How Much Did Yangtzekiang Garment's(HKG:294) Shareholders Earn From Share Price Movements Over The Last Year?

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Yangtzekiang Garment Limited (HKG:294) share price slid 34% over twelve months. That contrasts poorly with the market return of 12%. Taking the longer term view, the stock fell 29% over the last three years.

Check out our latest analysis for Yangtzekiang Garment

Yangtzekiang Garment isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Yangtzekiang Garment's revenue didn't grow at all in the last year. In fact, it fell 8.5%. That looks pretty grim, at a glance. The stock price has languished lately, falling 34% in a year. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

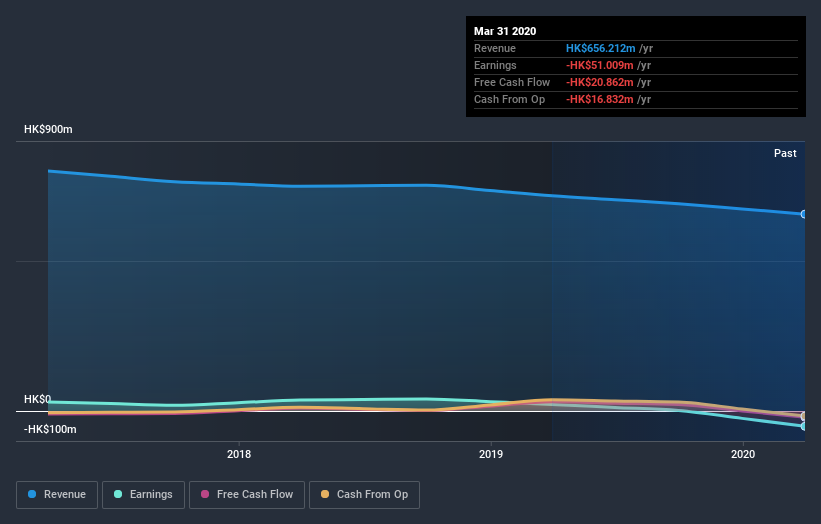

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Yangtzekiang Garment shareholders are down 34% for the year, but the market itself is up 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 0.9%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Yangtzekiang Garment you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Yangtzekiang Garment, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:294

Yangtzekiang Garment

Manufactures and sells garment and textile products in Hong Kong, Mainland China, the United Kingdom, Italy, Spain, Germany, rest of Europe, the United States, Canada, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives