- Hong Kong

- /

- Hospitality

- /

- SEHK:265

Gangyu Smart Urban Services Holding Limited's (HKG:265) 144% Share Price Surge Not Quite Adding Up

Gangyu Smart Urban Services Holding Limited (HKG:265) shares have continued their recent momentum with a 144% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 87% in the last year.

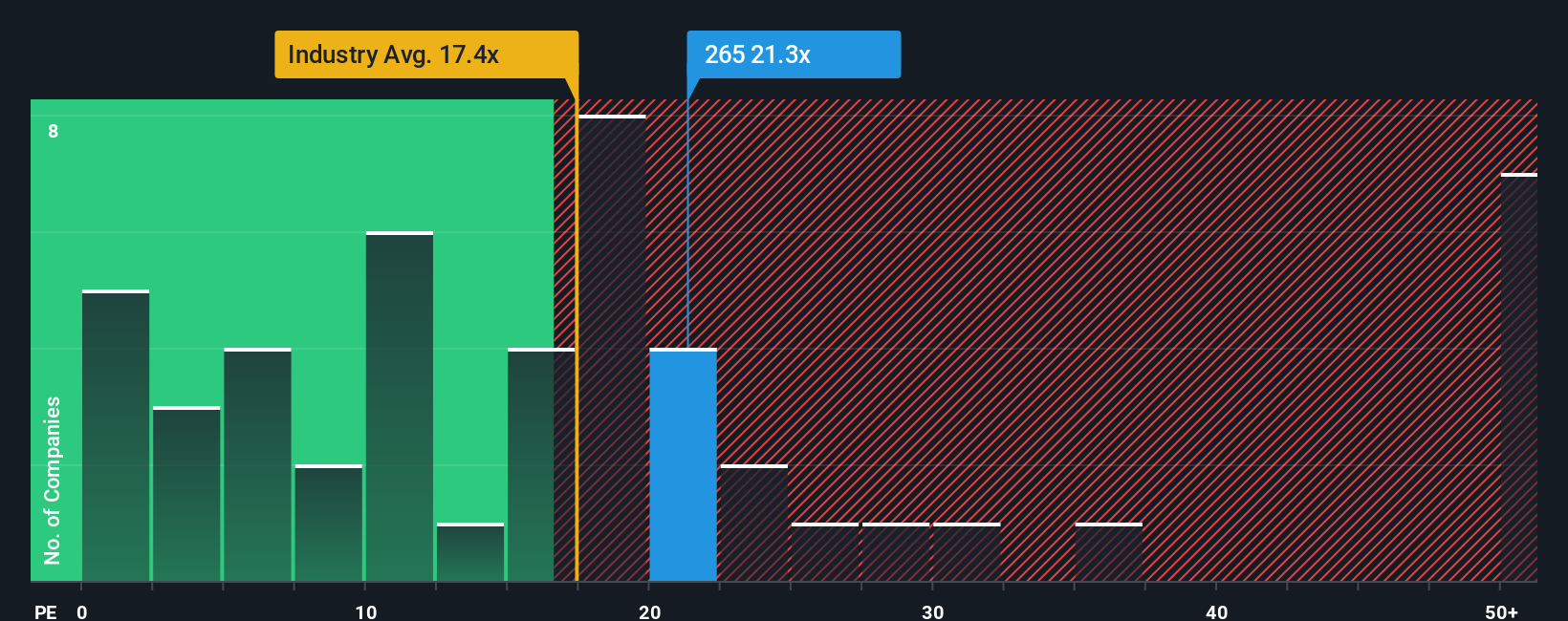

Since its price has surged higher, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 12x, you may consider Gangyu Smart Urban Services Holding as a stock to avoid entirely with its 21.3x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Gangyu Smart Urban Services Holding certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Gangyu Smart Urban Services Holding

Is There Enough Growth For Gangyu Smart Urban Services Holding?

The only time you'd be truly comfortable seeing a P/E as steep as Gangyu Smart Urban Services Holding's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 77%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 20% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it concerning that Gangyu Smart Urban Services Holding is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Gangyu Smart Urban Services Holding's P/E?

Shares in Gangyu Smart Urban Services Holding have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Gangyu Smart Urban Services Holding currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Gangyu Smart Urban Services Holding you should be aware of, and 1 of them shouldn't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:265

Gangyu Smart Urban Services Holding

An investment holding company, provides property management and leasing services for residential and commercial properties in Mainland China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives