- Hong Kong

- /

- Construction

- /

- SEHK:3822

Sam Woo Construction Group Limited's (HKG:3822) Shares Climb 109% But Its Business Is Yet to Catch Up

The Sam Woo Construction Group Limited (HKG:3822) share price has done very well over the last month, posting an excellent gain of 109%. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

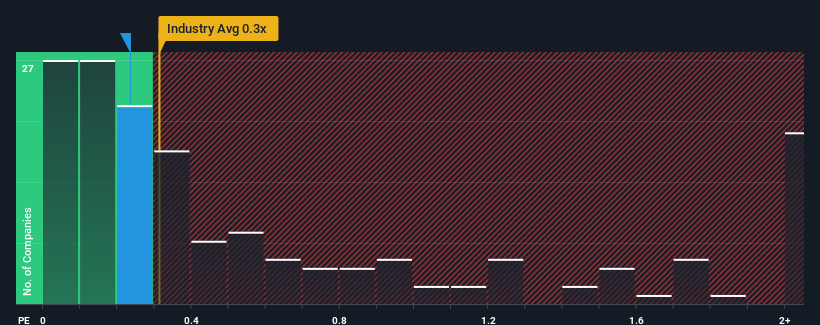

In spite of the firm bounce in price, there still wouldn't be many who think Sam Woo Construction Group's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Hong Kong's Construction industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Sam Woo Construction Group

What Does Sam Woo Construction Group's Recent Performance Look Like?

Sam Woo Construction Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sam Woo Construction Group's earnings, revenue and cash flow.How Is Sam Woo Construction Group's Revenue Growth Trending?

Sam Woo Construction Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 89% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 33% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 11% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's somewhat alarming that Sam Woo Construction Group's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Sam Woo Construction Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We find it unexpected that Sam Woo Construction Group trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Having said that, be aware Sam Woo Construction Group is showing 3 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Sam Woo Construction Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3822

Sam Woo Construction Group

An investment holding company, provides foundation works and ancillary services in Hong Kong and Macau.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives