Affluent Partners Holdings (HKG:1466) pulls back 14% this week, but still delivers shareholders solid 40% CAGR over 3 years

Affluent Partners Holdings Limited (HKG:1466) shareholders might be concerned after seeing the share price drop 14% in the last week. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. Indeed, the share price is up a very strong 162% in that time. To some, the recent share price pullback wouldn't be surprising after such a good run. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the long term performance has been good but there's been a recent pullback of 14%, let's check if the fundamentals match the share price.

View our latest analysis for Affluent Partners Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

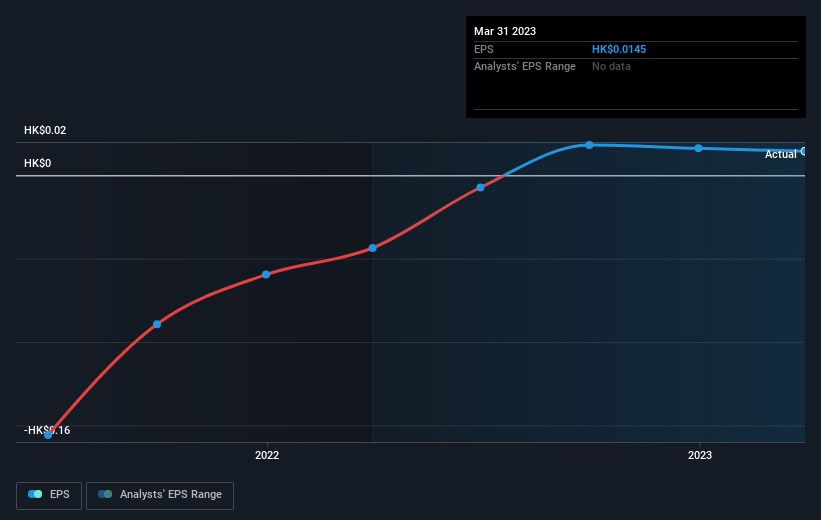

Affluent Partners Holdings became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Affluent Partners Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Affluent Partners Holdings' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Affluent Partners Holdings hasn't been paying dividends, but its TSR of 175% exceeds its share price return of 162%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Affluent Partners Holdings shareholders have received a total shareholder return of 127% over one year. That certainly beats the loss of about 14% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Affluent Partners Holdings better, we need to consider many other factors. Take risks, for example - Affluent Partners Holdings has 3 warning signs (and 2 which can't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1466

Affluent Partners Holdings

An investment holding company, engages in the purchase, process, design, production, and wholesale distribution of pearls and jewelry products.

Mediocre balance sheet very low.