- Hong Kong

- /

- Industrials

- /

- SEHK:19

Swire Pacific (SEHK:19) Valuation in Focus as Cathay Buyback Lifts Stake and Influence

Reviewed by Simply Wall St

Qatar Airways has fully exited its position in Cathay Pacific after selling its entire stake for approximately $897 million. As a result of this share buyback, Swire Pacific (SEHK:19) now sees its interest in the airline rise to nearly 48%.

See our latest analysis for Swire Pacific.

Swire Pacific's position in Cathay Pacific comes amid a year of shifting momentum. Even with some recent bumps, investors who stuck with the stock over the past year saw a 6.6% total return. Those with a five-year view enjoyed a remarkable 126% total shareholder return. The latest share price sits at HK$66.70, reflecting a mixed short-term trajectory but clear long-term strength.

If you're interested in what other established names in capital-intensive sectors are doing, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares trading at a notable discount to analyst targets and recent double-digit gains over five years, the key question is whether Swire Pacific is undervalued now or if the market has already taken future growth into account.

Most Popular Narrative: 16% Undervalued

Swire Pacific's most widely followed valuation narrative points to a fair value of HK$79.5 per share, which is notably higher than the latest close at HK$66.70. This gap has investors looking at the company with fresh interest as momentum shifts and analyst expectations converge on a bullish future for the conglomerate.

Significant continued investment in beverage production capacity across Mainland China and Southeast Asia, coupled with steady product innovation and improved efficiency, is set to capture increasing consumer demand in rapidly urbanizing markets. This is expected to drive robust future revenue growth and incremental EBITDA margin improvement from the Beverages segment.

Curious how aggressive expansion and bold financial assumptions shape this fair value? The narrative is built on projections rarely seen outside high-growth sectors. Revenue and margin leaps are expected, but what is fueling those optimistic estimates? Click through to uncover which numbers drive the analysts’ valuation outlook for Swire Pacific.

Result: Fair Value of $79.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Hong Kong's office market and rising financing costs could present challenges for Swire Pacific's margin growth and long-term earnings outlook.

Find out about the key risks to this Swire Pacific narrative.

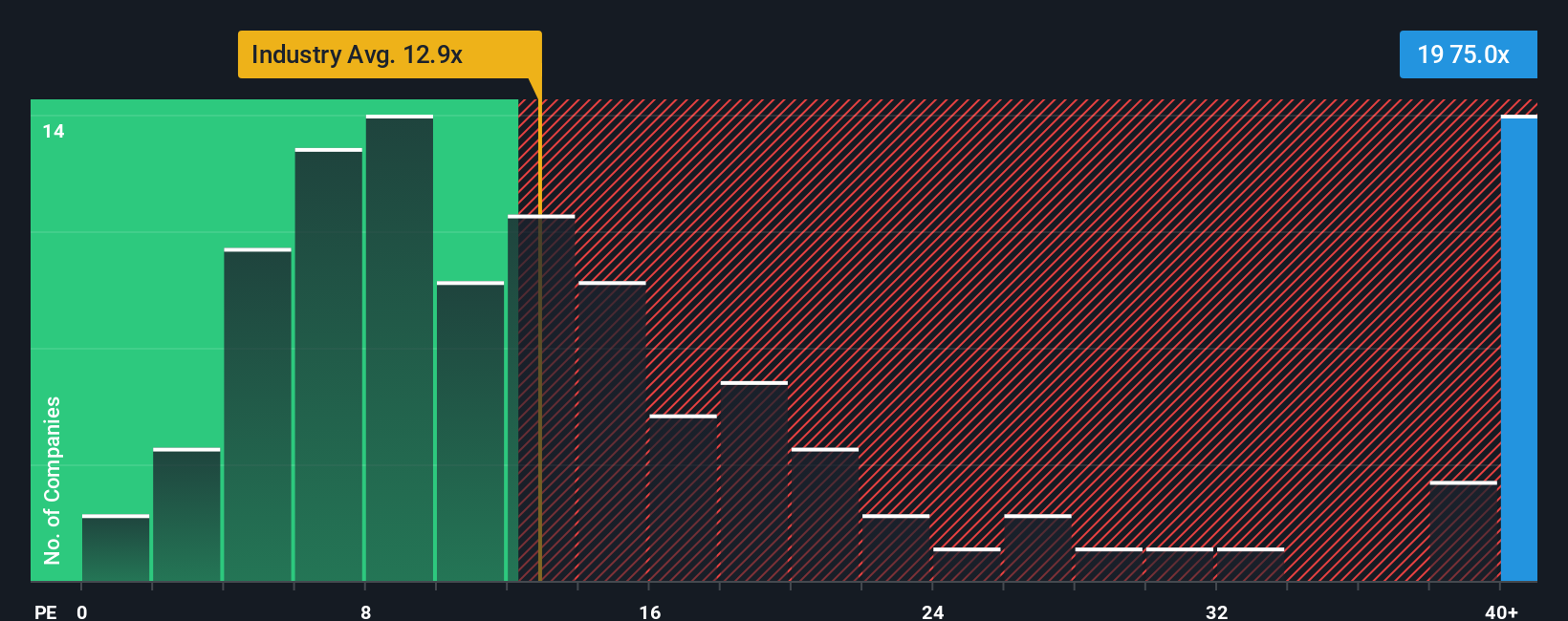

Another View: Price-Earnings Raises a Red Flag

Taking a different approach, Swire Pacific’s share price weighs in at 73.6 times its earnings, which is much higher than both the Hong Kong Industrials average of 12.8 times and the peer average of 13.5. Even when compared to a fair ratio of 16.2, this suggests investors are exposed to significant valuation risk if market sentiment shifts. Is the premium justified, or could this leave little cushion for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Swire Pacific Narrative

If you have a different perspective or want to dig deeper, you can analyze the numbers firsthand and piece together your own view in just a few minutes. Do it your way

A great starting point for your Swire Pacific research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Miss the chance now, and you could overlook outstanding opportunities that other smart investors are considering today. Instantly boost your research with these fresh ideas:

- Boost your income potential by targeting reliable payouts through these 16 dividend stocks with yields > 3%. These options deliver yields above 3% from established companies committed to shareholder returns.

- Ride the wave of technological evolution by starting with these 25 AI penny stocks. These stocks are at the forefront of artificial intelligence, transforming entire industries and markets.

- Seize early-stage growth by scanning these 3586 penny stocks with strong financials with solid fundamentals, where big moves often begin before most notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:19

Swire Pacific

Engages in the property, aviation, beverages, marine, and trading and industrial businesses in Hong Kong, Mainland China, Taiwan, rest of Asia, the United States, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives