- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:439

What Type Of Returns Would KuangChi Science's(HKG:439) Shareholders Have Earned If They Purchased Their SharesFive Years Ago?

KuangChi Science Limited (HKG:439) shareholders should be happy to see the share price up 16% in the last month. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. In fact, the share price has tumbled down a mountain to land 88% lower after that period. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for KuangChi Science

Given that KuangChi Science didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade KuangChi Science reduced its trailing twelve month revenue by 25% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 13% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

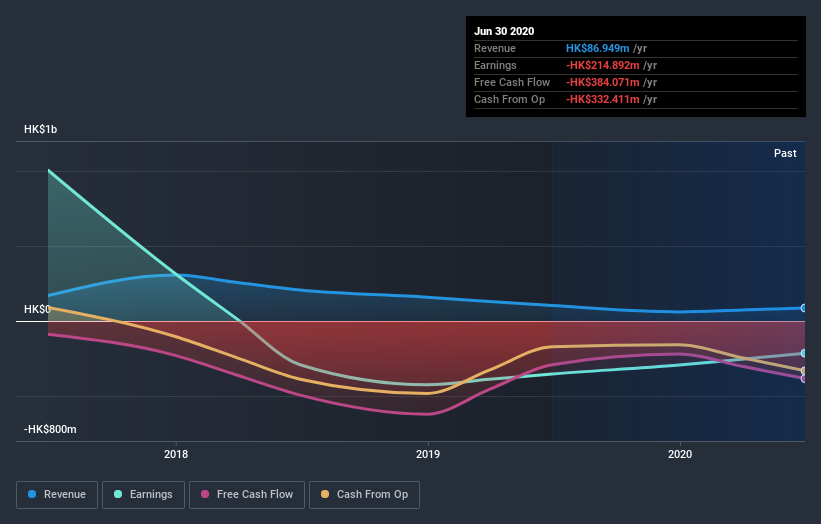

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that KuangChi Science shareholders have received a total shareholder return of 27% over the last year. Notably the five-year annualised TSR loss of 13% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand KuangChi Science better, we need to consider many other factors. Even so, be aware that KuangChi Science is showing 3 warning signs in our investment analysis , and 2 of those are a bit unpleasant...

Of course KuangChi Science may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade KuangChi Science, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KuangChi Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:439

KuangChi Science

An investment holding company, engages in the development of artificial intelligence (AI) technology and related products in the People’s Republic of China, Hong Kong, and internationally.

Flawless balance sheet and overvalued.