Investors Still Aren't Entirely Convinced By Sling Group Holdings Limited's (HKG:8285) Revenues Despite 29% Price Jump

Sling Group Holdings Limited (HKG:8285) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

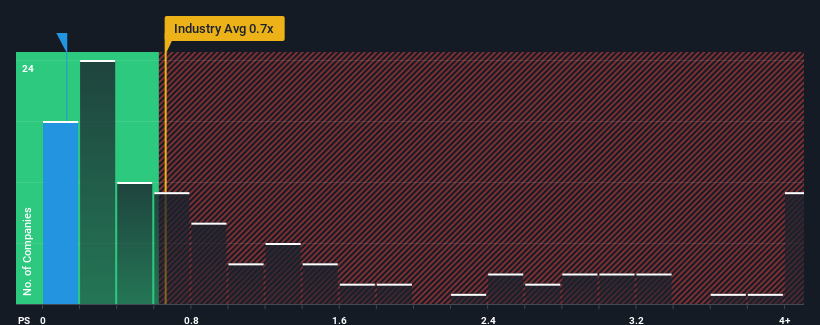

Even after such a large jump in price, it would still be understandable if you think Sling Group Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Hong Kong's Luxury industry have P/S ratios above 0.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Sling Group Holdings

How Sling Group Holdings Has Been Performing

Sling Group Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Sling Group Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Sling Group Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Sling Group Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Sling Group Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. The strong recent performance means it was also able to grow revenue by 45% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this information, we find it odd that Sling Group Holdings is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On Sling Group Holdings' P/S

Despite Sling Group Holdings' share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Sling Group Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

You should always think about risks. Case in point, we've spotted 3 warning signs for Sling Group Holdings you should be aware of, and 2 of them shouldn't be ignored.

If these risks are making you reconsider your opinion on Sling Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8285

Sling Group Holdings

An investment holding company, designs and sells women’s handbags, small leather goods, luggage, and travel goods in the People’s Republic of China.

Low risk and slightly overvalued.

Market Insights

Community Narratives