- Hong Kong

- /

- Hospitality

- /

- SEHK:27

Is Galaxy Entertainment Group's Q3 Growth and Resort Expansion Changing the Investment Case for SEHK:27?

Reviewed by Sasha Jovanovic

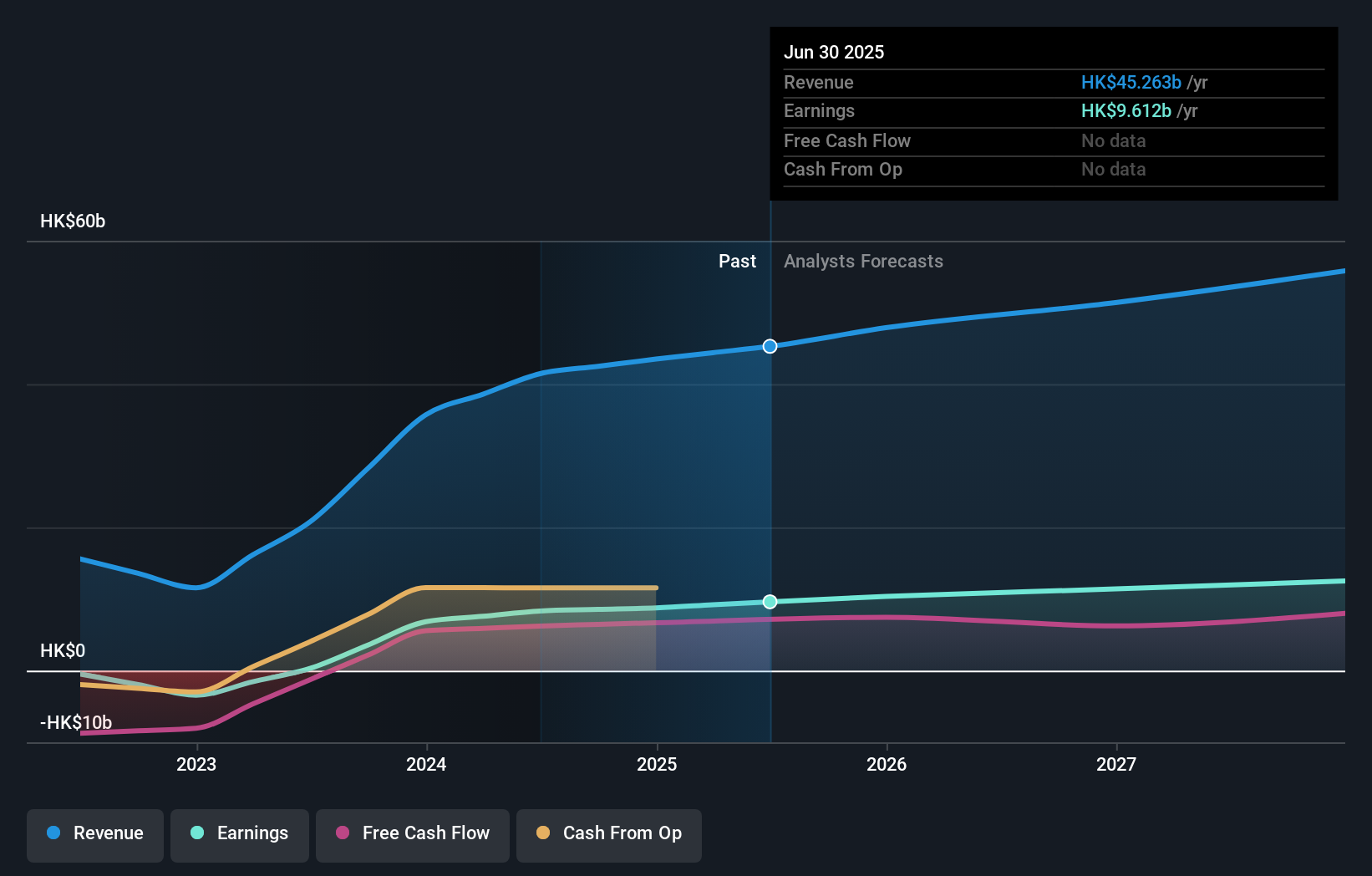

- Galaxy Entertainment Group recently reported a 14% year-on-year increase in net revenue and adjusted EBITDA for Q3 2025, despite disruptions from Typhoon Ragasa and seasonal factors.

- Continuing to lead Macau’s non-gaming diversification, the company advanced luxury resort developments and affirmed long-term confidence by announcing an interim dividend.

- We'll explore how Galaxy Entertainment Group’s commitment to non-gaming amenities and ongoing development projects shapes its investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Galaxy Entertainment Group's Investment Narrative?

Being a shareholder in Galaxy Entertainment Group means buying into the vision of Macau as a global tourism destination, a story that increasingly relies on non-gaming experiences and ambitious development. The recent Q3 update reinforces that narrative, with net revenue and EBITDA up 14% year-on-year despite weather disruptions. This resilience lends support to ongoing catalysts like the opening of Capella at Galaxy Macau, Phase 4’s progression, and the interim dividend announcement, each showing faith in the long-term demand for leisure and entertainment in the region. While adjusted earnings and revenue came in strong, short-term headwinds such as environmental shocks and the competitive pace of Macau's diversification remain relevant. Based on the limited share price reaction so far, the news appears to affirm existing momentum rather than materially shifting the risk or catalyst profile, keeping the spotlight on execution and sector-wide competition.

However, a closer look reveals challenges around board renewal and dividend sustainability that investors should consider.

Exploring Other Perspectives

Explore another fair value estimate on Galaxy Entertainment Group - why the stock might be worth as much as 26% more than the current price!

Build Your Own Galaxy Entertainment Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Galaxy Entertainment Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Galaxy Entertainment Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Galaxy Entertainment Group's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:27

Galaxy Entertainment Group

An investment holding company, engages in the gaming and entertainment businesses in Macau, Hong Kong, and Mainland China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives