- Hong Kong

- /

- Construction

- /

- SEHK:2386

How Proposed Governance Overhaul at SINOPEC Engineering (Group) (SEHK:2386) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- SINOPEC Engineering (Group) recently announced proposed amendments to its Articles of Association, which include dissolving the supervisory committee and reducing registered capital through share cancellations, with the changes subject to shareholder approval at an extraordinary general meeting scheduled for December 23, 2025.

- This proposed overhaul reflects the company's response to evolving regulatory requirements and a drive to streamline its governance framework.

- We'll explore how the supervisory committee’s cancellation could reshape SINOPEC Engineering's investment narrative and overall governance approach.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is SINOPEC Engineering (Group)'s Investment Narrative?

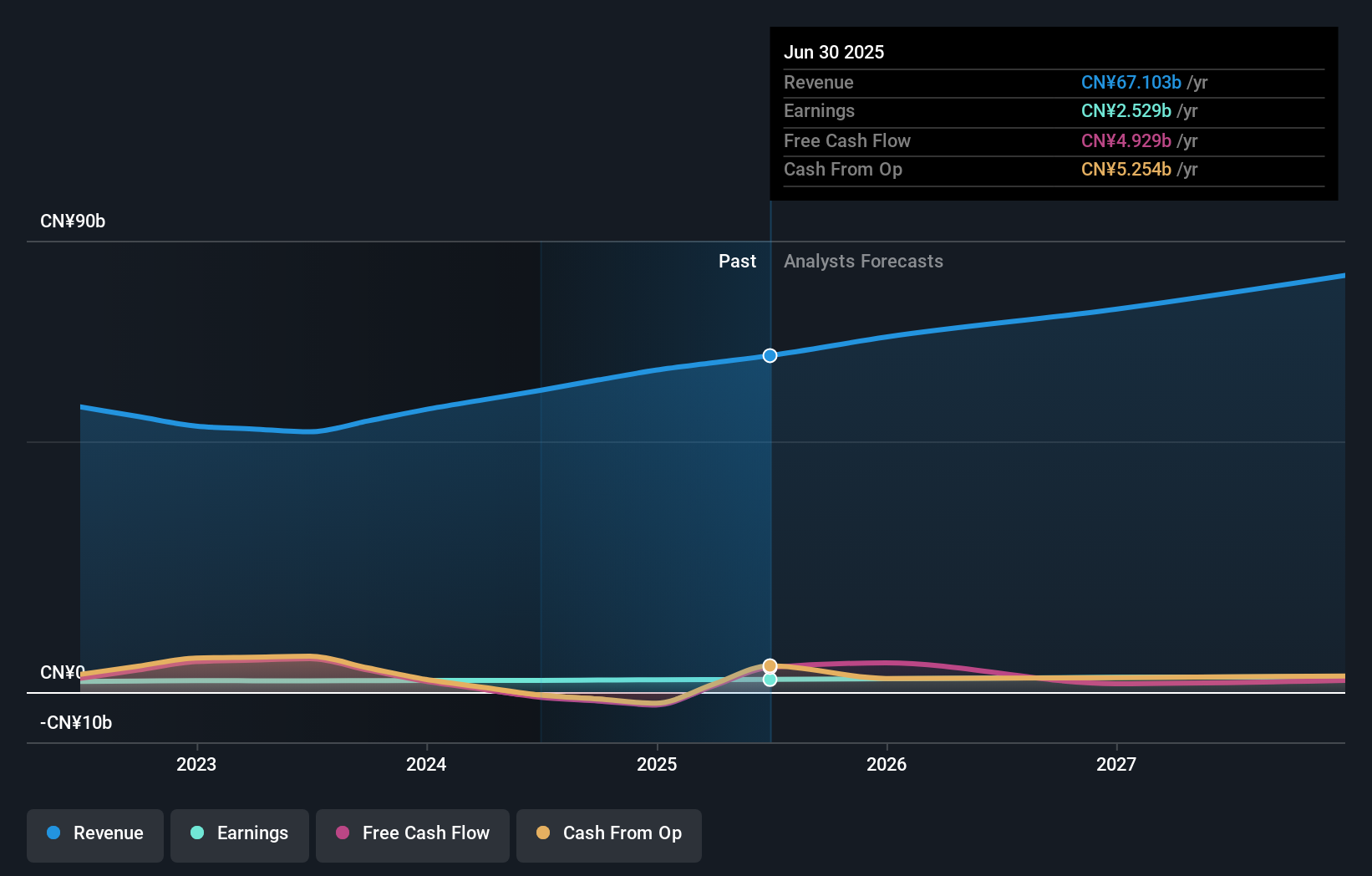

The big picture for SINOPEC Engineering (Group) has revolved around consistent contract wins, solid earnings, and healthy dividend payments, which have helped fuel impressive total returns over the past year. The recent move to dissolve the supervisory committee, reduce registered capital through share cancellations, and streamline governance could be a signal of the company aligning more closely with regulatory expectations and aiming for increased operational efficiency. For now, these proposed changes appear structural, with little immediate impact on the fundamental catalysts, like fresh project contracts and stable margins, or the key risks, such as persistently low profit margins and a board still considered inexperienced. However, over time, tighter governance and capital adjustments could affect how the company manages risk and capital allocation, an element investors will want to monitor as new leadership settles in.

But while the prospect of smoother governance is promising, concerns around low profitability remain front of mind for investors. SINOPEC Engineering (Group)'s shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on SINOPEC Engineering (Group) - why the stock might be worth as much as HK$7.41!

Build Your Own SINOPEC Engineering (Group) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SINOPEC Engineering (Group) research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SINOPEC Engineering (Group) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SINOPEC Engineering (Group)'s overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2386

SINOPEC Engineering (Group)

Provides engineering, procurement, and construction (EPC) contracting services in the People’s Republic of China, Saudi Arabia, Kuwait, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives