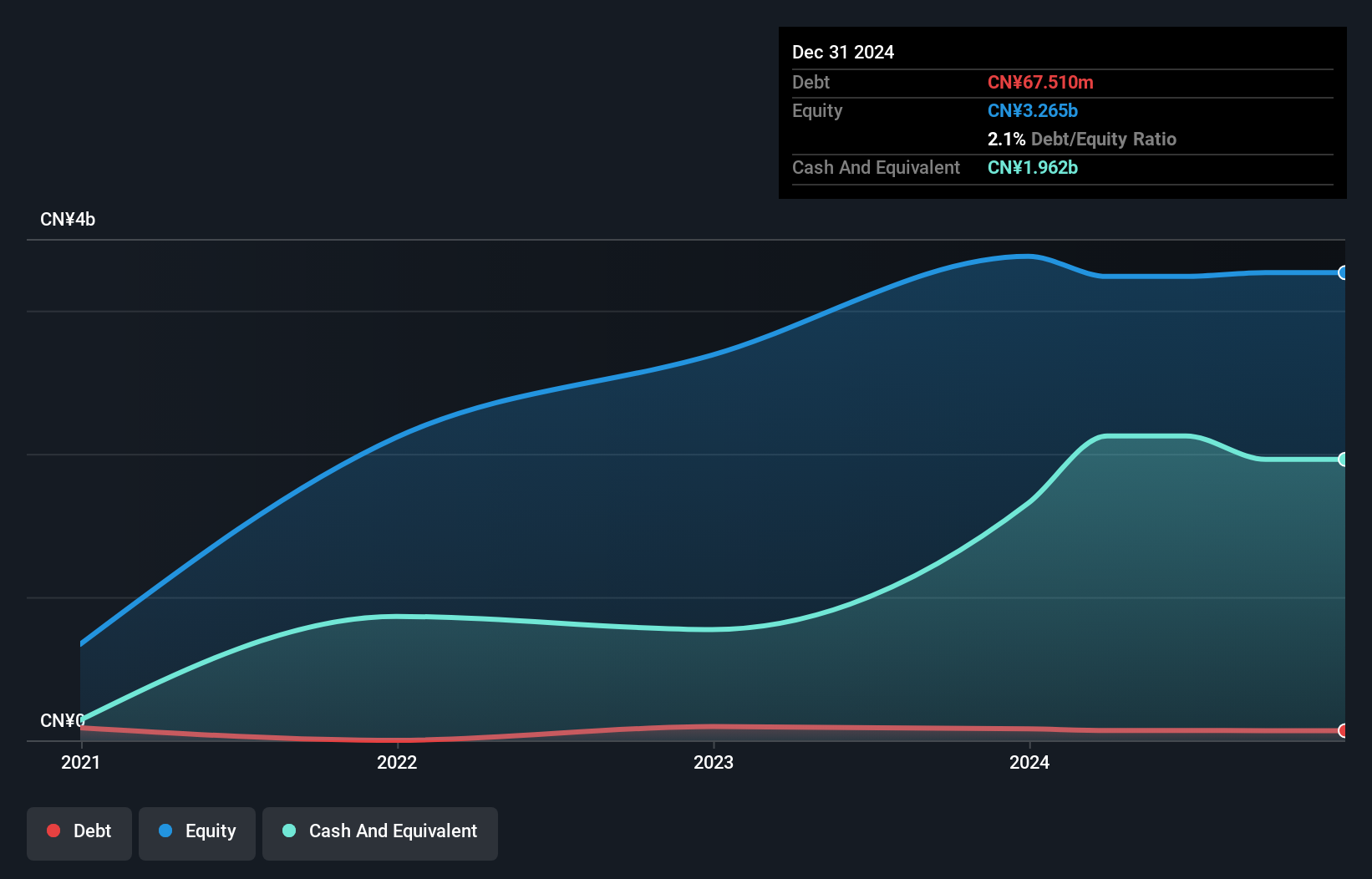

Operations: Guoquan Food generates revenue primarily from retail sales through grocery stores, totaling CN¥6.09 billion. The company's net profit margin is 15%.

Guoquan Food (Shanghai) has shown solid financial health, with earnings growth of 4.2% over the past year, outpacing the Consumer Retailing industry’s 1.6%. The company is profitable and generates positive free cash flow, which stood at RMB 543.34 million as of December 2023. Recently approved amendments to its Articles of Association and a final cash dividend of RMB 0.0521 per share reflect strong governance and shareholder value focus, while leadership changes signal strategic realignment for future growth.

- Delve into the full analysis health report here for a deeper understanding of Guoquan Food (Shanghai).

Evaluate Guoquan Food (Shanghai)'s historical performance by accessing our past performance report.

Next Steps

- Dive into all 174 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in China.

Excellent balance sheet with proven track record.