- Hong Kong

- /

- Industrials

- /

- SEHK:363

Three Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to experience record highs, driven by factors such as domestic policy shifts and geopolitical developments, investors are increasingly seeking stability amidst the volatility. In this dynamic environment, dividend stocks offer a compelling option for those looking to balance growth with income, providing potential resilience through regular payouts while navigating the complexities of today's market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.71% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Able Engineering Holdings (SEHK:1627)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Able Engineering Holdings Limited is an investment holding company that operates a building construction business in Hong Kong with a market cap of HK$890 million.

Operations: Able Engineering Holdings Limited generates revenue primarily from its construction segment, amounting to HK$6.43 billion.

Dividend Yield: 9.6%

Able Engineering Holdings' dividend yield is in the top 25% of Hong Kong's market, with a payout ratio of 48.8%, indicating earnings adequately cover dividends. Despite this, the company's six-year dividend history shows volatility and no growth, suggesting unreliability. Recent earnings growth of HK$99.89 million for the half-year ending September 2024 supports dividend sustainability, but past fluctuations may concern investors seeking stable income streams. The stock trades significantly below estimated fair value.

- Click here to discover the nuances of Able Engineering Holdings with our detailed analytical dividend report.

- Our expertly prepared valuation report Able Engineering Holdings implies its share price may be lower than expected.

Shanghai Industrial Holdings (SEHK:363)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Industrial Holdings Limited is an investment holding company involved in infrastructure and environmental protection, real estate, consumer products, and comprehensive healthcare operations across Hong Kong, China, the rest of Asia, and internationally with a market cap of approximately HK$12.55 billion.

Operations: Shanghai Industrial Holdings Limited generates revenue from its key segments, which include Real Estate (HK$17.26 billion), Infrastructure and Environmental Protection (HK$9.42 billion), and Consumer Products (HK$3.59 billion).

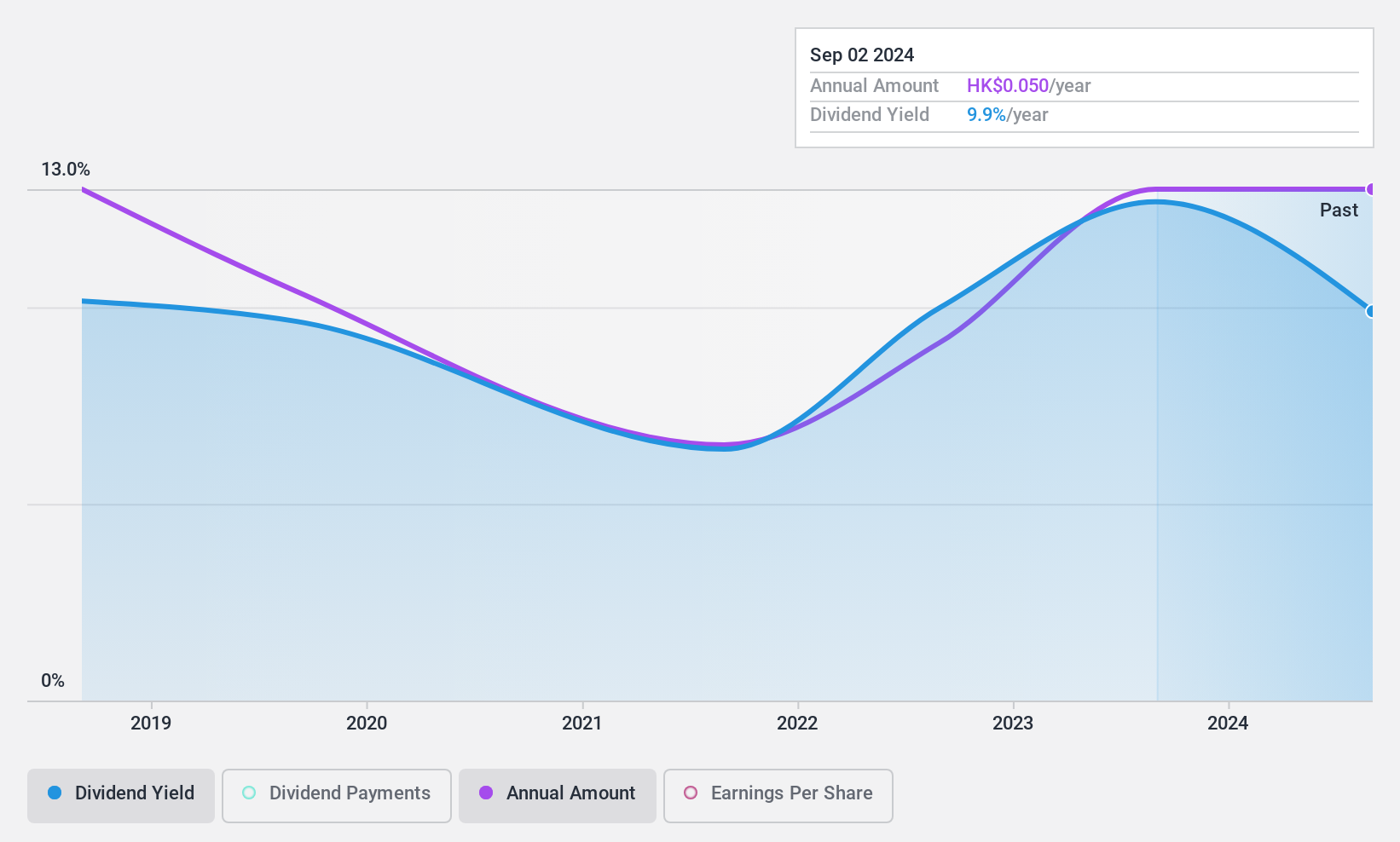

Dividend Yield: 8.1%

Shanghai Industrial Holdings offers a high dividend yield, ranking in the top 25% of Hong Kong's market. However, its dividend history is marked by volatility with significant drops over the past decade. Although earnings have grown by 25.6% recently and dividends are covered by a low payout ratio of 31.5%, they aren't sustained by free cash flows, raising concerns about long-term reliability despite attractive valuation metrics like a low price-to-earnings ratio of 3.9x.

- Click to explore a detailed breakdown of our findings in Shanghai Industrial Holdings' dividend report.

- Our expertly prepared valuation report Shanghai Industrial Holdings implies its share price may be too high.

Beijing Sifang AutomationLtd (SHSE:601126)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Sifang Automation Co., Ltd provides power transmission, transformation protection, automation systems, and related services both in China and internationally, with a market cap of CN¥14.12 billion.

Operations: Beijing Sifang Automation Co., Ltd generates revenue from supplying systems for power transmission, transformation protection, automation, power generation, enterprise power management, and distribution and consumption in both domestic and international markets.

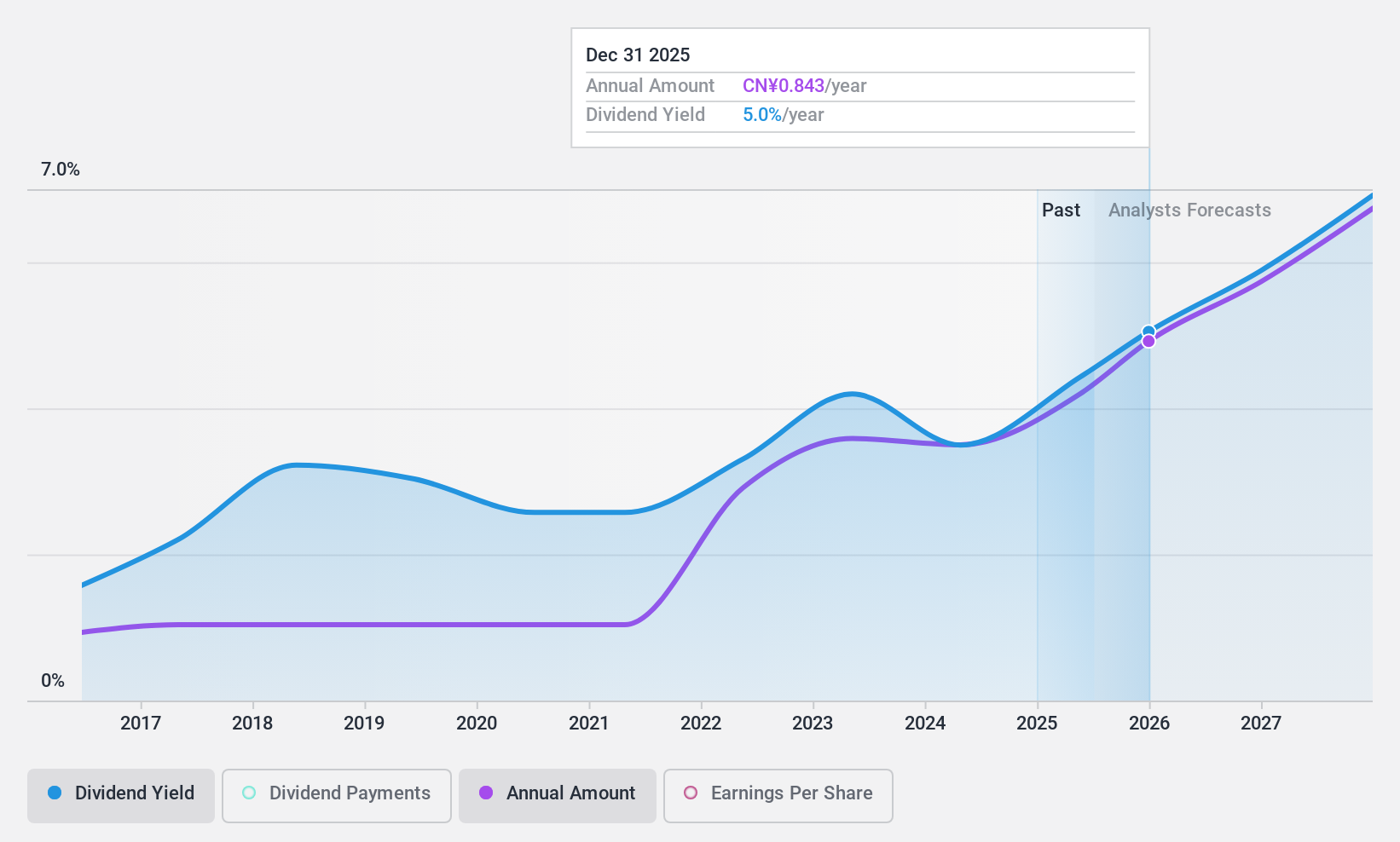

Dividend Yield: 3.5%

Beijing Sifang Automation's dividend yield is among the top 25% in China, supported by a sustainable payout ratio of 70% and a cash payout ratio of 39.6%. Despite past volatility, dividends have grown over the last decade. Recent earnings growth of 14.2% and revenue increase to CNY 5.09 billion indicate strong financial health, with analysts predicting further stock price appreciation. However, its dividend reliability remains questionable due to historical instability.

- Click here and access our complete dividend analysis report to understand the dynamics of Beijing Sifang AutomationLtd.

- Our valuation report here indicates Beijing Sifang AutomationLtd may be undervalued.

Taking Advantage

- Access the full spectrum of 1962 Top Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:363

Shanghai Industrial Holdings

An investment holding company, engages in the infrastructure and environmental protection, real estate, consumer products, and comprehensive healthcare operations businesses.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives