Stock Analysis

As global markets show signs of resilience, with the Hang Seng Index in Hong Kong recently advancing 2.64%, investors are keenly observing opportunities within this vibrant market. Amidst this backdrop, exploring dividend stocks in Hong Kong could offer a strategic avenue for those looking to potentially enhance their investment portfolios, especially considering the current economic dynamics and market performance.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.28% | ★★★★★★ |

| CITIC Telecom International Holdings (SEHK:1883) | 8.94% | ★★★★★★ |

| Consun Pharmaceutical Group (SEHK:1681) | 8.60% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.82% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.31% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.61% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.54% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 3.97% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 7.86% | ★★★★★☆ |

Click here to see the full list of 85 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Bank of Chongqing (SEHK:1963)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Chongqing Co., Ltd. offers a range of banking and financial services to corporate and individual clients in the People’s Republic of China, with a market capitalization of approximately HK$24.29 billion.

Operations: Bank of Chongqing Co., Ltd. generates its revenue primarily through various banking and financial services tailored for both corporate and individual clients in China.

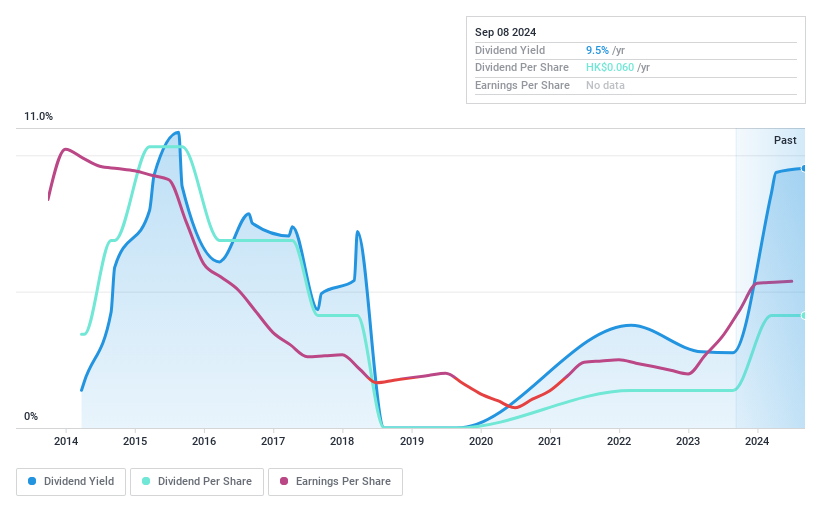

Dividend Yield: 8.4%

Bank of Chongqing's recent financial performance shows a slight increase in net income from CNY 1,482.26 million to CNY 1,542.08 million year-over-year for Q1 2024, despite a small drop in net interest income. The bank maintains a relatively low payout ratio at 29.8%, suggesting that its dividend payments are well covered by earnings. However, its dividend history has been marked by volatility and unreliability over the past decade, with no consistent growth pattern in payouts despite an attractive yield of 8.36%, which ranks in the top quartile within Hong Kong's market average of 7.5%. Recent board changes aim to enhance operational efficiency and governance.

- Unlock comprehensive insights into our analysis of Bank of Chongqing stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Bank of Chongqing is priced lower than what may be justified by its financials.

Chongqing Rural Commercial Bank (SEHK:3618)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Chongqing Rural Commercial Bank Co., Ltd. operates primarily in the banking sector within the People’s Republic of China, offering a range of financial services, with a market capitalization of approximately HK$55.77 billion.

Operations: Chongqing Rural Commercial Bank Co., Ltd. generates its revenue primarily through various banking services within the People’s Republic of China.

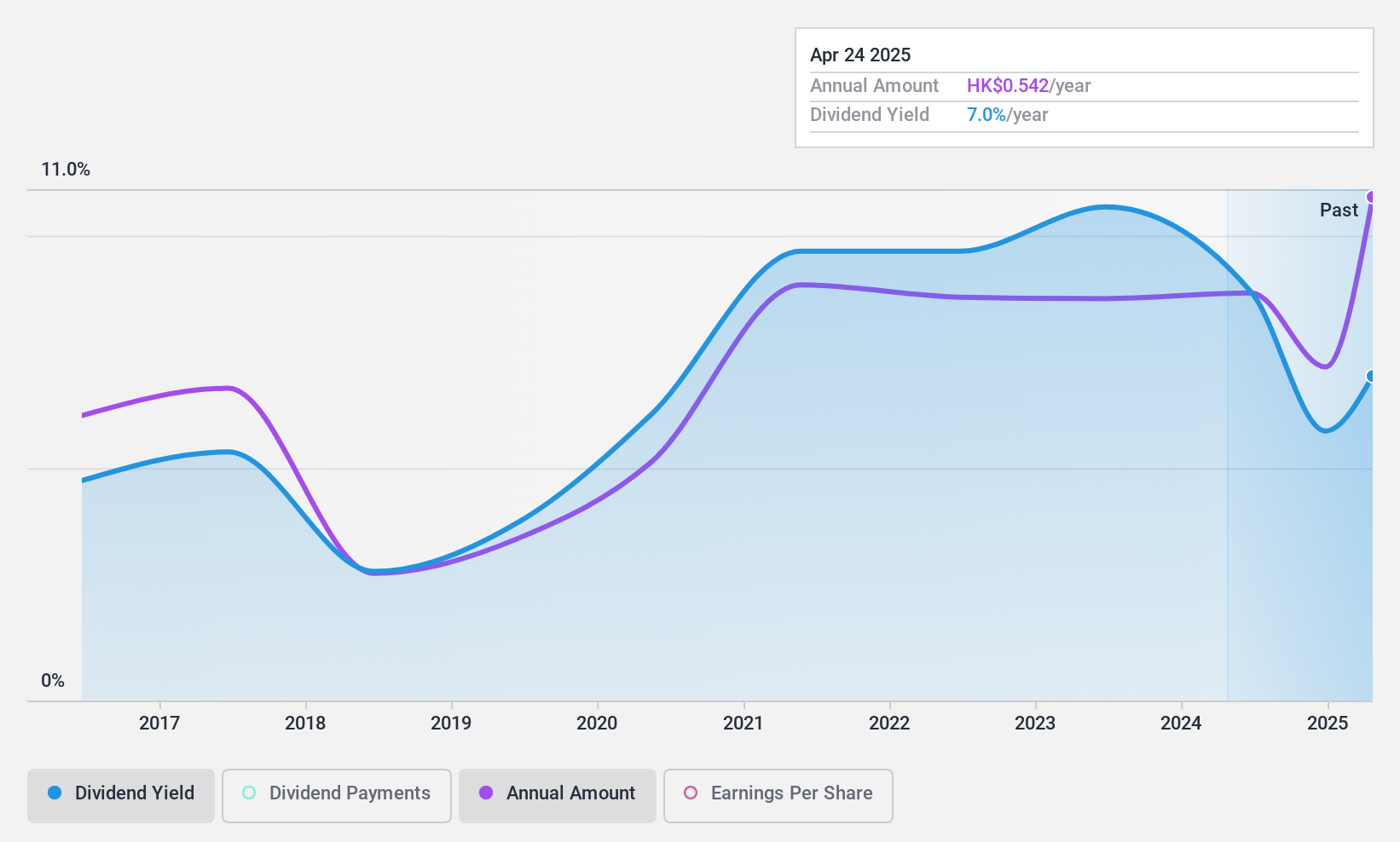

Dividend Yield: 8.3%

Chongqing Rural Commercial Bank offers a compelling dividend yield of 8.28%, ranking in the top 25% in Hong Kong's market. Trading at 74% below its estimated fair value and with a conservative payout ratio of 32.1%, its dividends are well-covered by earnings, ensuring stability and sustainability. Dividend growth has been consistent over the past decade, promising for long-term investors. Recent proposals from major shareholders suggest an active interest in enhancing corporate governance, potentially influencing future financial transparency and performance.

- Get an in-depth perspective on Chongqing Rural Commercial Bank's performance by reading our dividend report here.

- Our valuation report here indicates Chongqing Rural Commercial Bank may be undervalued.

Playmates Toys (SEHK:869)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Playmates Toys Limited is an investment holding company that specializes in the design, development, marketing, and distribution of toys and family entertainment activity products, with a market capitalization of approximately HK$0.80 billion.

Operations: Playmates Toys Limited generates its revenue primarily from toys and family entertainment activity products, totaling approximately HK$1.11 billion.

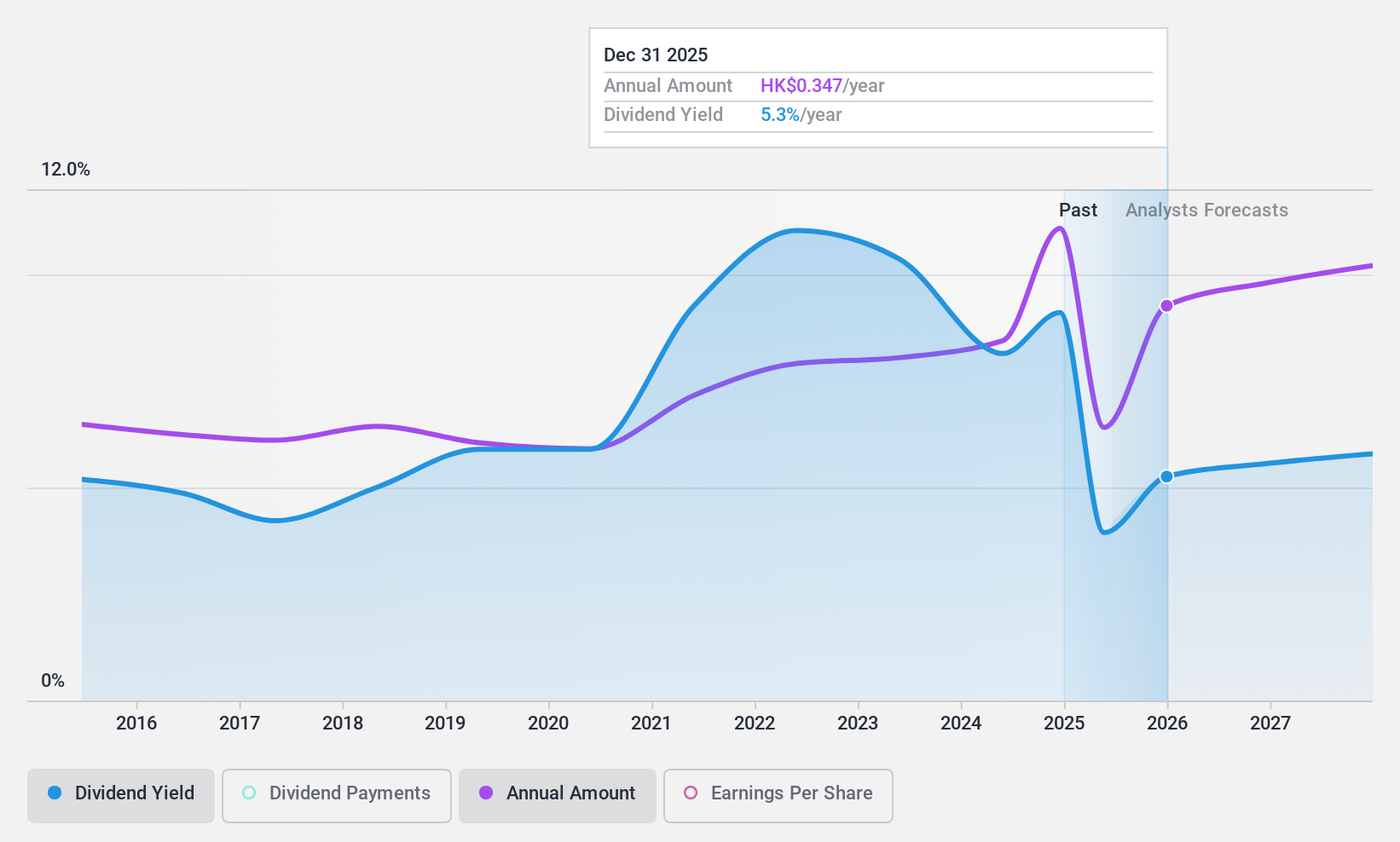

Dividend Yield: 8.8%

Playmates Toys has demonstrated a substantial increase in earnings, with net income rising to HK$223.75 million from HK$9.72 million last year, driven by successful product launches and favorable investment outcomes. Despite this growth, the company's dividend history is marked by inconsistency, with payments showing significant volatility over the past decade. However, recent dividends are well-supported by both earnings and cash flows, with a payout ratio of 26.4% and a cash payout ratio of 82.6%, indicating potential for future stability in dividend payments amid ongoing financial improvements.

- Dive into the specifics of Playmates Toys here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Playmates Toys shares in the market.

Next Steps

- Delve into our full catalog of 85 Top Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Playmates Toys is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:869

Playmates Toys

An investment holding company, engages in the design, development, marketing, and distribution of toys and family entertainment activity products.

Flawless balance sheet established dividend payer.