- China

- /

- Real Estate

- /

- SHSE:600684

Discovering Asia's Hidden Gems With Promising Small Cap Stocks

Reviewed by Simply Wall St

As global markets react to favorable trade deals, particularly in Asia where new agreements have bolstered investor confidence, the small-cap sector has shown resilience amidst broader market gains. In this dynamic environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals and growth potential that can thrive despite economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sinopower Semiconductor | NA | 1.45% | -4.33% | ★★★★★★ |

| System ResearchLtd | 12.02% | 10.93% | 15.51% | ★★★★★★ |

| Toukei Computer | NA | 5.68% | 13.35% | ★★★★★★ |

| Konishi | 0.13% | 1.06% | 11.48% | ★★★★★★ |

| Zkteco | 0.88% | 0.65% | 2.05% | ★★★★★★ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| Marusan Securities | 3.64% | 0.57% | 3.44% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| ShareHope Medicine | 36.85% | 2.73% | -7.82% | ★★★★☆☆ |

| Techno Smart | 10.18% | 12.81% | 17.66% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Hong Kong Zcloud Technology Construction (SEHK:9900)

Simply Wall St Value Rating: ★★★★★★

Overview: Hong Kong Zcloud Technology Construction Limited is an investment holding company involved in subcontracting works for both public and private sectors in Hong Kong, with a market capitalization of HK$5.22 billion.

Operations: Zcloud Technology Construction generates revenue primarily from building construction and RMAA services, totaling HK$1.28 billion. The company's financial performance is highlighted by its net profit margin, which reflects the efficiency of its operations and cost management strategies.

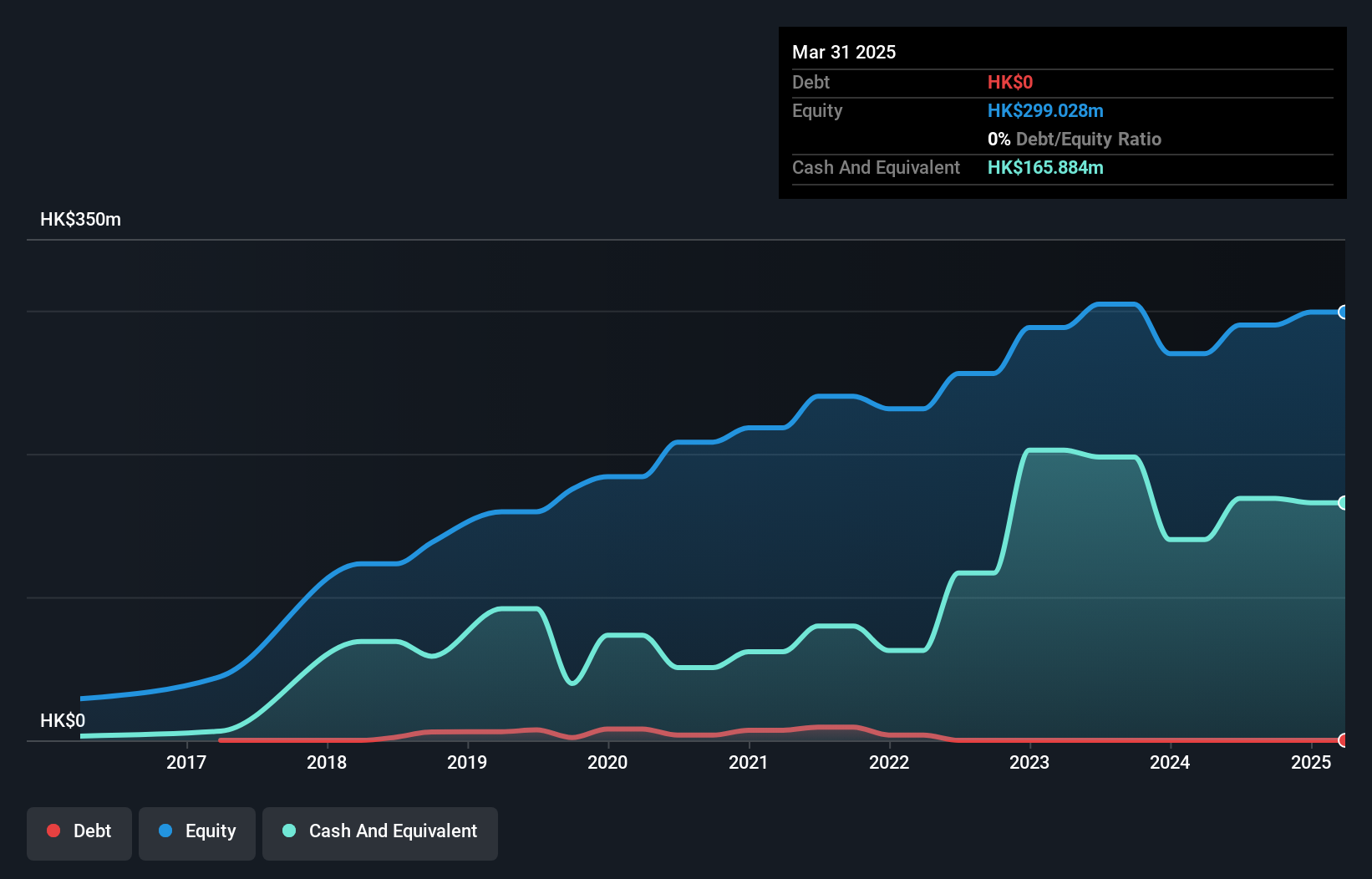

Zcloud Technology, a nimble player in the construction sector, showcases robust financial health with earnings growth of 12.1% over the past year, outpacing the industry average of -3.1%. The company is debt-free, a notable shift from five years ago when its debt to equity ratio was 4.3%, enhancing its financial flexibility. Recent earnings reveal sales climbing to HK$1.28 billion from HK$1.15 billion last year, alongside net income rising to HK$31 million from HK$27.7 million previously. Despite high volatility in share price recently, Zcloud's solid performance and strategic positioning hint at promising prospects ahead.

Guangzhou Pearl River Development Group (SHSE:600684)

Simply Wall St Value Rating: ★★★★★★

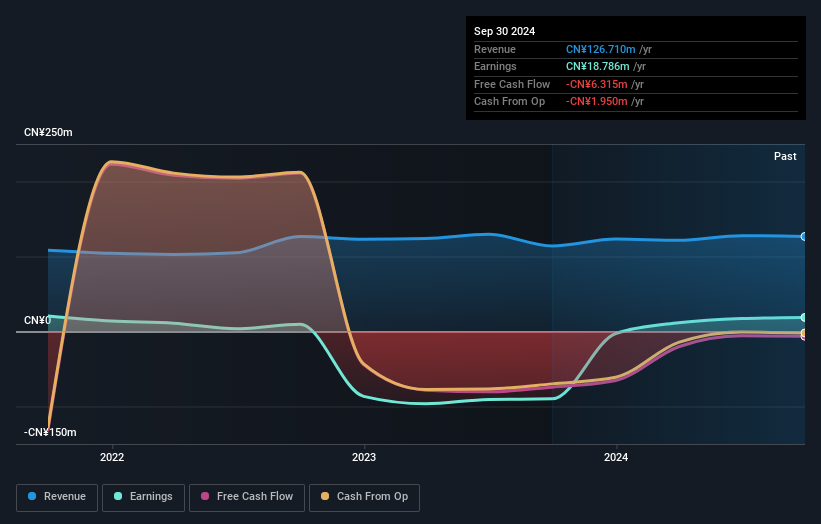

Overview: Guangzhou Pearl River Development Group Co., Ltd. operates in the real estate sector and has a market capitalization of approximately CN¥4.63 billion.

Operations: The company generates revenue primarily from its real estate operations.

Guangzhou Pearl River Development Group has emerged as a promising player in the real estate sector, recently achieving profitability amidst industry challenges. The company's debt management is commendable, with its debt-to-equity ratio significantly reduced from 218.8% to 19.7% over five years, indicating a stronger financial footing. Interest payments are comfortably covered by EBIT at 5.5x, underscoring robust earnings quality and operational efficiency. Despite a volatile share price in recent months, the stock trades at an attractive valuation—73.7% below fair value estimates—suggesting potential upside for investors seeking undervalued opportunities in Asia's dynamic markets.

- Delve into the full analysis health report here for a deeper understanding of Guangzhou Pearl River Development Group.

Understand Guangzhou Pearl River Development Group's track record by examining our Past report.

China Hi-Tech Group (SHSE:600730)

Simply Wall St Value Rating: ★★★★★★

Overview: China Hi-Tech Group Co., Ltd. operates in the education and real estate leasing sectors in China, with a market capitalization of CN¥4.92 billion.

Operations: The company generates revenue primarily from its education and real estate leasing sectors. It has a market capitalization of CN¥4.92 billion.

With an impressive earnings growth of 277% over the past year, China Hi-Tech Group is outpacing its Consumer Services industry peers. The company operates debt-free, which eliminates concerns about interest payments and enhances financial stability. Its high-quality earnings further underscore its robust performance. Despite fluctuations in levered free cash flow, the group remains profitable with a positive outlook on cash runway management. Recent events include a special shareholders meeting scheduled for May 2025 in Beijing, indicating active shareholder engagement and potential strategic developments on the horizon for this nimble player in the market.

Make It Happen

- Access the full spectrum of 2588 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600684

Guangzhou Pearl River Development Group

Guangzhou Pearl River Development Group Co., Ltd.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives