- Hong Kong

- /

- Auto Components

- /

- SEHK:1571

Xin Point Holdings And 2 Other Undiscovered Gems In Hong Kong

Reviewed by Simply Wall St

As global markets react to forthcoming interest rate cuts and small-cap stocks outperform their larger counterparts, the Hong Kong market offers intriguing opportunities for discerning investors. In this environment, identifying undervalued stocks with solid fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Xin Point Holdings (SEHK:1571)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xin Point Holdings Limited, an investment holding company, manufactures and sells automotive and electronic components in China, North America, Europe, and internationally with a market cap of HK$3.26 billion.

Operations: Xin Point Holdings generates revenue primarily from the manufacture and sale of automotive and electronic components, amounting to CN¥3.23 billion. The company's market cap stands at HK$3.26 billion.

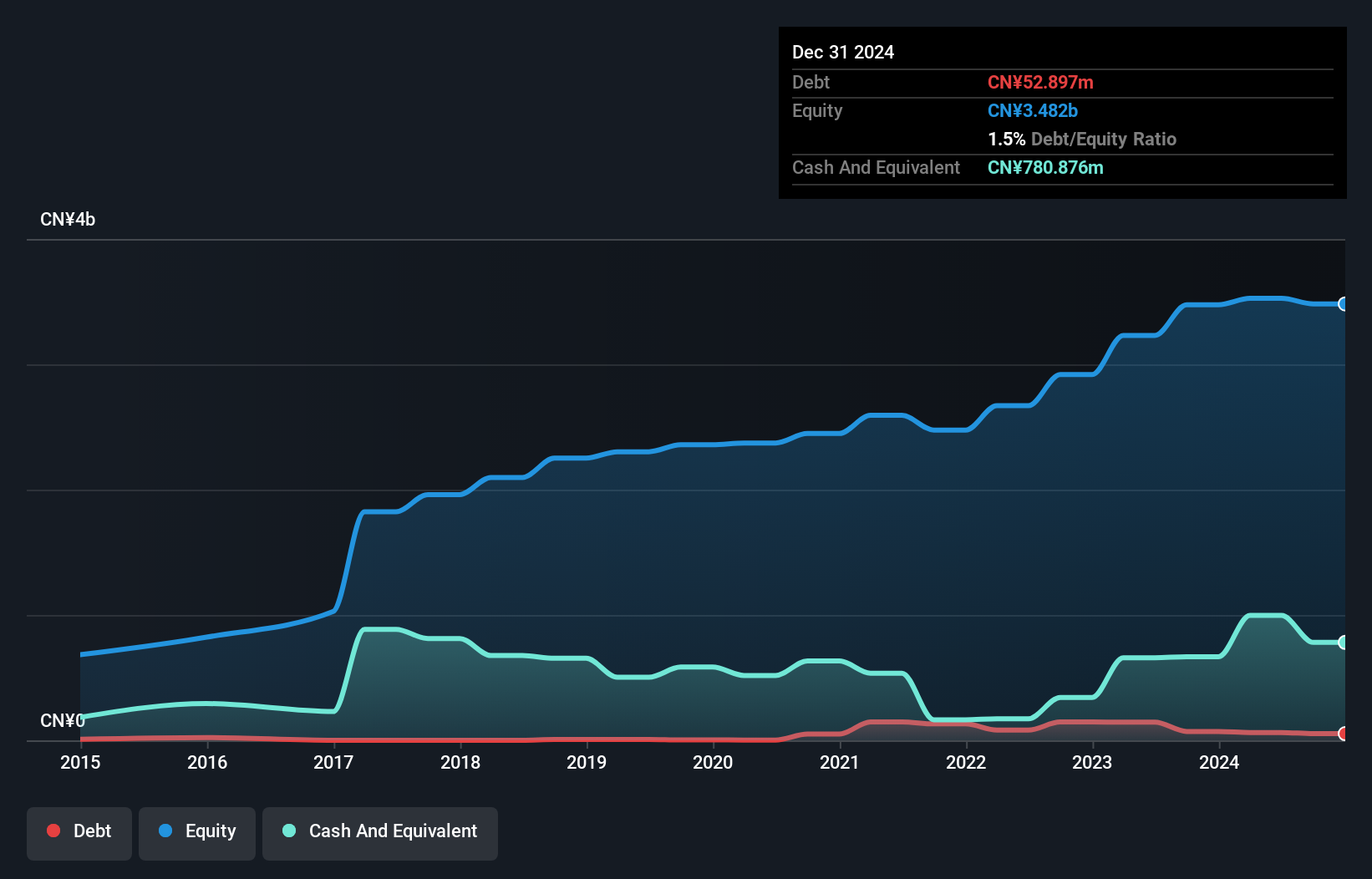

Xin Point Holdings seems to be an intriguing prospect, trading at 76.2% below its estimated fair value. The company reported earnings growth of 27.4% over the past year, outpacing the Auto Components industry’s -16.7%. Net income for the first half of 2024 was CNY322 million compared to CNY264 million a year ago, and basic earnings per share rose from CNY0.2635 to CNY0.321 in the same period. Additionally, Xin Point declared an interim dividend of HKD0.2 per share for June 2024, reflecting robust financial health and shareholder returns.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$8.16 billion.

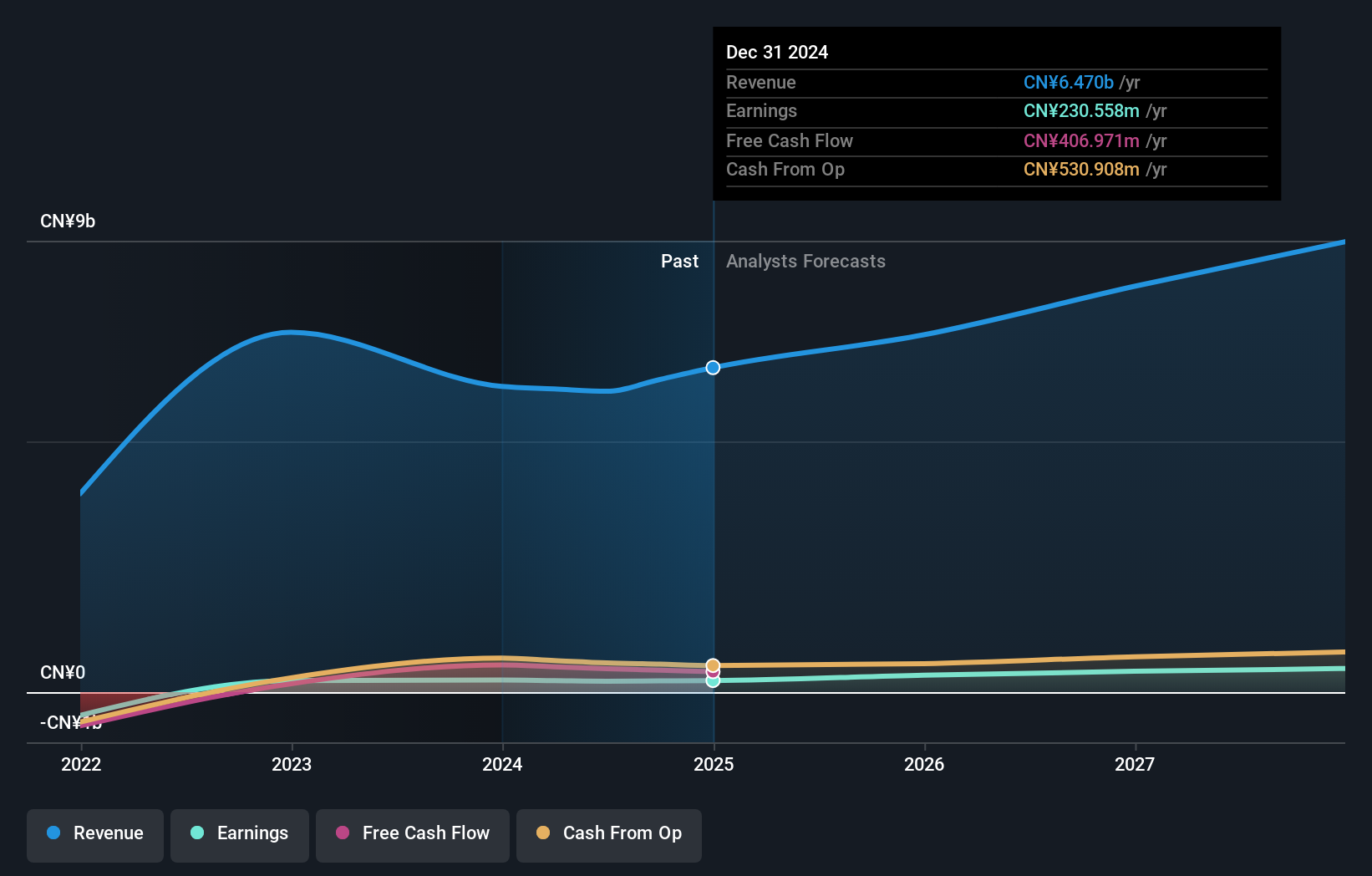

Operations: The company's primary revenue stream is from retail grocery stores, generating CN¥6.09 billion.

Guoquan Food (Shanghai) has seen notable developments recently, including a 4.2% earnings growth over the past year, outpacing the Consumer Retailing industry’s 0.9%. The company approved a final cash dividend of RMB 0.0521 per share for FY2023, payable by August 29, 2024. Additionally, Guoquan repurchased shares this year and maintains more cash than its total debt, indicating strong financial health despite recent executive changes such as Mr. Zeng Xinghai's resignation as non-executive director on August 14th.

- Dive into the specifics of Guoquan Food (Shanghai) here with our thorough health report.

Understand Guoquan Food (Shanghai)'s track record by examining our Past report.

COSCO SHIPPING International (Hong Kong) (SEHK:517)

Simply Wall St Value Rating: ★★★★★★

Overview: COSCO SHIPPING International (Hong Kong) Co., Ltd. is an investment holding company that offers shipping services both within the People’s Republic of China and globally, with a market cap of HK$5.85 billion.

Operations: The company generates revenue primarily from shipping services within China and internationally. For the recent period, it reported a market cap of HK$5.85 billion.

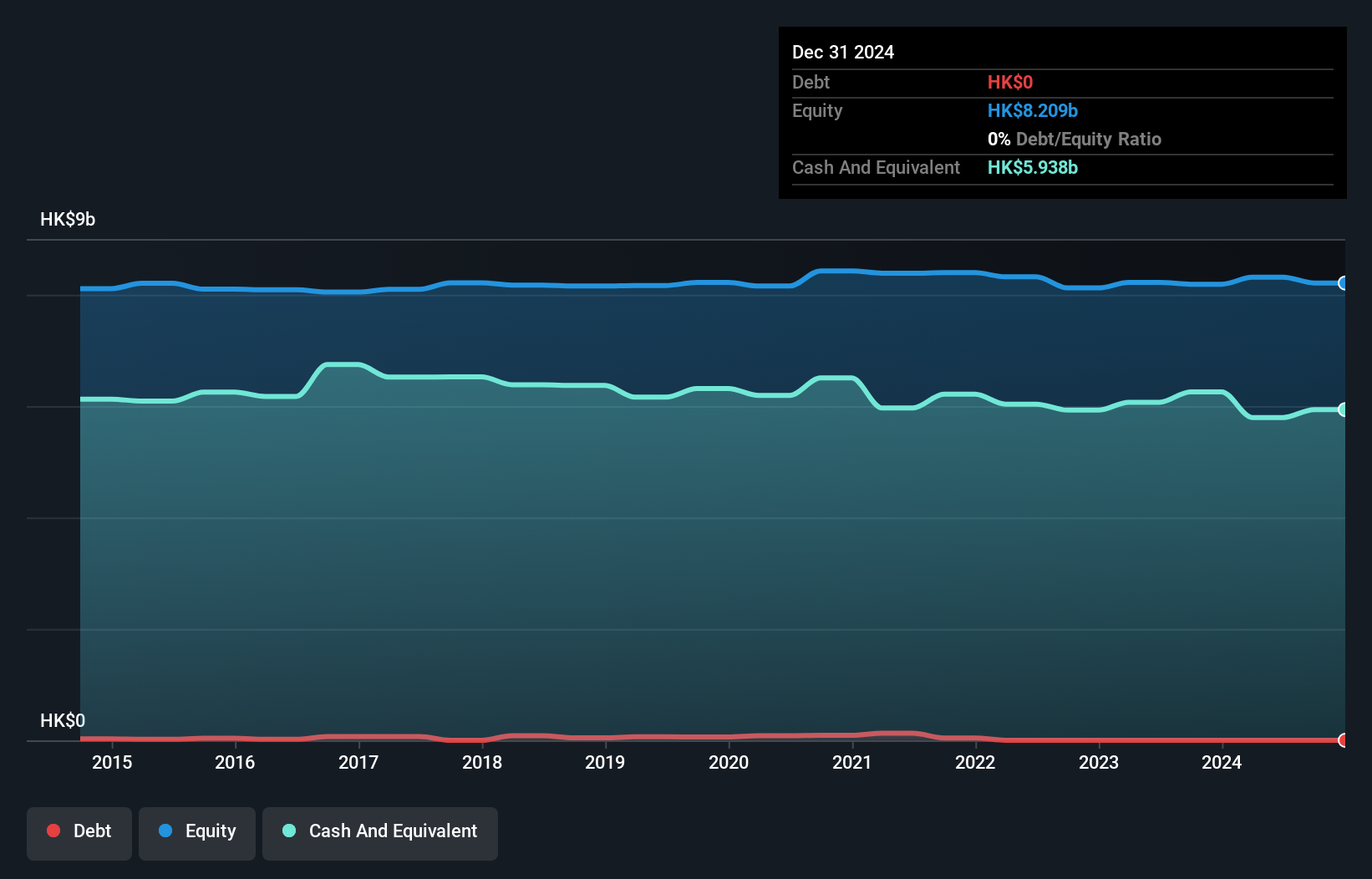

COSCO SHIPPING International (Hong Kong) has shown notable progress, reporting sales of HK$1.75 billion for the half year ended June 30, 2024, up from HK$1.62 billion a year ago. Net income also increased to HK$388 million from HK$336 million in the previous period. The company declared an interim dividend of HKD 0.265 per share and basic earnings per share rose to HKD 0.2647 from last year's HKD 0.2269, reflecting its strong financial health and growth trajectory

Where To Now?

- Dive into all 175 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1571

Xin Point Holdings

An investment holding company, manufactures and sells automotive and electronic components in China, North America, Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.