As global markets grapple with fluctuating consumer sentiment and economic uncertainties, Asian markets have shown resilience, particularly in the face of easing U.S.-China trade tensions which have bolstered investor confidence. In this dynamic environment, uncovering hidden gems involves identifying companies that demonstrate robust fundamentals and adaptability to shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Imuraya Group | 9.20% | 5.21% | 23.19% | ★★★★★★ |

| AlpenLtd | 8.29% | 4.16% | -11.59% | ★★★★★★ |

| Triocean Industrial Corporation | 41.36% | 46.98% | 79.47% | ★★★★★★ |

| Toukei Computer | NA | 5.71% | 14.11% | ★★★★★☆ |

| CTCI Advanced Systems | 28.70% | 17.79% | 19.38% | ★★★★★☆ |

| Pacific Construction | 22.17% | -12.87% | 37.11% | ★★★★★☆ |

| Anfu CE LINK | 70.49% | 7.92% | -8.47% | ★★★★☆☆ |

| Wuhan Huakang Century Clean Technology | 49.07% | 21.27% | 6.99% | ★★★★☆☆ |

| Tibet TourismLtd | 21.50% | 10.05% | 27.69% | ★★★★☆☆ |

| Mirai Semiconductors | 46.15% | 10.52% | 56.25% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Sinofert Holdings (SEHK:297)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sinofert Holdings Limited is an investment holding company involved in the production, import and export, distribution, and retail of fertilizer raw materials and crop nutrition products both in Mainland China and internationally, with a market cap of approximately HK$11.94 billion.

Operations: Sinofert generates revenue primarily from its Basic Business segment, contributing CN¥16.37 billion, and its Growth Business segment, which adds CN¥11.18 billion. The Production segment accounts for CN¥5.54 billion in revenue.

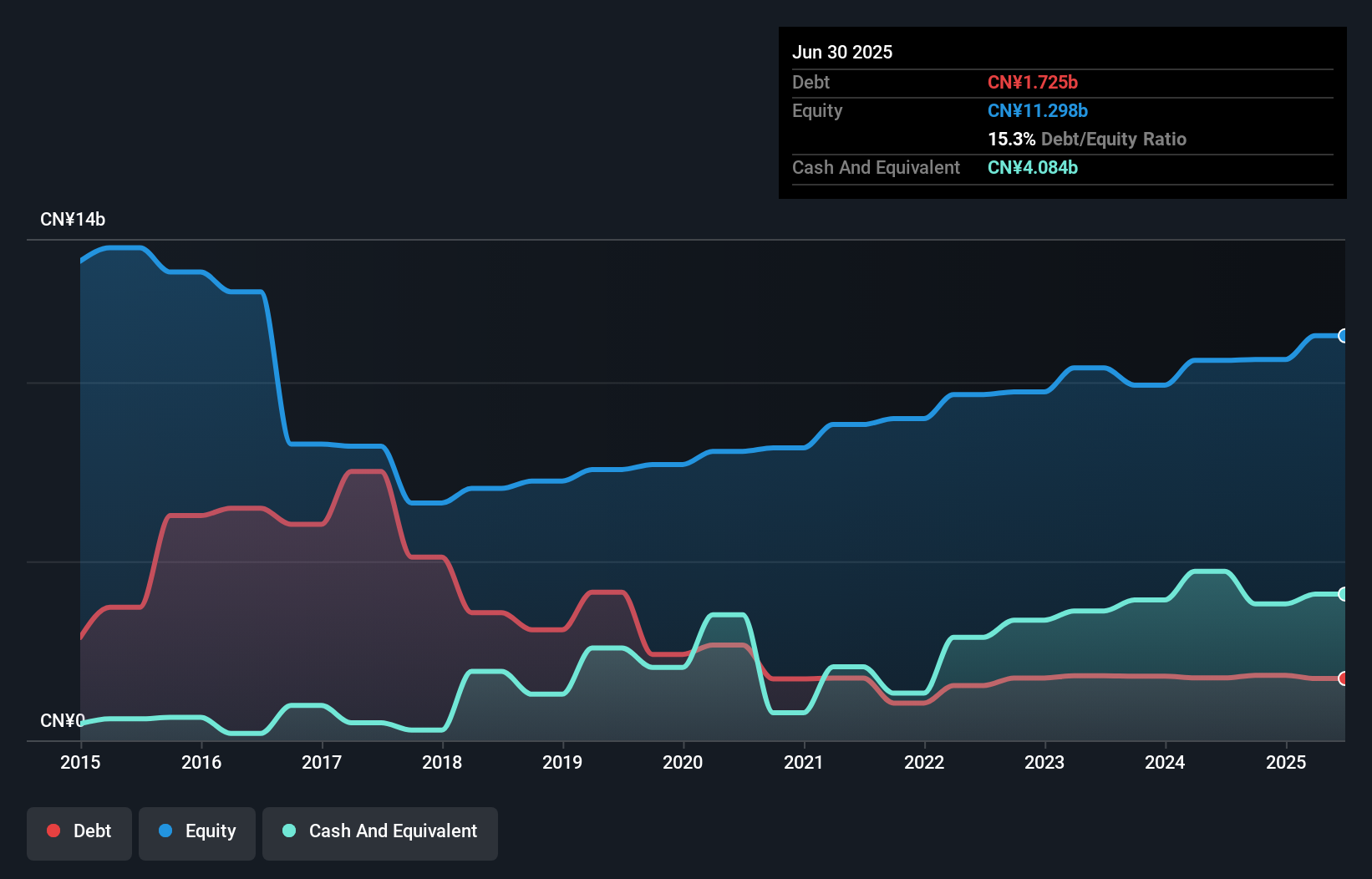

Sinofert Holdings, a notable player in the chemicals sector, has shown impressive growth with earnings surging 65.7% over the past year, outpacing the industry’s 21.8%. Trading at 30.4% below its estimated fair value suggests potential undervaluation in the market. The company reported sales of CNY 14.71 billion for H1 2025, up from CNY 13.68 billion in H1 2024, while net income increased to CNY 1.10 billion from CNY 1.05 billion last year. With a debt-to-equity ratio reduced to 15.3% over five years and high-quality earnings noted, Sinofert seems poised for continued stability and growth within its niche market segment.

- Click to explore a detailed breakdown of our findings in Sinofert Holdings' health report.

Evaluate Sinofert Holdings' historical performance by accessing our past performance report.

Hong Kong Zcloud Technology Construction (SEHK:9900)

Simply Wall St Value Rating: ★★★★★★

Overview: Hong Kong Zcloud Technology Construction Limited is an investment holding company that provides subcontracting works for both public and private sectors in Hong Kong, with a market cap of HK$12.44 billion.

Operations: Zcloud Technology Construction generates revenue primarily from building construction services and RMAA services, amounting to HK$1.28 billion. The company's financial performance can be assessed by examining its profit margins over time.

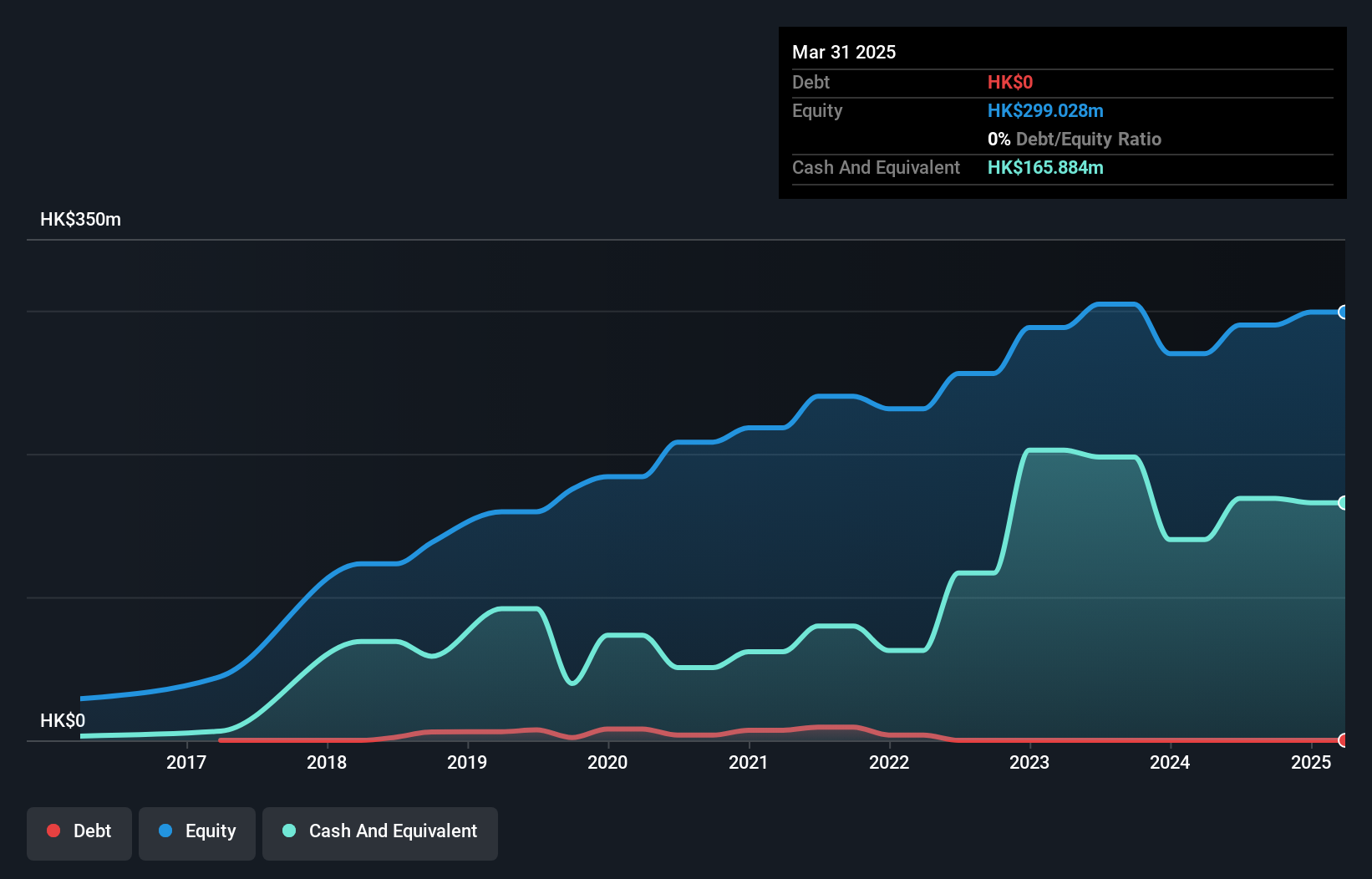

Zcloud Technology Construction, a small player in the construction sector, has shown impressive earnings growth of 12.1% over the past year, outpacing the industry average of -1.9%. The company is debt-free, a significant improvement from five years ago when its debt to equity ratio was 4.3%, indicating prudent financial management. Despite recent volatility in its share price, Zcloud remains free cash flow positive with US$16.21 million as of March 2025. Recently added to the S&P Global BMI Index and undergoing an 8:1 stock split in August 2025, it seems poised for increased visibility and potential investor interest.

Guodian Nanjing Automation (SHSE:600268)

Simply Wall St Value Rating: ★★★★★★

Overview: Guodian Nanjing Automation Co., Ltd. specializes in the manufacture and sale of industrial power automation equipment both in China and internationally, with a market capitalization of CN¥13.05 billion.

Operations: The company generates revenue primarily through the manufacture and sale of industrial power automation equipment, catering to both domestic and international markets. It operates with a market capitalization of CN¥13.05 billion.

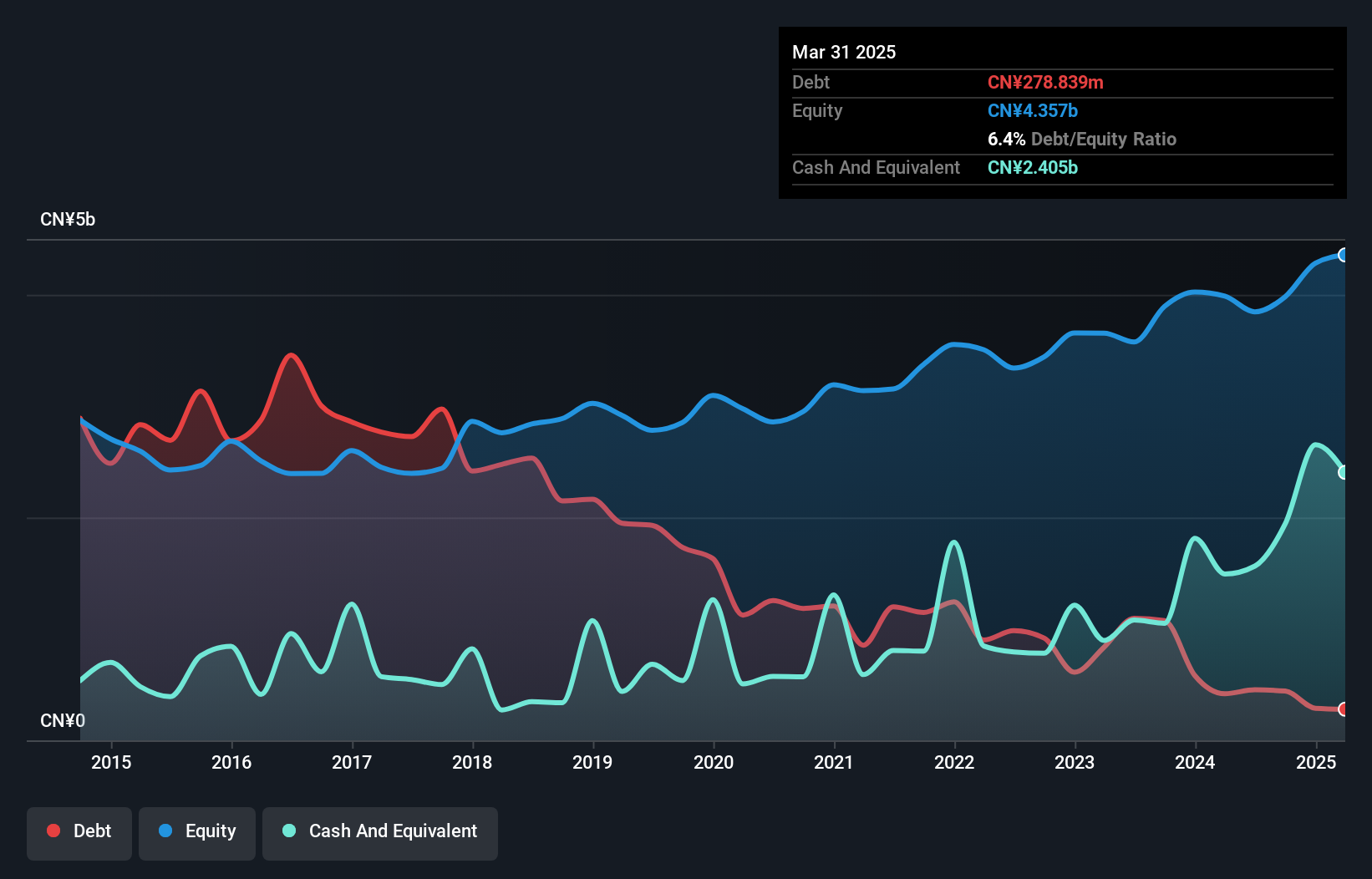

Guodian Nanjing Automation has showcased impressive earnings growth, outpacing the Electrical industry with a 62.9% increase over the past year. The company's net income for the nine months ended September 2025 reached CNY 210.62 million, doubling from CNY 104.86 million in the previous year, while sales climbed to CNY 6.31 billion from CNY 5.54 billion a year ago. With a price-to-earnings ratio of 29x, it remains attractively valued against the CN market average of 45x. Additionally, its debt-to-equity ratio improved significantly to just under 7%, highlighting prudent financial management amidst volatile share prices recently observed in this small cap stock's journey.

Next Steps

- Click through to start exploring the rest of the 2426 Asian Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:297

Sinofert Holdings

An investment holding company, engages in the production, import and export, distribution, and retail of fertilizer raw materials and crop nutrition products in Mainland China and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives