Stock Analysis

- Hong Kong

- /

- Consumer Durables

- /

- SEHK:776

Shareholders in Imperium Technology Group (HKG:776) have lost 70%, as stock drops 18% this past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Imperium Technology Group Limited (HKG:776) shareholders know that all too well, since the share price is down considerably over three years. Regrettably, they have had to cope with a 70% drop in the share price over that period. Shareholders have had an even rougher run lately, with the share price down 35% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

If the past week is anything to go by, investor sentiment for Imperium Technology Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Imperium Technology Group

Given that Imperium Technology Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Imperium Technology Group saw its revenue shrink by 25% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 19% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

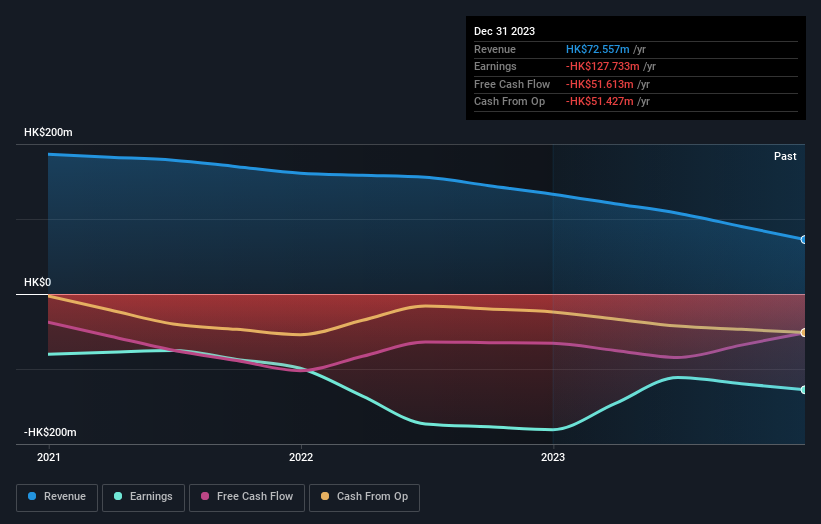

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Imperium Technology Group's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Imperium Technology Group shareholders are down 18% for the year. Unfortunately, that's worse than the broader market decline of 2.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Imperium Technology Group you should be aware of.

But note: Imperium Technology Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Imperium Technology Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:776

Imperium Technology Group

An investment holding company, engages in the esports business in Hong Kong, the People’s Republic of China, East and South Asia, and internationally.

Weak fundamentals or lack of information.