- Hong Kong

- /

- Real Estate

- /

- SEHK:3319

Here's Why We Think A-Living Smart City Services (HKG:3319) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like A-Living Smart City Services (HKG:3319), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for A-Living Smart City Services

How Quickly Is A-Living Smart City Services Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. I, for one, am blown away by the fact that A-Living Smart City Services has grown EPS by 58% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

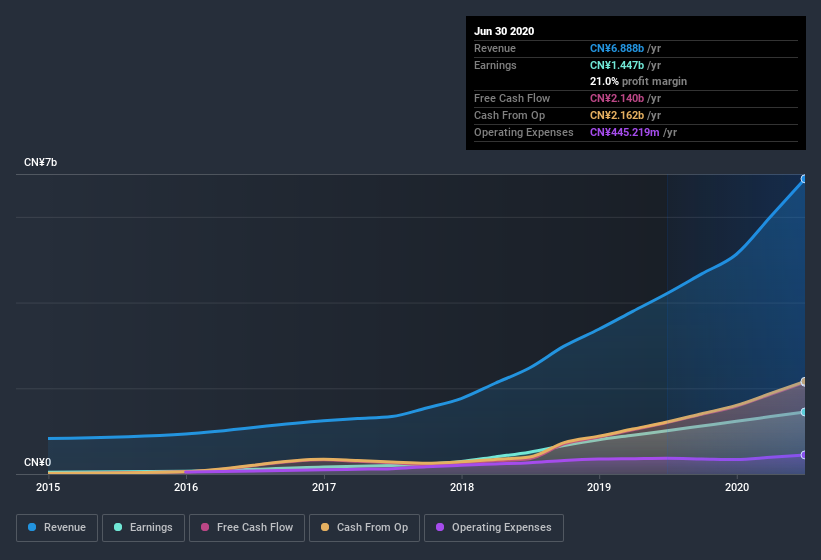

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. A-Living Smart City Services maintained stable EBIT margins over the last year, all while growing revenue 63% to CN¥6.9b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future A-Living Smart City Services EPS 100% free.

Are A-Living Smart City Services Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One shining light for A-Living Smart City Services is the serious outlay one insider has made to buy shares, in the last year. Specifically, the CEO, GM & Executive Director, Dalong Li, accumulated CN¥6.5m worth of shares around CN¥32.36. It doesn't get much better than that, in terms of large investments from insiders.

Is A-Living Smart City Services Worth Keeping An Eye On?

A-Living Smart City Services's earnings have taken off like any random crypto-currency did, back in 2017. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put A-Living Smart City Services on your watchlist. Of course, just because A-Living Smart City Services is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of A-Living Smart City Services, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade A-Living Smart City Services, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3319

A-Living Smart City Services

A-Living Smart City Services Co., Ltd., together with its subsidiaries, provide property management, sale, and inspection services in the People’s Republic of China.

Undervalued with excellent balance sheet.