ANTA Sports (SEHK:2020): Exploring Valuation as Share Momentum Sparks Investor Interest

Reviewed by Simply Wall St

Most Popular Narrative: 19.6% Undervalued

The most widely followed narrative suggests that ANTA Sports Products is trading significantly below its estimated fair value, which implies meaningful upside for investors if narrative assumptions hold true.

The deployment of advanced AI technologies in operations, product design, and marketing is expected to increase efficiency and sales conversion rates. These improvements may enhance operating profit margins and contribute to earnings growth.

Ever wondered what powers a price target that towers above today's mark? The answer lies in ambitious goals for faster earnings, steadily rising sales, and a future profit multiple that is uncommon for consumer stocks. Discover which key metrics and optimistic projections shape this valuation story—the numbers might surprise you.

Result: Fair Value of $118.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, signs such as shrinking profit margins and increased competition could challenge the optimism behind ANTA Sports Products' current undervaluation story.

Find out about the key risks to this ANTA Sports Products narrative.Another View: How Does Traditional Valuation Stack Up?

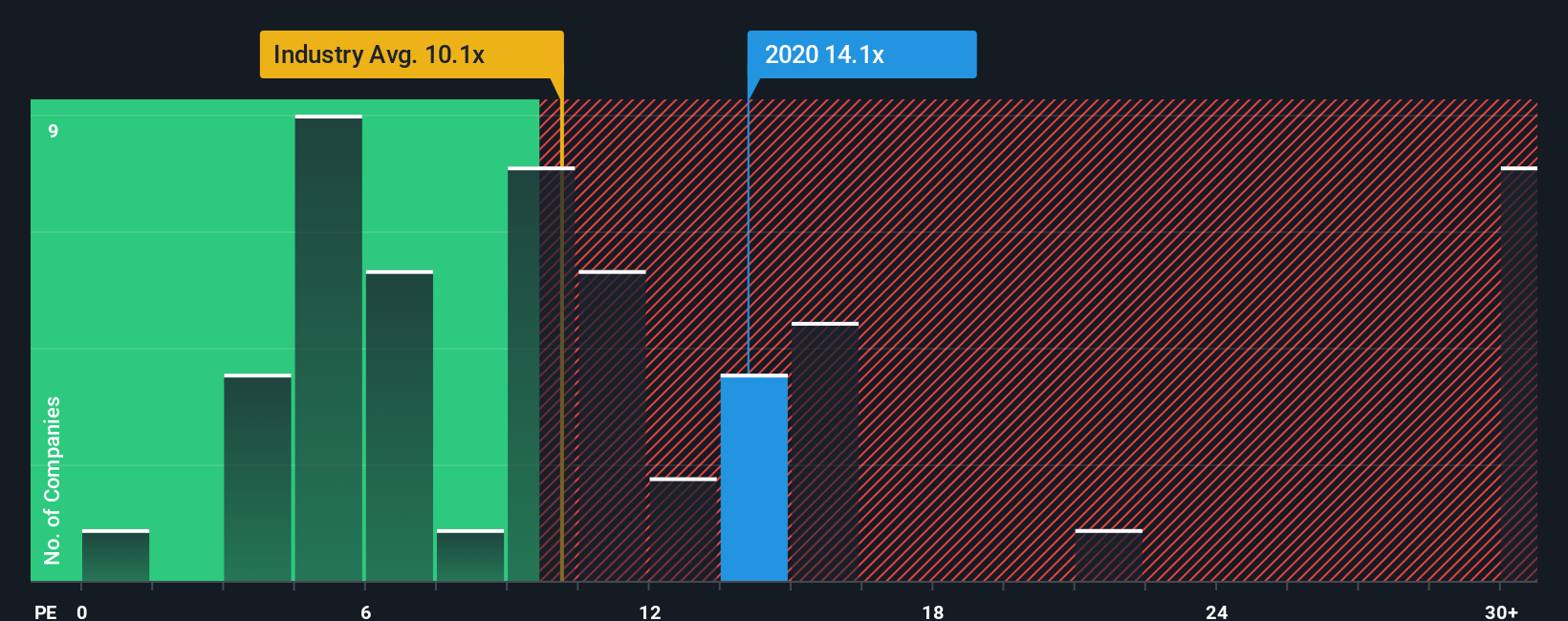

Looking through the lens of current market pricing, ANTA Sports Products appears expensive compared to the industry, even as its earnings performance outpaces most rivals. Could the market be pricing in more optimism than reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ANTA Sports Products Narrative

If you look at things differently or want to investigate your own angle, you can shape your personal narrative in just a few minutes: Do it your way.

A great starting point for your ANTA Sports Products research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why settle for just one opportunity? By using the Simply Wall Street screener, you can quickly find companies leading emerging trends and strong performers in sectors you might not have considered. Make your next move a step ahead of the crowd, as these handpicked strategies could help shape your financial future.

- Spot value with companies trading below their intrinsic worth and take action through our undervalued stocks based on cash flows for potential hidden gems.

- Ignite your portfolio with ground-breaking innovations in the medical field by stepping into our healthcare AI stocks.

- Boost your passive income by targeting reliable payouts; start your search for steady earners inside our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:2020

ANTA Sports Products

Engages in the research, design, development, manufacture, market, and sale of professional sports footwear, apparel, and accessories in China and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives