- Hong Kong

- /

- Metals and Mining

- /

- SEHK:340

Asian Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

Amid the evolving global economic landscape, Asian markets have shown resilience, with Chinese indices experiencing gains due to easing trade tensions. In this context, penny stocks—often smaller or newer companies—remain a noteworthy investment area despite their historical connotations. These stocks can offer a unique blend of affordability and growth potential when backed by strong financials, making them intriguing options for investors seeking opportunities beyond mainstream equities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.84 | HK$2.31B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.54 | HK$952.52M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.58 | HK$2.14B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.12 | SGD453.92M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.98 | THB2.99B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.099 | SGD51.83M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.38 | SGD13.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.03 | HK$2.77B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.40 | THB8.89B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 945 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Newton Resources (SEHK:1231)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Newton Resources Ltd is an investment holding company involved in the identification and exploration of sourcing and supply of iron ores and other commodities both in Mainland China and internationally, with a market cap of HK$1.30 billion.

Operations: The company generates revenue of $243.86 million from its resources business segment.

Market Cap: HK$1.3B

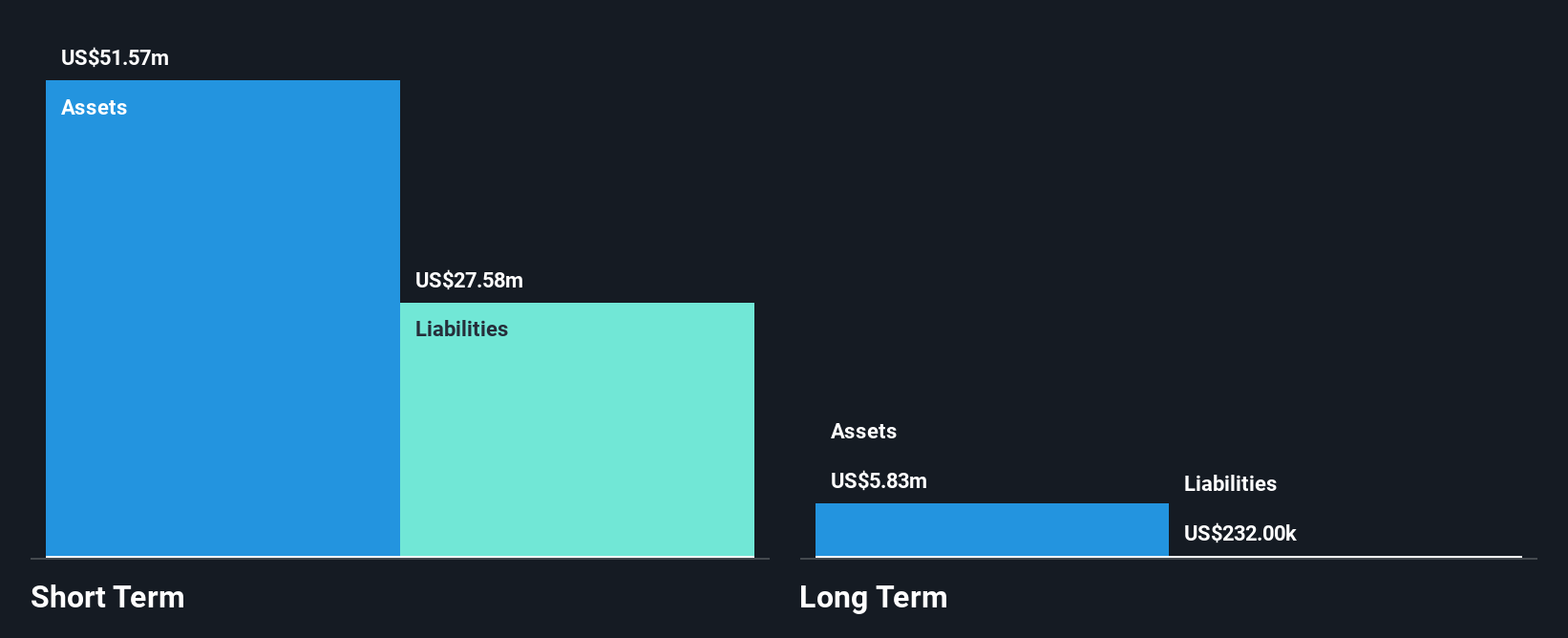

Newton Resources Ltd, with a market cap of HK$1.30 billion, operates in the resources sector and reported revenue of US$108.68 million for the first half of 2025, down from US$174.76 million a year prior. Despite being unprofitable with a net loss of US$0.35 million recently, it has significantly reduced its losses over five years by 16.2% annually and maintains sufficient cash runway for over three years without debt concerns. However, increased volatility and trading at a substantial discount to estimated fair value highlight potential risks alongside opportunities in this highly speculative investment space.

- Click here to discover the nuances of Newton Resources with our detailed analytical financial health report.

- Gain insights into Newton Resources' historical outcomes by reviewing our past performance report.

Tongguan Gold Group (SEHK:340)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tongguan Gold Group Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and related products in China with a market cap of HK$12.18 billion.

Operations: The company's revenue primarily comes from its gold mining operations, totaling HK$1.69 billion.

Market Cap: HK$12.18B

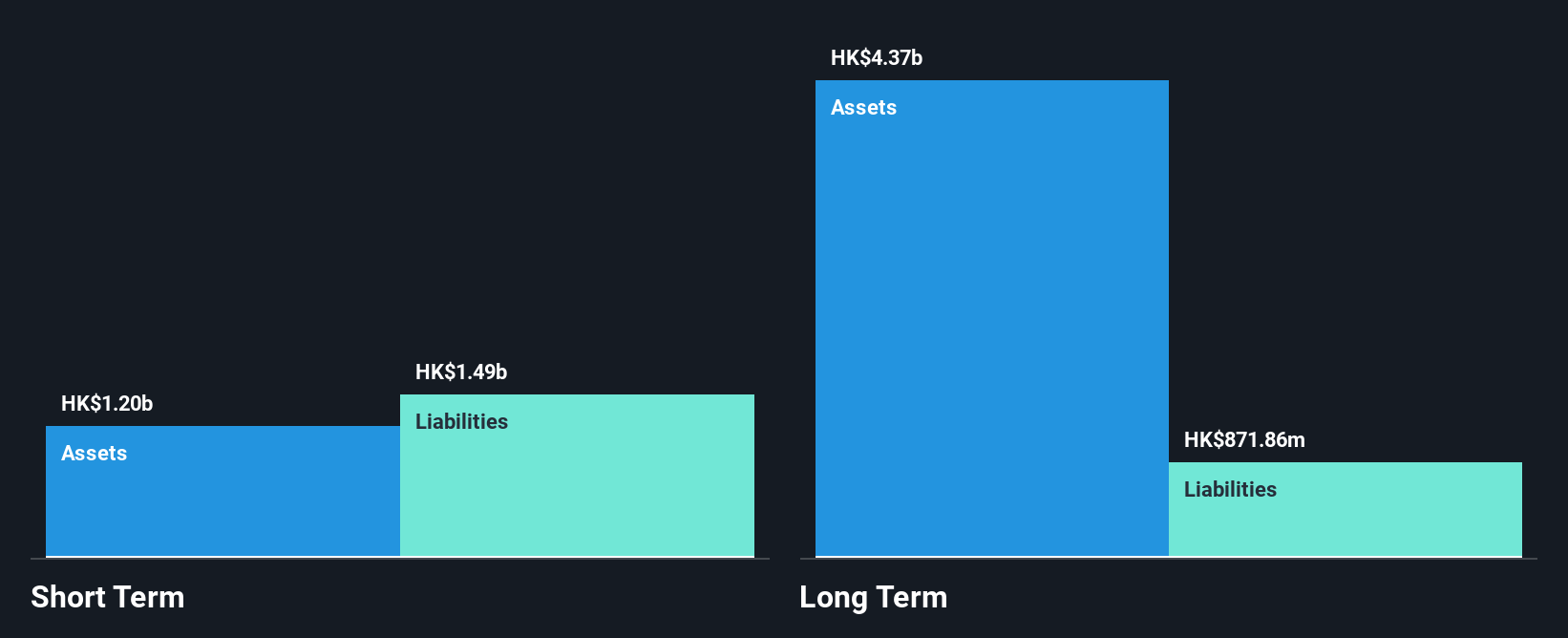

Tongguan Gold Group has demonstrated robust financial performance, with earnings growing significantly by a very large margin over the past year, surpassing both its historical averages and industry benchmarks. The company's net profit margins have improved substantially, and it maintains a strong cash position relative to its debt. Recent executive changes saw the appointment of Mr. Wang Dequan as CEO, bringing extensive expertise in gold mining operations. Despite these positives, investors should note the stock's high volatility and low return on equity compared to industry standards, which could present challenges in this speculative investment category.

- Navigate through the intricacies of Tongguan Gold Group with our comprehensive balance sheet health report here.

- Gain insights into Tongguan Gold Group's future direction by reviewing our growth report.

Raffles Medical Group (SGX:BSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raffles Medical Group Ltd offers integrated private healthcare services across Singapore, Greater China, Vietnam, Cambodia, and Japan with a market capitalization of SGD1.87 billion.

Operations: The company's revenue is primarily derived from Hospital Services (SGD352.07 million), Insurance Services (SGD186.63 million), and Healthcare Services (SGD295.96 million).

Market Cap: SGD1.87B

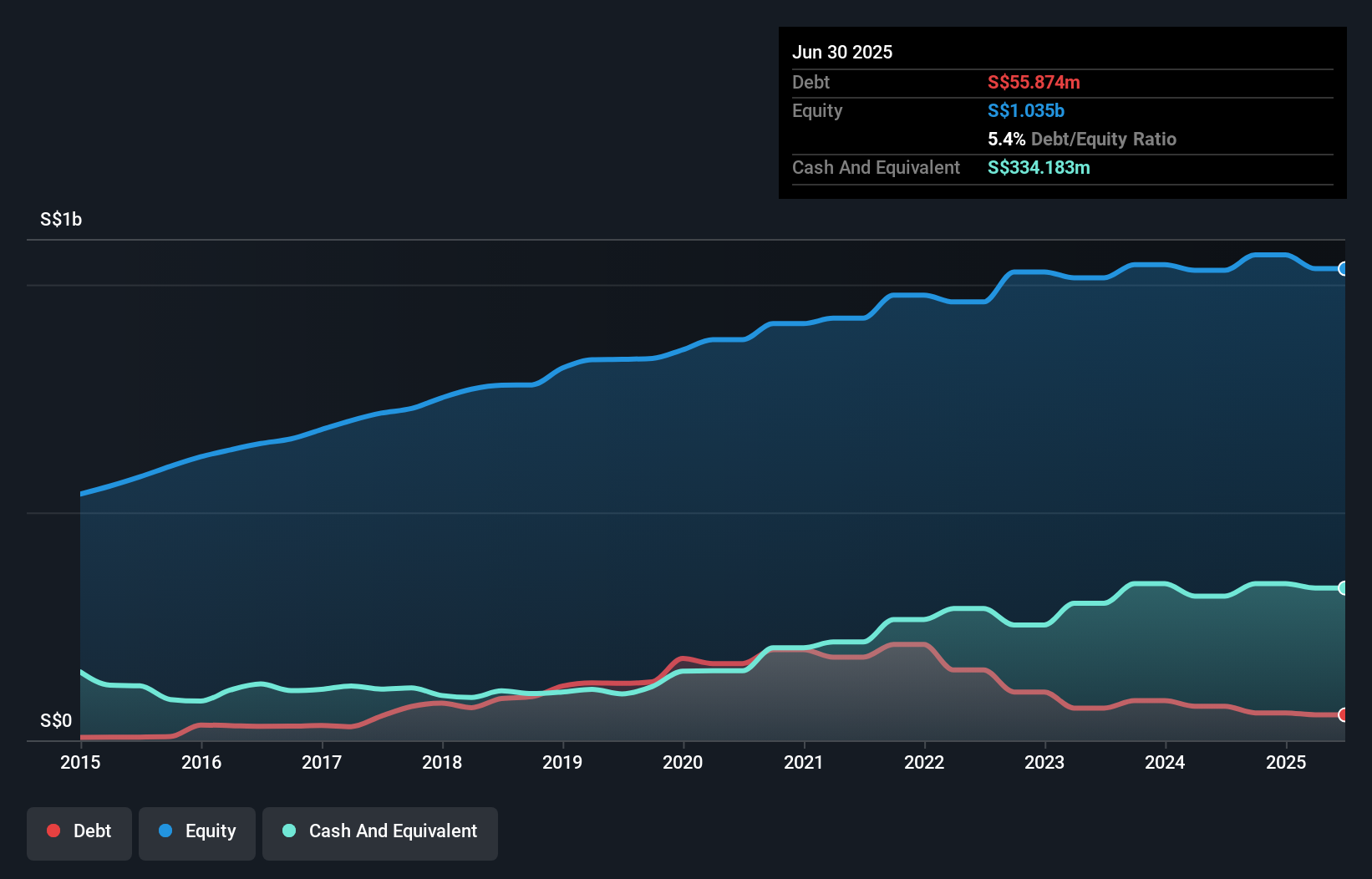

Raffles Medical Group, with a market cap of SGD1.87 billion, has shown financial stability, with short-term assets exceeding both its long-term and short-term liabilities. The company trades significantly below estimated fair value and has reduced its debt-to-equity ratio from 19.2% to 5.4% over five years while maintaining more cash than total debt. However, earnings have grown by only 0% annually over the past five years despite recent acceleration to 4.5%. The recent appointment of Ms. Woo Yeng Yeng as CFO could enhance strategic financial management amid an unstable dividend track record and low return on equity at 6.2%.

- Click here and access our complete financial health analysis report to understand the dynamics of Raffles Medical Group.

- Review our growth performance report to gain insights into Raffles Medical Group's future.

Where To Now?

- Dive into all 945 of the Asian Penny Stocks we have identified here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tongguan Gold Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:340

Tongguan Gold Group

An investment holding company, engages in the exploration, mining, processing, smelting, and sale of gold and related products in China.

High growth potential with solid track record.

Market Insights

Community Narratives