- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2098

The five-year loss for Zall Smart Commerce Group (HKG:2098) shareholders likely driven by its shrinking earnings

It is a pleasure to report that the Zall Smart Commerce Group Ltd. (HKG:2098) is up 60% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Like a ship taking on water, the share price has sunk 87% in that time. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the last five years has been tough for Zall Smart Commerce Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Zall Smart Commerce Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Zall Smart Commerce Group became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

Revenue is actually up 14% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

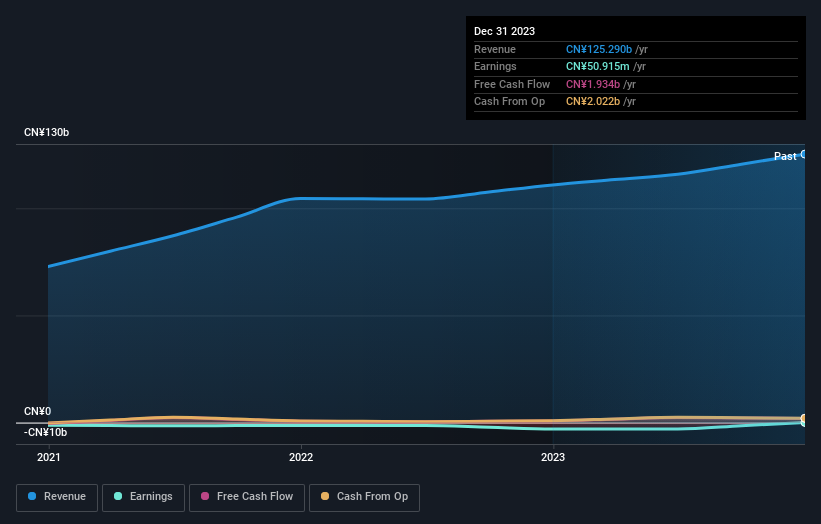

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Although it hurts that Zall Smart Commerce Group returned a loss of 2.5% in the last twelve months, the broader market was actually worse, returning a loss of 4.6%. What is more upsetting is the 13% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. It's always interesting to track share price performance over the longer term. But to understand Zall Smart Commerce Group better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Zall Smart Commerce Group you should be aware of, and 2 of them are a bit concerning.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zall Smart Commerce Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2098

Zall Smart Commerce Group

An investment holding company, engages in the supply chain management and trading businesses in the People’s Republic of China and Singapore.

Low and slightly overvalued.