Stock Analysis

- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1277

Exploring Undervalued Small Caps With Insider Actions In Hong Kong July 2024

Reviewed by Simply Wall St

As global markets experience a shift towards small-cap and value shares, the Hong Kong market presents intriguing opportunities for investors looking to explore undervalued sectors. With recent insider actions signaling potential hidden gems among small caps, this article aims to highlight three such stocks in Hong Kong's dynamic market landscape.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| China Overseas Grand Oceans Group | 2.5x | 0.1x | 8.60% | ★★★★★☆ |

| Wasion Holdings | 10.8x | 0.8x | 35.63% | ★★★★☆☆ |

| Ever Sunshine Services Group | 5.7x | 0.4x | 19.89% | ★★★★☆☆ |

| Nissin Foods | 14.5x | 1.3x | 40.91% | ★★★★☆☆ |

| China Education Group Holdings | 7.2x | 1.7x | 49.29% | ★★★★☆☆ |

| China Leon Inspection Holding | 9.9x | 0.7x | 27.27% | ★★★★☆☆ |

| Transport International Holdings | 11.6x | 0.6x | 43.95% | ★★★★☆☆ |

| Skyworth Group | 5.7x | 0.1x | -311.59% | ★★★☆☆☆ |

| Kinetic Development Group | 4.3x | 1.9x | 14.40% | ★★★☆☆☆ |

| Shenzhen International Holdings | 8.0x | 0.7x | 14.24% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

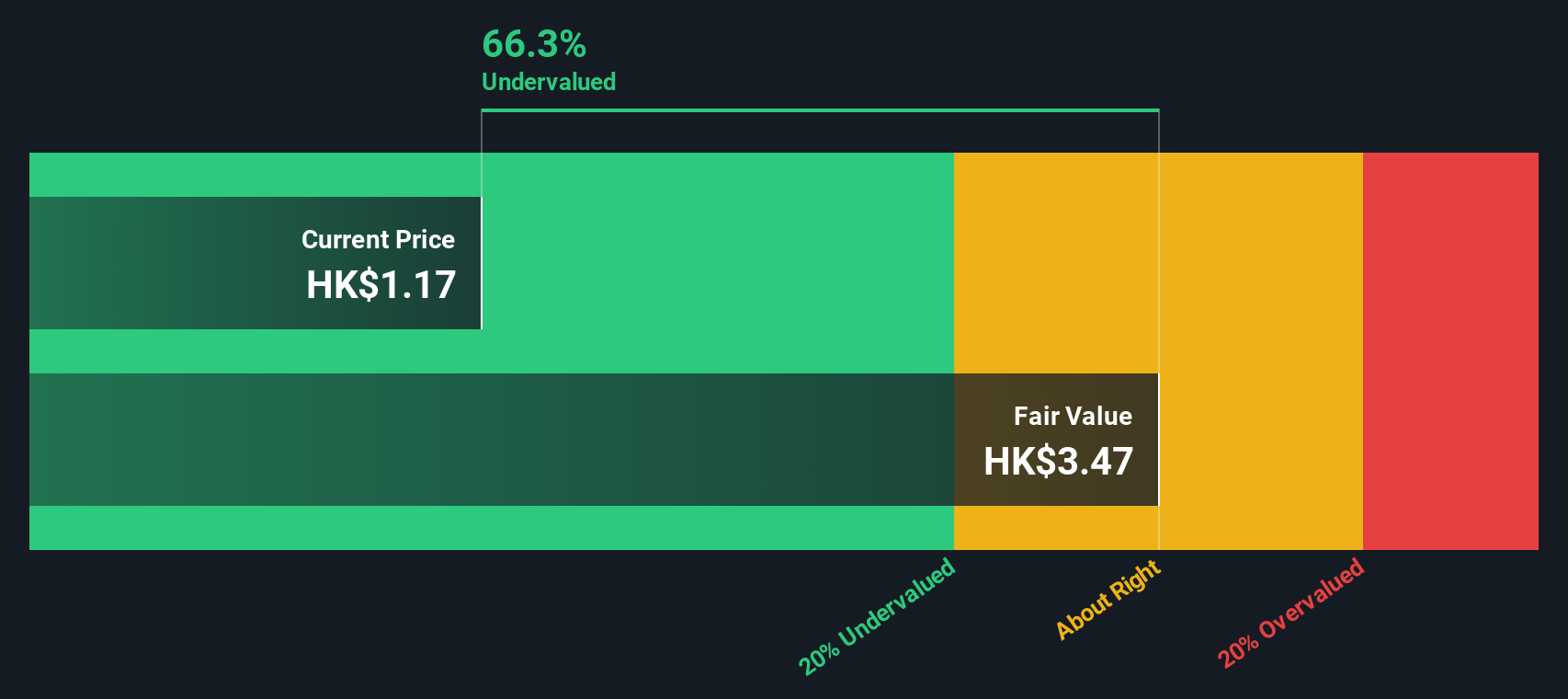

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company primarily engaged in property development and investment, with a market capitalization of approximately CN¥1.23 billion.

Operations: From 2013 to 2024, the company experienced a significant increase in gross profit margin from approximately 9.05% to about 59.07%. This improvement was accompanied by a notable rise in net income, turning from substantial losses in earlier years to robust profits, peaking at CN¥2.08 billion by the end of the period under review.

PE: 4.3x

Kinetic Development Group, a lesser-known entity in Hong Kong's equity market, recently showcased insider confidence with significant share purchases. This activity underscores a strong belief in the company’s potential despite its modest market cap. Financially, Kinetic operates on high-risk funding entirely from external borrowings, reflecting an aggressive growth strategy. Moreover, at their latest annual general meeting on May 7, 2024, dividends were reduced to HK$0.05 per share—a move possibly aimed at reallocating resources for future expansion plans while also revising corporate governance structures to enhance operational flexibility. These developments suggest a strategic pivot towards long-term value creation amidst current undervaluation signs.

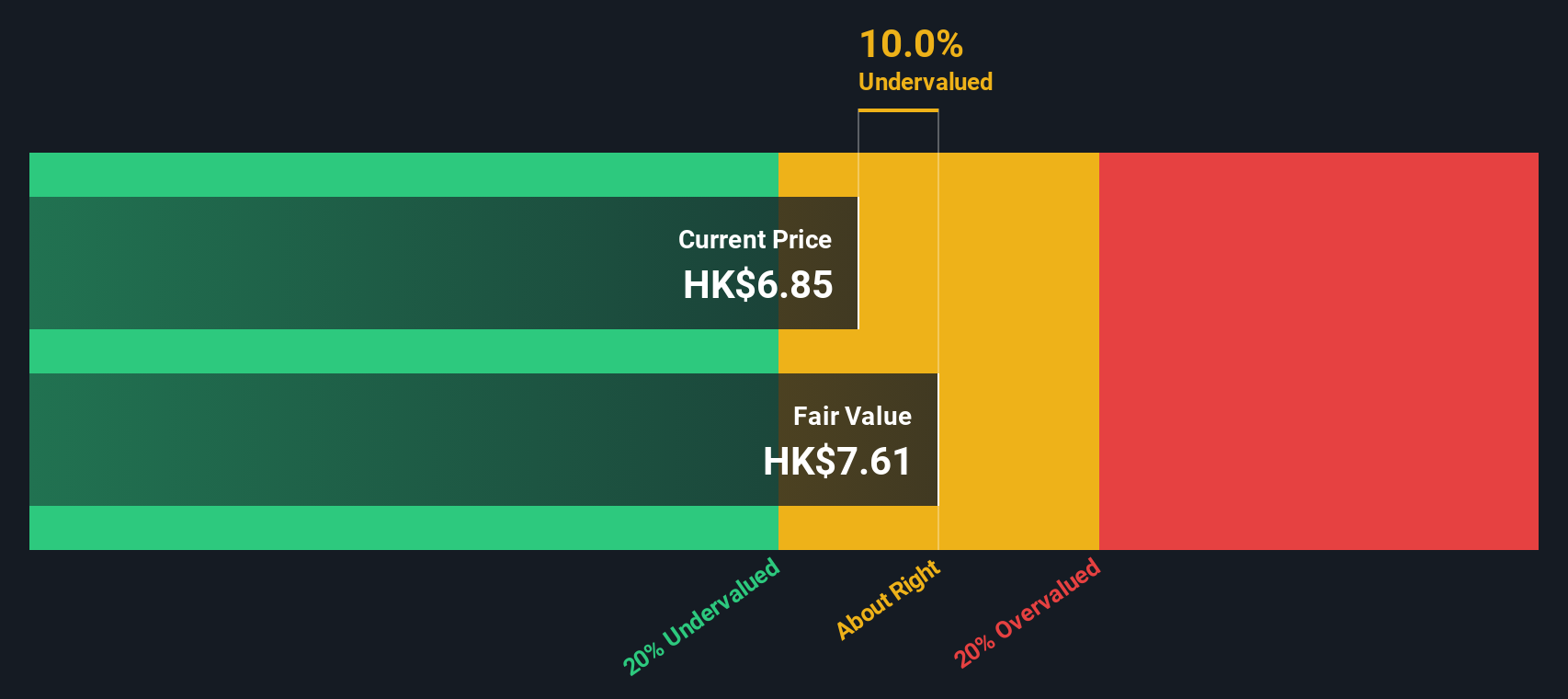

Nissin Foods (SEHK:1475)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nissin Foods is a company specializing in the production and sale of instant noodles, primarily serving markets in Mainland China, Hong Kong, and other parts of Asia.

Operations: From 2014 to 2024, the company saw its revenue grow from HK$2.54 billion to HK$3.76 billion, while gross profit margin showed a notable increase from approximately 34.13% to about 34.16%. Notably, net income also rose significantly during this period, indicating improved profitability and operational efficiency.

PE: 14.5x

Nissin Foods, a notable player in the Hong Kong market, recently saw insider confidence demonstrated through a significant share purchase by Kiyotaka Ando, who acquired 155,430 shares. This move underscores a strong belief in the company’s prospects. Additionally, with earnings forecasted to grow annually by 7.04%, and recent executive leadership enhancements signaling strategic growth focus, Nissin positions itself as an appealing entity within its sector. A recent dividend increase further reflects its financial health and commitment to shareholder value.

- Navigate through the intricacies of Nissin Foods with our comprehensive valuation report here.

Explore historical data to track Nissin Foods' performance over time in our Past section.

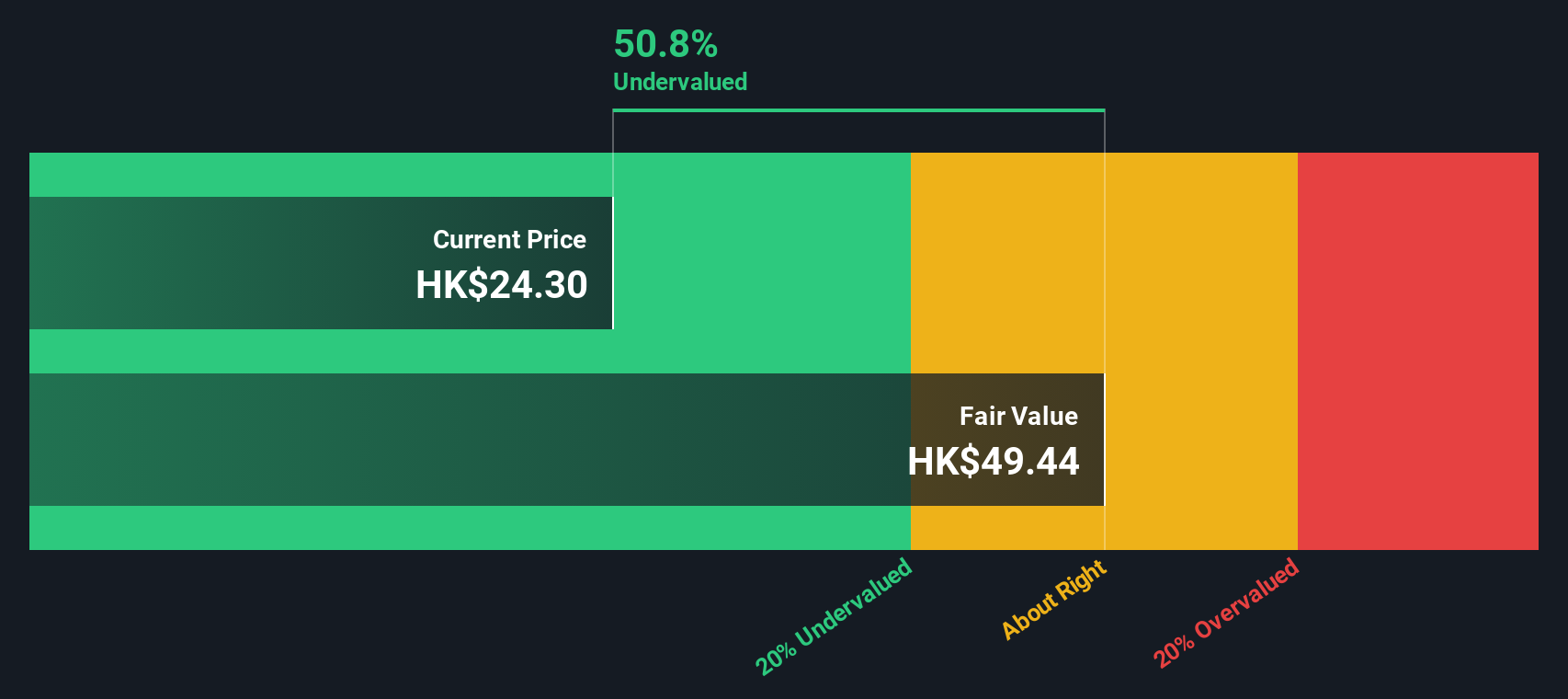

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti specializes in the design, construction, and marketing of yachts and recreational boats.

Operations: The business recorded a gross profit of €455.82 million in its latest reporting period, with a corresponding gross profit margin of 37.08%. Over recent years, the company has seen an increase in revenue, reaching €1.23 billion by the end of 2023.

PE: 11.4x

Ferretti, a noteworthy entity among Hong Kong's smaller listed companies, recently confirmed its 2024 revenue forecast in the range of €1.22 billion to €1.24 billion, reflecting an anticipated growth of up to 11.6%. With insiders having recently purchased shares, this move signals strong insider confidence in the company's future prospects. Additionally, Ferretti's commitment to shareholder returns is evident from its recent dividend increase and strategic amendments to company bylaws aimed at enhancing shareholder value. These financial maneuvers underscore the firm’s potential as an undervalued investment opportunity within its sector.

- Delve into the full analysis valuation report here for a deeper understanding of Ferretti.

Gain insights into Ferretti's historical performance by reviewing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 17 Undervalued SEHK Small Caps With Insider Buying by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Kinetic Development Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1277

Kinetic Development Group

An investment holding company, engages in the extraction and sale of coal products in the People’s Republic of China.

Excellent balance sheet with proven track record.