- Hong Kong

- /

- Commercial Services

- /

- SEHK:895

Further weakness as Dongjiang Environmental (HKG:895) drops 11% this week, taking five-year losses to 78%

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held Dongjiang Environmental Company Limited (HKG:895) for half a decade as the share price tanked 81%. And it's not just long term holders hurting, because the stock is down 38% in the last year. Furthermore, it's down 12% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 6.1% decline in the broader market, throughout the period. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

If the past week is anything to go by, investor sentiment for Dongjiang Environmental isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Dongjiang Environmental

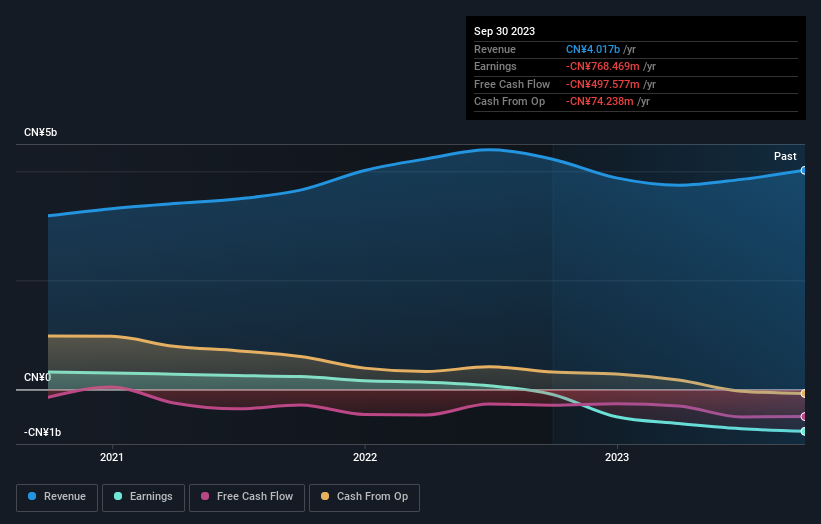

Because Dongjiang Environmental made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Dongjiang Environmental saw its revenue increase by 5.0% per year. That's far from impressive given all the money it is losing. It's not so sure that share price crash of 13% per year is completely deserved, but the market is doubtless disappointed. We'd be pretty cautious about this one, although the sell-off may be too severe. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Dongjiang Environmental stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Dongjiang Environmental's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Dongjiang Environmental's TSR, which was a 78% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 20% in the twelve months, Dongjiang Environmental shareholders did even worse, losing 38%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Dongjiang Environmental (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

We will like Dongjiang Environmental better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:895

Dongjiang Environmental

Provides environmental services in the People’s Republic of China.

Slightly overvalued very low.