- Hong Kong

- /

- Electrical

- /

- SEHK:1072

Dongfang Electric (SEHK:1072): Evaluating Valuation After Strong Revenue and Net Income Growth in 2025

Reviewed by Simply Wall St

Dongfang Electric (SEHK:1072) just released its earnings for the first nine months of 2025, showing clear gains in both revenue and net income compared to the same stretch last year. This strong performance is attracting attention from investors.

See our latest analysis for Dongfang Electric.

Dongfang Electric’s upbeat 2025 earnings report builds on a remarkable year for shareholders. The company’s share price has jumped 128.8% year-to-date and total shareholder return has exceeded 100%. This surge reflects both accelerating growth and renewed investor confidence. Recent amendments proposed to the company’s Articles of Association hint at further changes on the horizon.

If you’re looking for other opportunities beyond traditional names, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With such a rapid rise in both earnings and share price, the critical question now is whether Dongfang Electric’s stock still offers value for new investors or if the current price already reflects all anticipated growth.

Price-to-Earnings of 20.7: Is it justified?

Dongfang Electric’s shares are currently trading at a price-to-earnings ratio of 20.7, which suggests the stock is attractively valued relative to its peers.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings. For a company like Dongfang Electric, which has demonstrated robust profit growth and strong returns for shareholders, the P/E offers a snapshot of how the market views its earnings potential.

Despite the recent surge in share price, Dongfang Electric’s P/E of 20.7 is considerably lower than both the peer average of 30.5 and the industry average of 34.2. When compared to the estimated fair P/E ratio of 26, the current P/E also suggests potential for further upside if the market rerates the stock closer to its fair value.

Explore the SWS fair ratio for Dongfang Electric

Result: Price-to-Earnings of 20.7 (UNDERVALUED)

However, slower revenue growth or a shift in analyst sentiment could quickly temper the current optimism around Dongfang Electric’s stock.

Find out about the key risks to this Dongfang Electric narrative.

Another View: Is the Stock Overvalued?

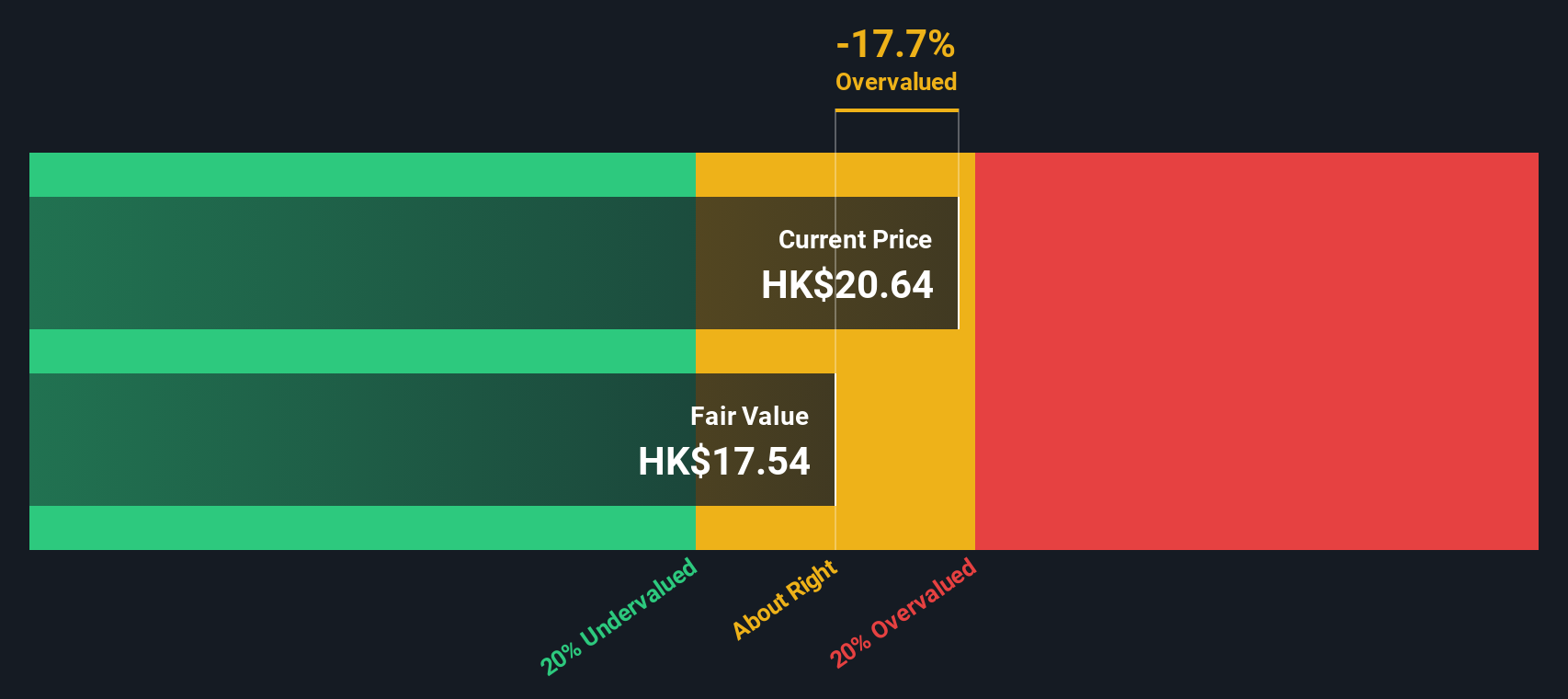

Looking at Dongfang Electric through the lens of our DCF model provides a different perspective. The SWS DCF model estimates a fair value of HK$17.41, while the current share price sits higher at HK$21.3. This suggests the market may have already priced in much of the expected growth. Which valuation should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dongfang Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dongfang Electric Narrative

If you feel differently or want to analyze the numbers firsthand, you can quickly build your own interpretation of Dongfang Electric’s story in just minutes. Do it your way

A great starting point for your Dongfang Electric research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Find Your Next Big Opportunity?

Stop waiting on the sidelines while others jump on emerging trends. The Simply Wall Street Screener makes it easy to find your next high-potential investment right now.

- Tap into powerful long-term growth by reviewing these 848 undervalued stocks based on cash flows. See which companies have room to run based on their real cash flows.

- Supercharge your portfolio with passive income and stability by browsing these 17 dividend stocks with yields > 3%, offering strong, reliable yields above 3%.

- Stay ahead of tech innovation and seize early opportunities with these 25 AI penny stocks, which benefit from breakthroughs in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1072

Dongfang Electric

Engages in the design, develop, manufacture, and sale of power generation equipment in China and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives