How Investors May Respond To Samsonite Group (SEHK:1910) CFO Departure and Debt Refinancing Moves

Reviewed by Sasha Jovanovic

- Samsonite Group recently announced that its CFO, Reza Taleghani, will step down for a new opportunity, remaining through January 2026 to ensure continuity, while the company undertakes a search for his successor.

- Alongside this executive change, Samsonite also completed a significant refinancing of its senior notes and credit facilities, extending debt maturities and modestly increasing available liquidity without a major change in cash interest expenses.

- We'll examine how Samsonite's CFO transition and renewed debt structure could influence its forward-looking investment narrative and financial flexibility.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Samsonite Group Investment Narrative Recap

To own Samsonite Group shares, you have to believe in the global recovery in travel and the long-term appeal of branded, premium luggage, especially as emerging-market consumers return and direct-to-consumer channels expand. The recent CFO transition and debt refinancing, while important operationally, do not appear to materially alter the core short-term catalyst of recovering travel demand, nor do they meaningfully ease the ongoing risk tied to weakening consumer sentiment and wholesale channel caution in key regions.

Of the company’s recent announcements, the refinancing of Samsonite’s senior notes and credit facilities stands out. This action extends debt maturities and modestly boosts liquidity, but it does not significantly change Samsonite’s cash interest expenses; as a result, it’s unlikely to have an immediate impact on the core demand drivers or exposures that remain central to the investment narrative.

On the other hand, investors should be aware that even as Samsonite shores up its balance sheet, the challenge of softening consumer demand in China and North America remains...

Read the full narrative on Samsonite Group (it's free!)

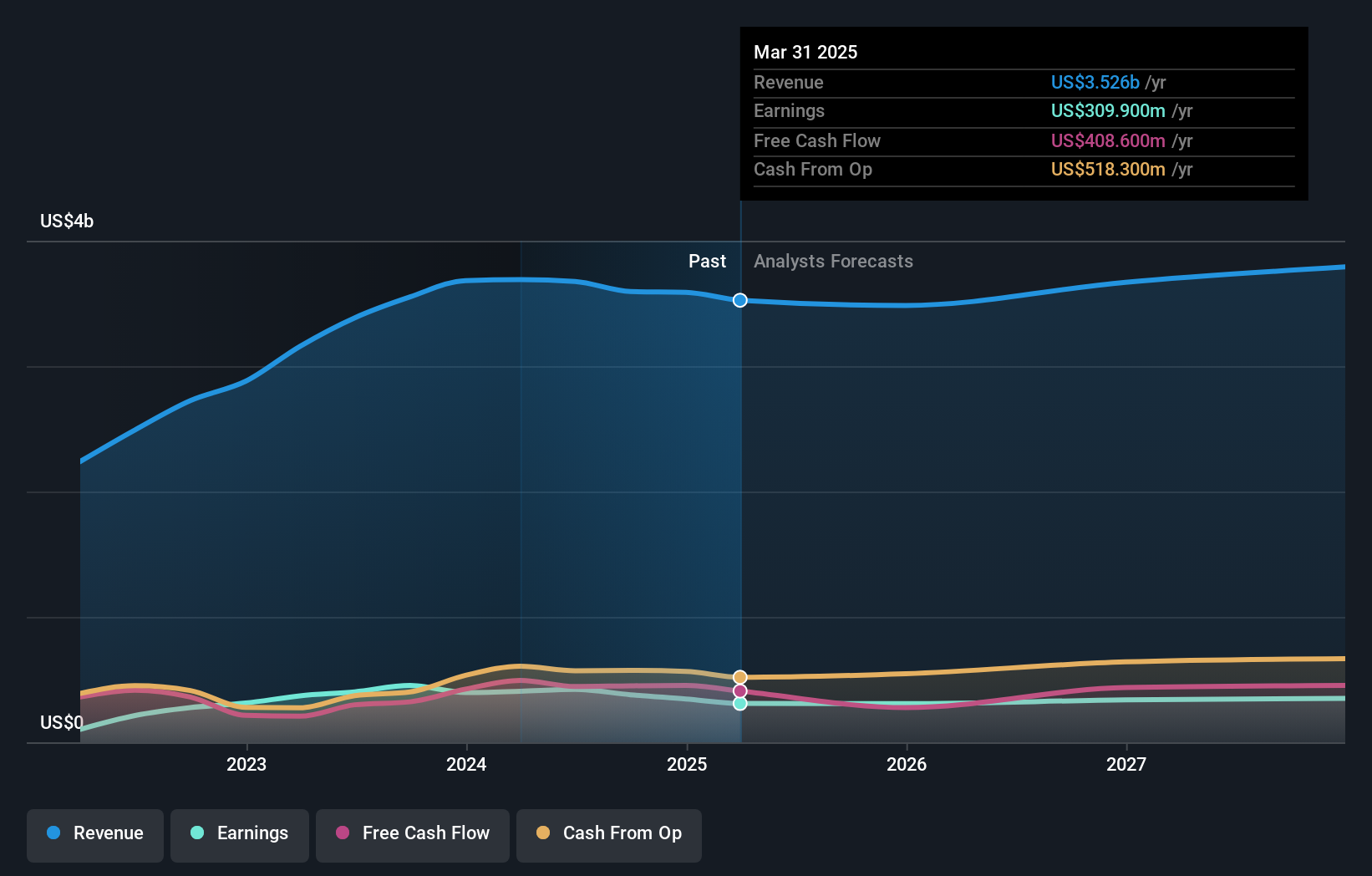

Samsonite Group's outlook projects $3.9 billion in revenue and $349.5 million in earnings by 2028. This assumes a 3.7% annual revenue growth rate and an earnings increase of $55.1 million from current earnings of $294.4 million.

Uncover how Samsonite Group's forecasts yield a HK$20.49 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered fair value views for Samsonite ranging from HK$13.97 to HK$42.05 across three independent analyses. With persistent concerns about consumer sentiment and wholesale channel volatility still top of mind, you can explore a broad spectrum of peer perspectives here.

Explore 3 other fair value estimates on Samsonite Group - why the stock might be worth 15% less than the current price!

Build Your Own Samsonite Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Samsonite Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Samsonite Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Samsonite Group's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1910

Samsonite Group

Engages in the design, manufacture, sourcing, and distribution of luggage, business and computer bags, outdoor and casual bags, and travel accessories in Asia, North America, Europe, and Latin America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives