Market Cool On EPS Creative Health Technology Group Limited's (HKG:3860) Revenues Pushing Shares 26% Lower

To the annoyance of some shareholders, EPS Creative Health Technology Group Limited (HKG:3860) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 29% share price drop.

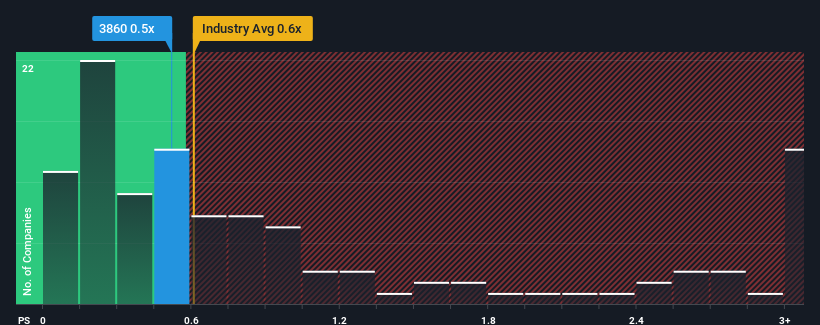

Although its price has dipped substantially, there still wouldn't be many who think EPS Creative Health Technology Group's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Hong Kong's Luxury industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for EPS Creative Health Technology Group

What Does EPS Creative Health Technology Group's Recent Performance Look Like?

EPS Creative Health Technology Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on EPS Creative Health Technology Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on EPS Creative Health Technology Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, EPS Creative Health Technology Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 59% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 13%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that EPS Creative Health Technology Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From EPS Creative Health Technology Group's P/S?

With its share price dropping off a cliff, the P/S for EPS Creative Health Technology Group looks to be in line with the rest of the Luxury industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision EPS Creative Health Technology Group's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

We don't want to rain on the parade too much, but we did also find 4 warning signs for EPS Creative Health Technology Group (1 is potentially serious!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EPS Creative Health Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3860

EPS Creative Health Technology Group

An investment holding company, operates as an apparel supply chain management service provider in Hong Kong, Mainland China, Japan, the United States, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives