- Hong Kong

- /

- Construction

- /

- SEHK:2110

Optimistic Investors Push Tian Cheng Holdings Limited (HKG:2110) Shares Up 39% But Growth Is Lacking

Those holding Tian Cheng Holdings Limited (HKG:2110) shares would be relieved that the share price has rebounded 39% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 48% in the last twelve months.

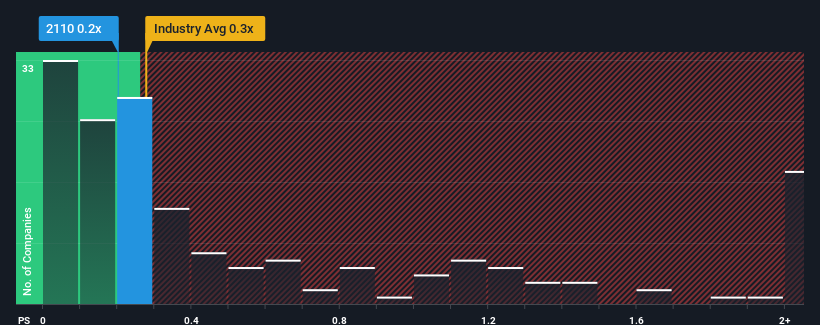

Although its price has surged higher, it's still not a stretch to say that Tian Cheng Holdings' price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Construction industry in Hong Kong, where the median P/S ratio is around 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Tian Cheng Holdings

What Does Tian Cheng Holdings' Recent Performance Look Like?

The revenue growth achieved at Tian Cheng Holdings over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Tian Cheng Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Tian Cheng Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Still, lamentably revenue has fallen 35% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.9% shows it's an unpleasant look.

With this in mind, we find it worrying that Tian Cheng Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What Does Tian Cheng Holdings' P/S Mean For Investors?

Its shares have lifted substantially and now Tian Cheng Holdings' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We find it unexpected that Tian Cheng Holdings trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Tian Cheng Holdings (of which 2 are a bit concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tian Cheng Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2110

Tian Cheng Holdings

An investment holding company, operates as a marine construction works subcontractor in Hong Kong and the People's Republic of China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives