- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:2357

AviChina Industry & Technology (SEHK:2357): Assessing Valuation as Governance Changes Go to Shareholder Vote

Reviewed by Simply Wall St

AviChina Industry & Technology (SEHK:2357) has triggered attention after announcing the closure of its register of members ahead of an extraordinary shareholders’ meeting scheduled for December 12. The gathering will address potential changes to the company’s foundational governance documents.

See our latest analysis for AviChina Industry & Technology.

After a rocky stretch, AviChina’s shares closed at HK$3.96, recovering slightly from recent lows. The stock’s 1-year total return is down 10.39%. Despite short-term volatility, the three-year total shareholder return of 18.10% suggests that longer-term investors have still come out ahead.

If you’re curious where momentum might be building in this sector, consider exploring See the full list for free.

With shares trading at a marked discount to analyst targets and the company posting double-digit revenue and net income growth, the question remains: does AviChina represent an overlooked value, or is the market simply factoring in future risks and opportunities?

Price-to-Earnings of 14.7x: Is it justified?

AviChina's shares currently trade at a price-to-earnings (P/E) ratio of 14.7x, noticeably higher than the average of its peer group, despite the last close price of HK$3.96 reflecting a sizable discount to analyst targets.

The price-to-earnings ratio assesses how much investors are willing to pay for each dollar of earnings and is widely used to compare valuation across similar companies. For AviChina, this higher-than-peer multiple implies the market expects stronger growth or superior quality of earnings compared to competitors, but recent results show that profit growth has not kept pace with industry averages.

While AviChina appears to offer better value than the broader Asian Aerospace & Defense sector, where the average P/E is a lofty 57.7x, its multiple still overshoots both the peer group average (12.1x) and the estimated fair P/E ratio (12.6x). This suggests the market is pricing in future growth or a recovery, but there may be some risk of excess optimism if those expectations are not met.

Explore the SWS fair ratio for AviChina Industry & Technology

Result: Price-to-Earnings of 14.7x (OVERVALUED)

However, slower profit growth compared to industry peers and a continued discount to analyst targets could challenge the view that AviChina is currently undervalued.

Find out about the key risks to this AviChina Industry & Technology narrative.

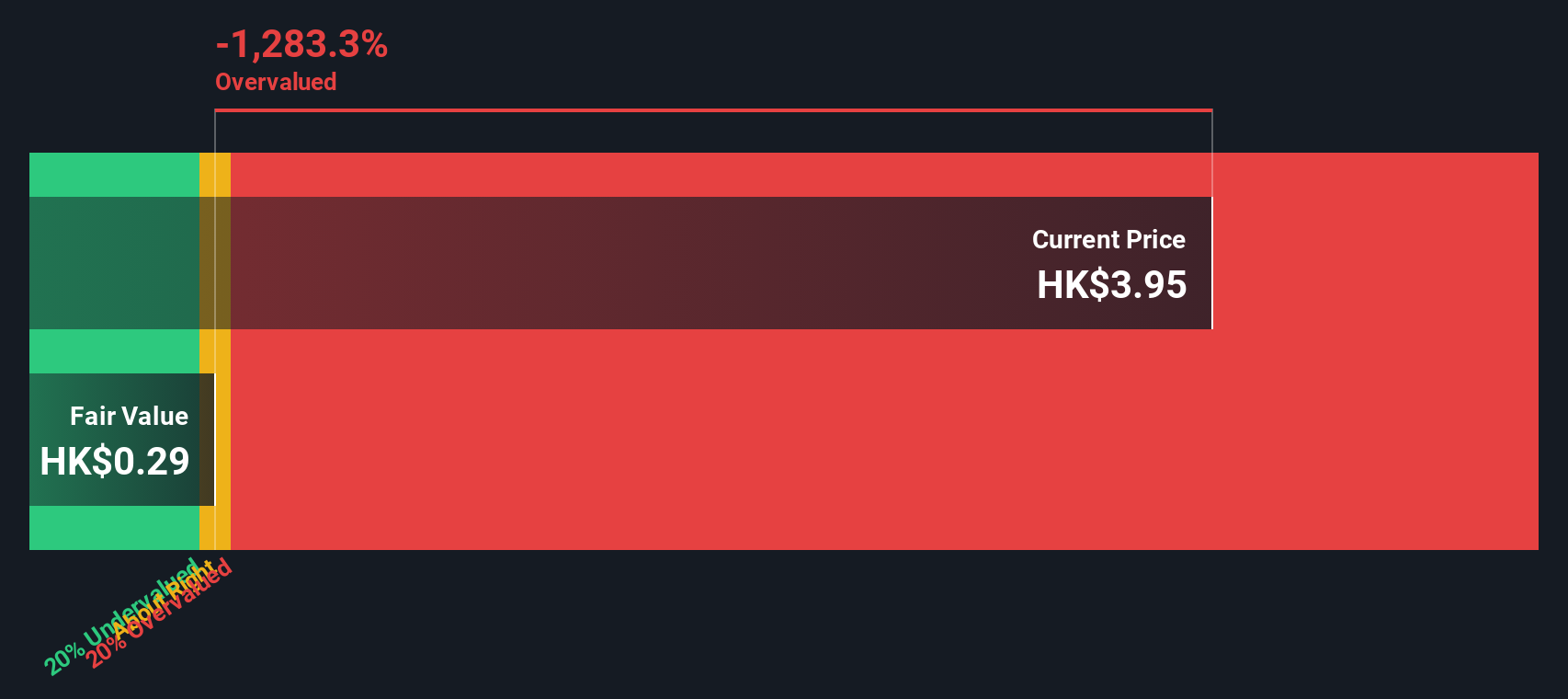

Another View: Discounted Cash Flow Shows a Bleak Picture

Looking at a different valuation lens, our DCF model suggests AviChina could be trading well above what long-term cash flows might justify. While trading below analyst targets and industry averages according to earnings multiples, the DCF approach produces a much lower fair value and raises doubts about whether the market is mispricing risk. Which outlook will ultimately prove right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AviChina Industry & Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AviChina Industry & Technology Narrative

Keep in mind, if you have a different perspective or want to take a hands-on approach, you can craft your own analysis in just a few minutes using our tools. Go ahead and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding AviChina Industry & Technology.

Looking for More Investable Opportunities?

Take the next step beyond AviChina and discover a world of smart investment choices. Countless investors are already benefiting from carefully curated stock ideas you don’t want to miss.

- Tap into potential market gains by checking out these 868 undervalued stocks based on cash flows, which highlights stocks trading below their intrinsic value.

- Enhance your portfolio with the growth potential of these 25 AI penny stocks, featuring companies leveraging transformative artificial intelligence innovations.

- Find opportunities for reliable returns and long-term income by exploring these 16 dividend stocks with yields > 3%, focusing on stocks with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2357

AviChina Industry & Technology

Engages in the development, manufacture, and sale of civil aviation and defense products in Hong Kong and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives