SEHK Dividend Stocks Spotlight China Shenhua Energy And Two More

Reviewed by Simply Wall St

As global markets navigate through volatility and economic uncertainties, the Hong Kong market has shown resilience with the Hang Seng Index posting a modest gain. In this environment, dividend stocks can offer a stable income stream, making them an attractive option for investors seeking reliability amidst market fluctuations. When selecting dividend stocks, it's crucial to consider companies with strong fundamentals and consistent payout histories. This article will spotlight three such stocks listed on the SEHK: China Shenhua Energy and two more noteworthy contenders.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Lenovo Group (SEHK:992) | 3.78% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.80% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.41% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.91% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 9.90% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.23% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.12% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.48% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 6.94% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.84% | ★★★★★☆ |

Click here to see the full list of 84 stocks from our Top SEHK Dividend Stocks screener.

We'll examine a selection from our screener results.

China Shenhua Energy (SEHK:1088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Shenhua Energy Company Limited, with a market cap of HK$837.09 billion, operates in the production and sale of coal and power as well as railway, port, and shipping transportation businesses both in China and internationally.

Operations: China Shenhua Energy Company Limited's revenue segments (in millions of CN¥) are as follows: Coal: 273.67 billion, Power: 93.61 billion, Railway: 43.62 billion, Port: 6.84 billion, Shipping: 4.92 billion, and Coal Chemical: 6.08 billion.

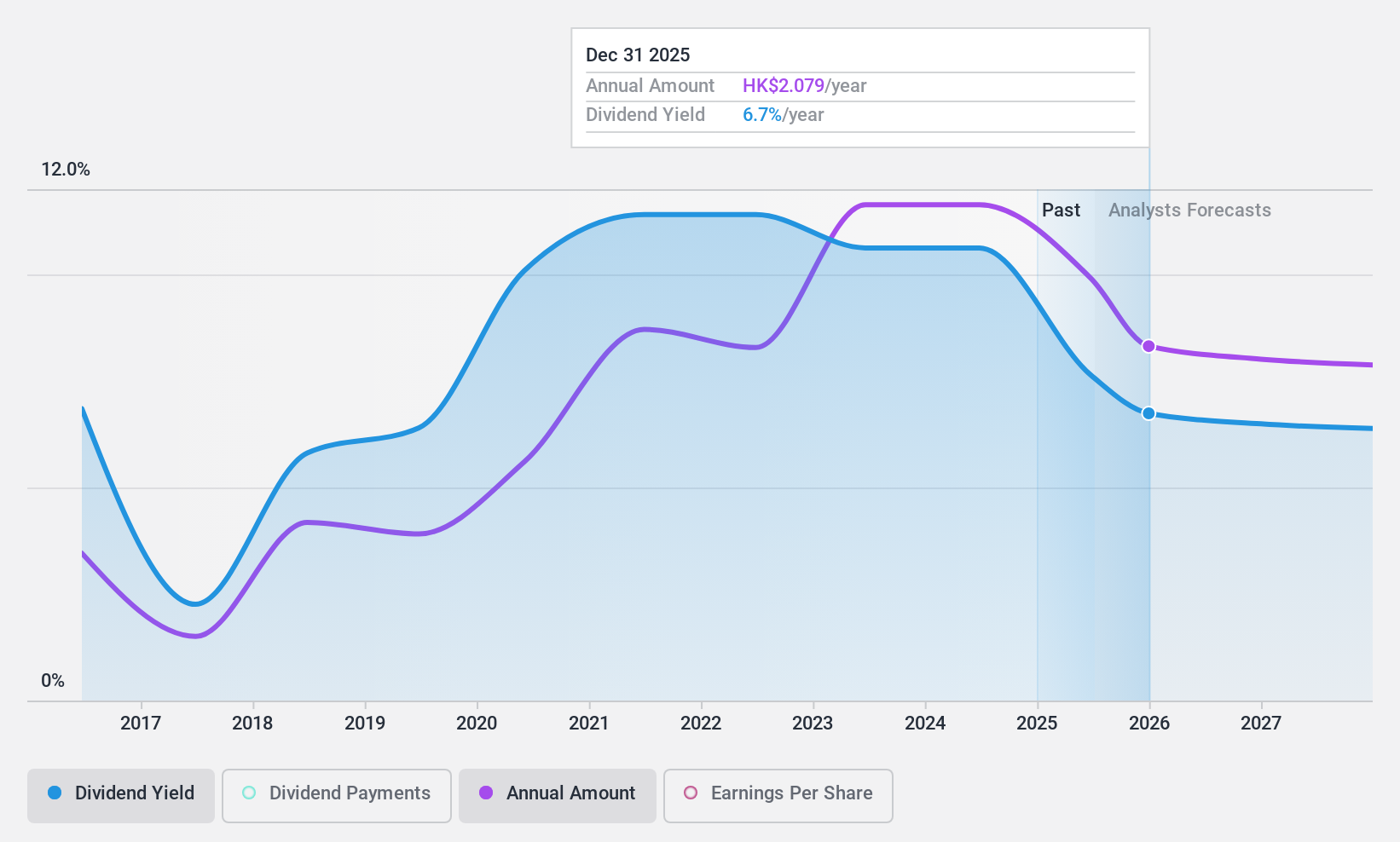

Dividend Yield: 7.3%

China Shenhua Energy's dividend payments are covered by earnings (payout ratio: 79.1%) and cash flows (cash payout ratio: 87%). However, the dividends have been volatile over the past decade, with occasional drops exceeding 20%, making them unreliable. Recent news includes a final ordinary dividend of RMB 2.26 per share for FY2023 and a reported decrease in first-half profits for 2024 by up to 13.8%.

- Take a closer look at China Shenhua Energy's potential here in our dividend report.

- Our expertly prepared valuation report China Shenhua Energy implies its share price may be lower than expected.

PC Partner Group (SEHK:1263)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PC Partner Group Limited, with a market cap of HK$1.68 billion, is an investment holding company that designs, develops, manufactures, and sells computer electronics.

Operations: The company's revenue segment primarily consists of HK$9.17 billion from the design, manufacturing, and trading of electronics and PC parts and accessories.

Dividend Yield: 9.2%

PC Partner Group's recent earnings guidance indicates a significant improvement, with expected net profit rising to HK$150 million for the first half of 2024 from HK$20 million in the same period last year. Despite this, the company's dividend payments remain volatile and unreliable over the past decade. The high payout ratio (191.2%) suggests dividends are not well covered by earnings, although they are supported by cash flows due to a low cash payout ratio (4.4%).

- Get an in-depth perspective on PC Partner Group's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that PC Partner Group is trading behind its estimated value.

Bank of Communications (SEHK:3328)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Communications Co., Ltd. offers commercial banking products and services in China, with a market cap of HK$533.31 billion.

Operations: Bank of Communications Co., Ltd.'s revenue segments include Personal Banking (CN¥81.71 billion), Treasury Business (CN¥20.99 billion), and Corporate Banking Business (CN¥97.35 billion).

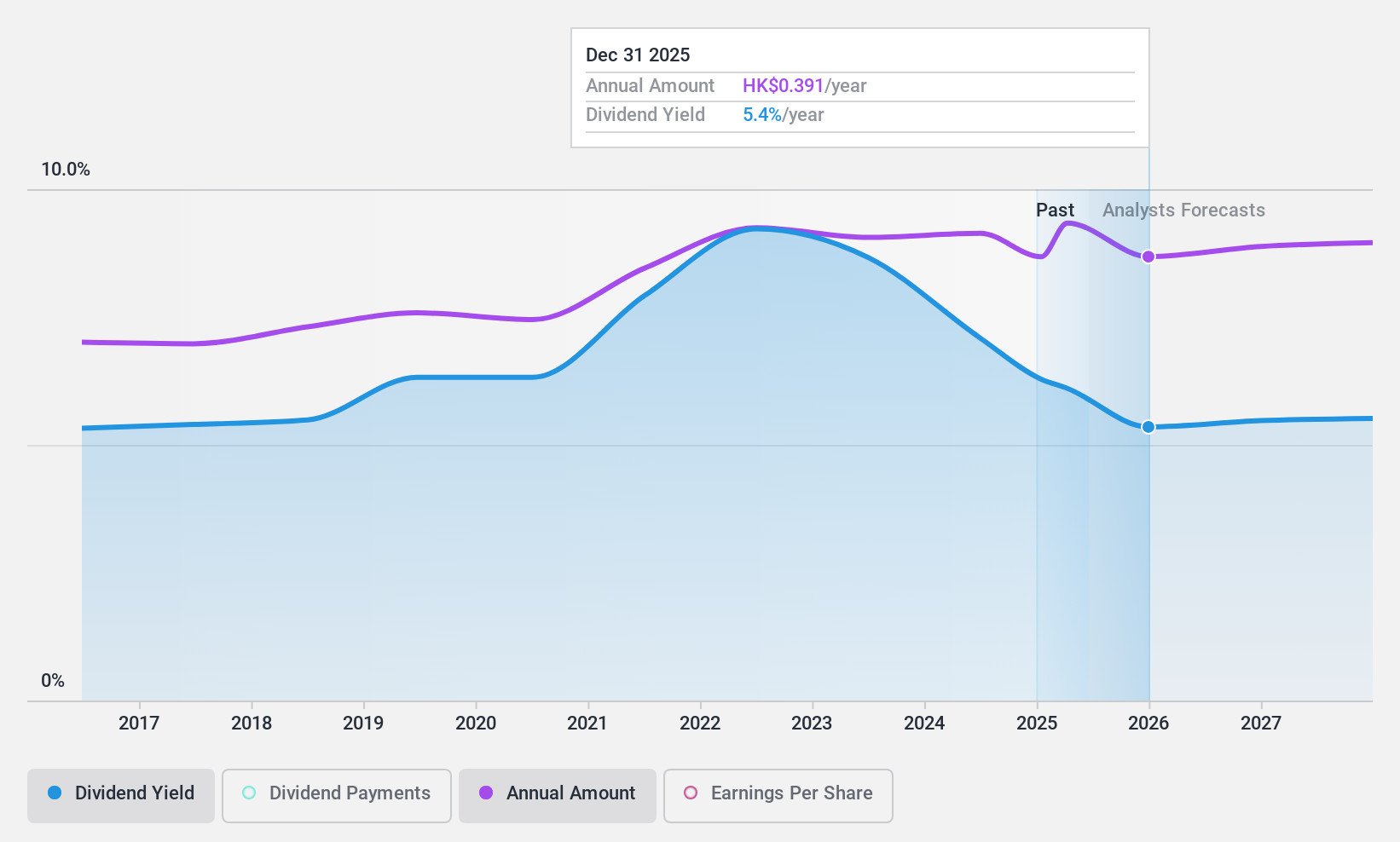

Dividend Yield: 6.9%

Bank of Communications offers a stable dividend, having consistently increased payments over the past decade. The current payout ratio of 32.7% indicates dividends are well covered by earnings, with forecasts suggesting continued coverage at 31.2%. Recent news includes a final dividend distribution of RMB 0.375 per share for 2023 and the completion of an CNY 800 million fixed-income offering, which may support financial stability and future payouts.

- Click here to discover the nuances of Bank of Communications with our detailed analytical dividend report.

- According our valuation report, there's an indication that Bank of Communications' share price might be on the cheaper side.

Next Steps

- Access the full spectrum of 84 Top SEHK Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3328

Bank of Communications

Provides commercial banking products and services in China.

Flawless balance sheet, undervalued and pays a dividend.