- Hong Kong

- /

- Consumer Durables

- /

- SEHK:751

Insider Action On Hong Kong's Undervalued Small Caps For October 2024

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate, global markets have experienced volatility, with Hong Kong's Hang Seng Index climbing 10.2% amid optimism about Beijing's support measures. In this environment of fluctuating market sentiment, identifying promising small-cap stocks in Hong Kong requires a keen understanding of economic indicators and insider activities that may signal potential opportunities.

Top 5 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Edianyun | NA | 0.8x | 24.79% | ★★★★★☆ |

| Ferretti | 10.7x | 0.7x | 47.78% | ★★★★☆☆ |

| Hang Lung Group | 7.7x | 1.3x | 49.46% | ★★★★☆☆ |

| Gemdale Properties and Investment | NA | 0.3x | 34.12% | ★★★★☆☆ |

| Vesync | 8.0x | 1.2x | -15.03% | ★★★☆☆☆ |

| Beijing Chunlizhengda Medical Instruments | 17.0x | 3.8x | 38.45% | ★★★☆☆☆ |

| China Lesso Group Holdings | 7.3x | 0.5x | -643.31% | ★★★☆☆☆ |

| Skyworth Group | 6.8x | 0.1x | -379.03% | ★★★☆☆☆ |

| Guangdong Kanghua Healthcare Group | 13.7x | 0.3x | 5.82% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Hang Lung Group (SEHK:10)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hang Lung Group is primarily engaged in property sales and leasing in Hong Kong and Mainland China, with a market capitalization of HK$24.92 billion.

Operations: The company's revenue primarily stems from property sales and leasing activities in Hong Kong and Mainland China. Over recent periods, the gross profit margin has shown fluctuations, with a notable decrease to 63.42% as of June 30, 2024. Operating expenses have remained relatively stable compared to other costs, while non-operating expenses have varied significantly, impacting net income margins.

PE: 7.7x

Hang Lung Group, a smaller player in Hong Kong's market, has caught attention with insider confidence shown by Wenbwo Chan purchasing 200,000 shares for HK$1.93 million between July and October 2024. Despite recent earnings challenges—net income for H1 2024 was HK$888 million compared to HK$1.68 billion last year—the company maintains its dividend at HK$0.21 per share. While earnings have declined by an average of 12% annually over the past five years, sales have grown to HK$6.38 billion from HK$5.53 billion year-on-year, suggesting potential resilience amid financial pressures primarily due to higher-risk external borrowing sources without customer deposits backing liabilities.

- Click here and access our complete valuation analysis report to understand the dynamics of Hang Lung Group.

Review our historical performance report to gain insights into Hang Lung Group's's past performance.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading industrial group in China specializing in the production and sale of building materials and interior decoration products, with a market capitalization of CN¥21.35 billion.

Operations: The company generates revenue primarily from its Plastics & Rubber segment, with recent figures indicating a gross profit margin of 26.04%. Cost of goods sold (COGS) is a significant component, impacting overall profitability. Operating expenses include sales and marketing as well as general and administrative costs, contributing to the net income margin of 6.58%.

PE: 7.3x

China Lesso Group Holdings, a small company in Hong Kong, reported declining sales and net income for the first half of 2024, with sales at CNY 13.56 billion and net income at CNY 1.04 billion. Despite this, insider confidence is evident as Luen Hei Wong purchased four million shares for approximately CNY 10.05 million between January and October 2024. Although the company faces high debt levels with risky external funding sources, earnings are projected to grow annually by over 10%.

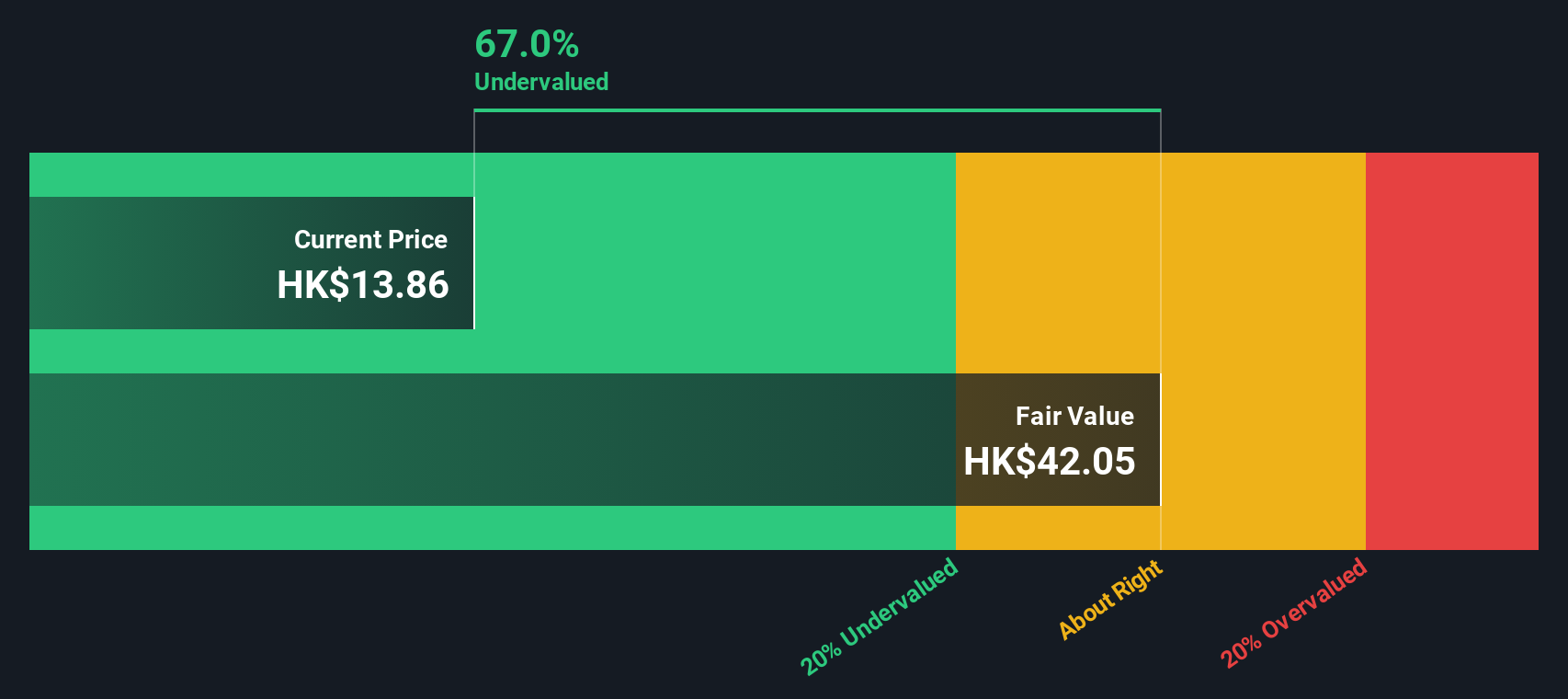

Skyworth Group (SEHK:751)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Skyworth Group is a diversified company engaged in smart household appliances, smart systems technology, modern services, and new energy businesses with a market capitalization of CN¥8.51 billion.

Operations: Skyworth Group generates revenue primarily from its Smart Household Appliances and New Energy Business segments, with the former contributing significantly to overall sales. The company's cost of goods sold (COGS) has been a major expense, impacting its gross profit. Over recent periods, the gross profit margin has shown variability, reaching 14.36% in the latest quarter. Operating expenses are largely driven by sales and marketing efforts along with research and development activities.

PE: 6.8x

Skyworth Group, a smaller player in Hong Kong's market, recently reported earnings for the first half of 2024 with net income rising to CNY 384 million from CNY 302 million the previous year. Despite revenue dipping slightly to CNY 30.15 billion, insider confidence is evident as CEO Chi Shi acquired over two million shares valued at approximately CNY 6.3 million, indicating potential optimism about future growth. Their strategic expansion into Russia showcases commitment to technological innovation and market diversification amidst financial challenges like reliance on external borrowing.

- Click to explore a detailed breakdown of our findings in Skyworth Group's valuation report.

Understand Skyworth Group's track record by examining our Past report.

Next Steps

- Unlock our comprehensive list of 9 Undervalued SEHK Small Caps With Insider Buying by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:751

Skyworth Group

An investment holding company, researches and develops, manufactures, sells, trades, and exports consumer electronic products.

Proven track record with mediocre balance sheet.