- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:6808

Is Sun Art Retail Group's Swing to Net Loss Altering the Investment Case for SEHK:6808?

Reviewed by Sasha Jovanovic

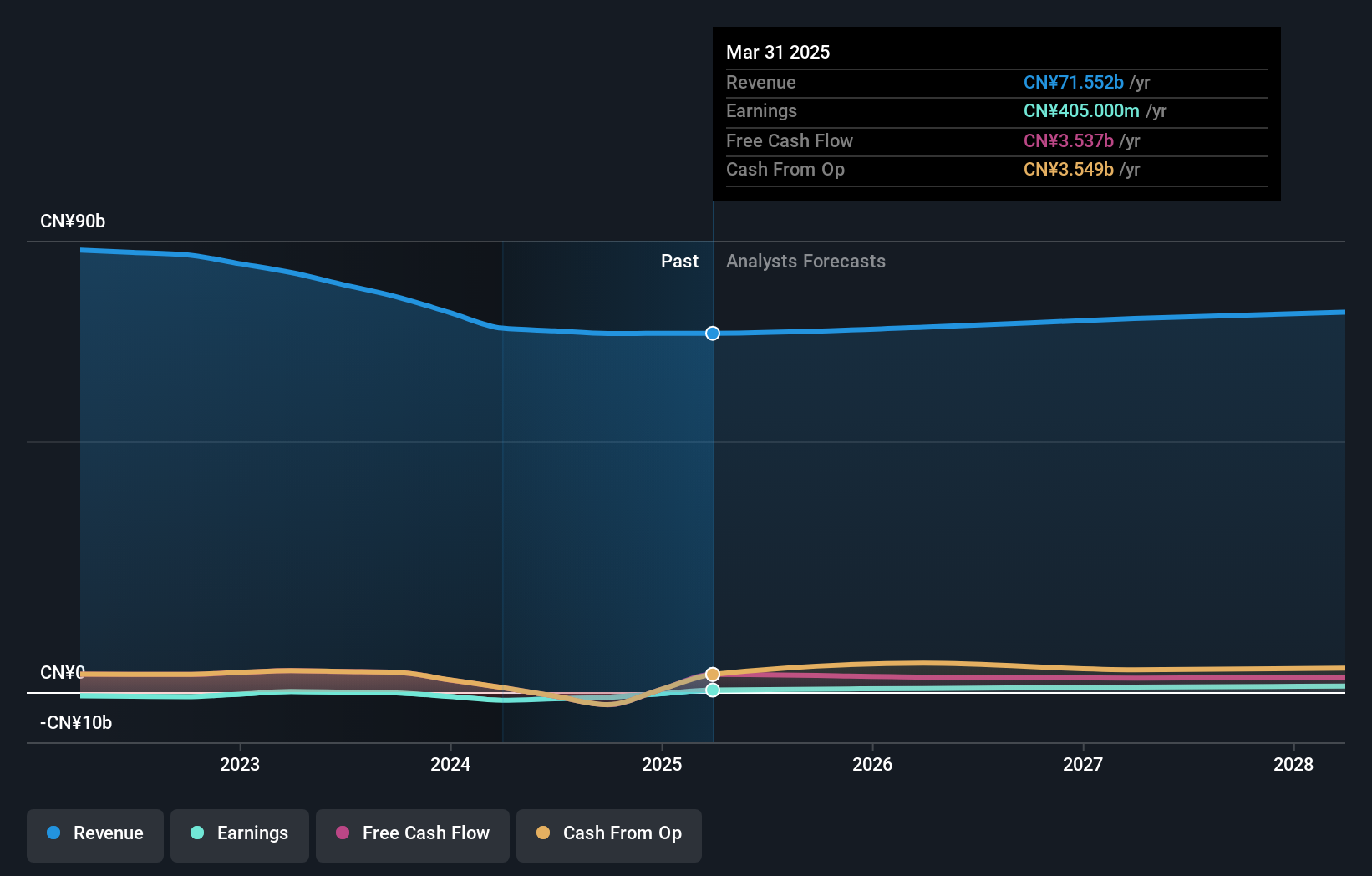

- Sun Art Retail Group Limited reported its half-year results for the period ended September 30, 2025, with sales declining to CNY 30.50 billion from CNY 34.71 billion a year earlier and a swing from net income of CNY 206 million to a net loss of CNY 123 million.

- This reversal from profit to loss marks a significant shift in the company's recent financial performance and signals increased challenges in its core retail operations.

- We'll explore how the return to net loss and falling sales influence Sun Art Retail Group's investment narrative and operational outlook.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Sun Art Retail Group's Investment Narrative?

To be a Sun Art Retail Group shareholder right now, you need to believe in a turnaround despite mounting headwinds. The latest half-year results, with sales shrinking by CNY 4.2 billion and a swing to a CNY 123 million net loss, have shifted the focus from growth to resilience, and place a spotlight on management’s ability to execute on cost controls and adapt store formats to tough consumer trends. This report is particularly meaningful because it confirms prior warnings around losses and raises the stakes for upcoming operational and leadership changes, with the recently completed major acquisition and a new board still bedding in. Key short-term catalysts, like recovering sales or margin gains through restructuring, will now be scrutinized far more closely. Risks tied to declining revenue momentum, limited board experience and the cancelled dividend appear more acute, with profit recovery timelines now less certain.

By contrast, board turnover and unsettled governance are risks investors should keep on their radar.

Exploring Other Perspectives

Explore another fair value estimate on Sun Art Retail Group - why the stock might be worth as much as 25% more than the current price!

Build Your Own Sun Art Retail Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Art Retail Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sun Art Retail Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Art Retail Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6808

Sun Art Retail Group

An investment holding company, operates brick-and-mortar stores and online sales channels in the People’s Republic of China.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives