- Hong Kong

- /

- Electrical

- /

- SEHK:1072

Why Dongfang Electric (SEHK:1072) Is Up 9.0% After Posting Higher Sales and Net Income for Q3

Reviewed by Sasha Jovanovic

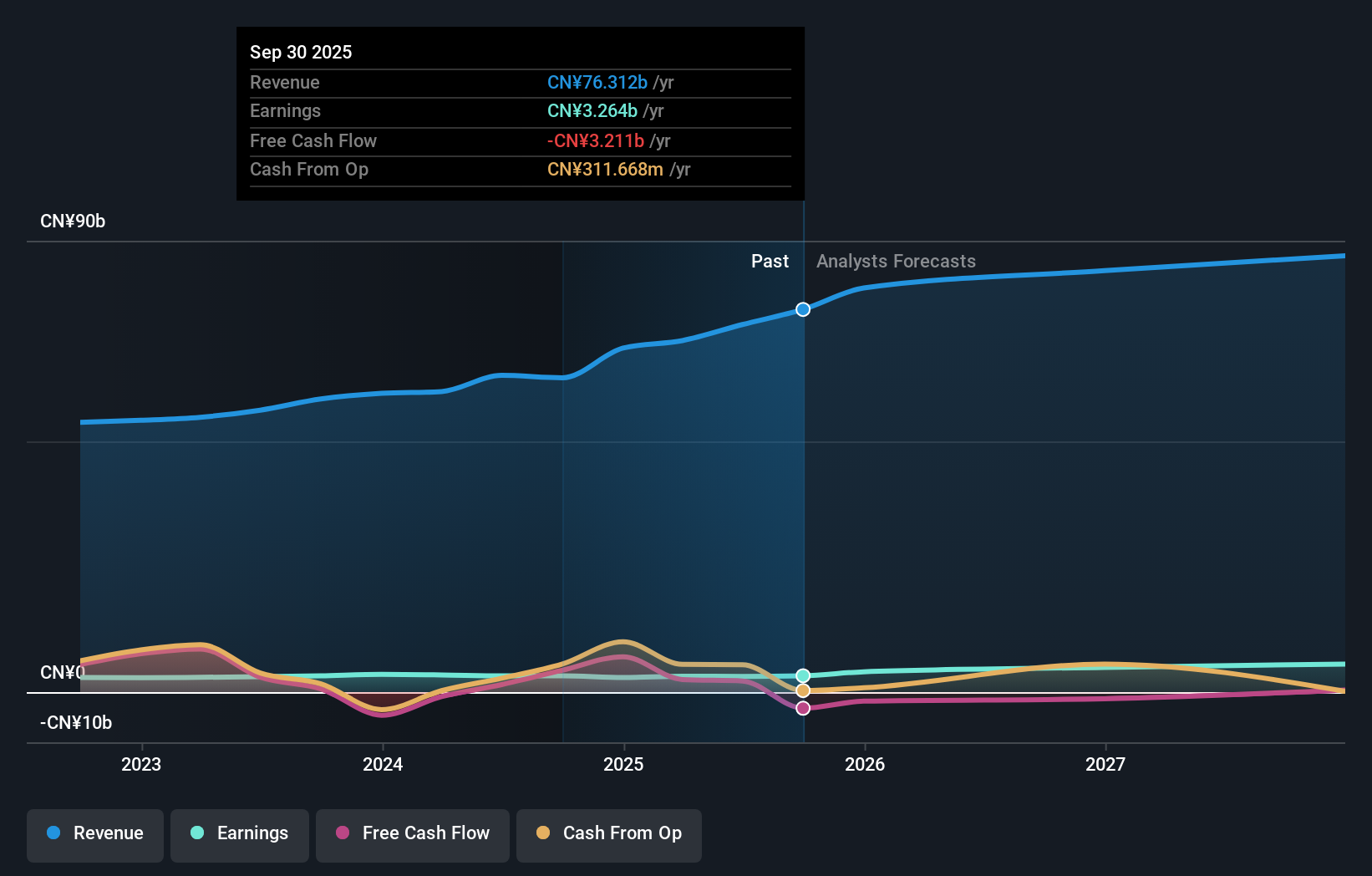

- Earlier this month, Dongfang Electric Corporation Limited released earnings results for the nine months ended September 30, 2025, reporting sales of CNY 54.74 billion and net income of CNY 2.97 billion, both higher than the same period last year.

- The company also announced plans to amend its Articles of Association, with changes pending shareholder approval at an upcoming extraordinary general meeting.

- We'll explore how Dongfang Electric's strong earnings growth reinforces its investment story and potential for business improvement ahead.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Dongfang Electric's Investment Narrative?

To see Dongfang Electric as a compelling holding, you’d need confidence in its ability to sustain earnings momentum while weathering recent board changes and evolving market dynamics. The latest results, higher sales and net income over last year, add weight to the narrative of operational improvement and reinforce short-term optimism around execution and demand. The proposed amendments to the Articles of Association, set for shareholder approval, are unlikely to disrupt the main business catalysts immediately but do highlight ongoing changes in corporate governance. Past analysis called out board inexperience and rapid turnover as key risks, and these remain relevant given continuing updates at the top. While fresh financials provide reassurance, the real test will be how smoothly the company adjusts as its leadership continues to evolve and strategic priorities shift.

But board inexperience is an ongoing concern all investors should keep front of mind. Dongfang Electric's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Dongfang Electric - why the stock might be worth less than half the current price!

Build Your Own Dongfang Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dongfang Electric research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dongfang Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dongfang Electric's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1072

Dongfang Electric

Engages in the design, develop, manufacture, and sale of power generation equipment in China and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives