Does BOC Hong Kong's (SEHK:2388) Steady Dividend Payout Reflect a Focused Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- BOC Hong Kong (Holdings) Limited recently announced a third quarter dividend of HK$0.29 per share for the period ended September 30, 2025, with the ex-dividend date on November 12, 2025, record date on November 20, and payment date on November 26.

- This dividend affirmation delivers certainty and highlights the company's commitment to consistent shareholder returns, which can bolster investor confidence.

- With the third quarter dividend now confirmed, we'll explore how reliable dividend payouts may influence BOC Hong Kong's broader investment story.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

BOC Hong Kong (Holdings) Investment Narrative Recap

To see BOC Hong Kong (Holdings) as an investment, you need to believe in the bank's ability to deliver steady income amid a complex global environment, where consistent dividends matter but pressures on net interest margin (NIM) and asset quality remain the key swing factors. The recent dividend affirmation reinforces reliability for income-focused investors, but it does not materially shift attention from the biggest short-term catalyst, expansion in private banking, or from core risks like commercial property exposures and rate pressures.

The most relevant recent update is the company’s ongoing streak of quarterly dividend payments, with Q3’s HK$0.29 per share following identical payouts in previous quarters. This pattern signals consistency, but underlying business challenges, especially related to maintaining NIM under higher funding costs, still set the tone for the near term and carry more weight for the bank’s future returns.

On the other hand, investors should keep a close eye on signs of stress in Hong Kong’s commercial property market, as...

Read the full narrative on BOC Hong Kong (Holdings) (it's free!)

BOC Hong Kong (Holdings) is projected to reach HK$80.2 billion in revenue and HK$41.7 billion in earnings by 2028. This implies a 4.8% annual revenue growth rate and a HK$1.4 billion increase in earnings from HK$40.3 billion today.

Uncover how BOC Hong Kong (Holdings)'s forecasts yield a HK$38.60 fair value, in line with its current price.

Exploring Other Perspectives

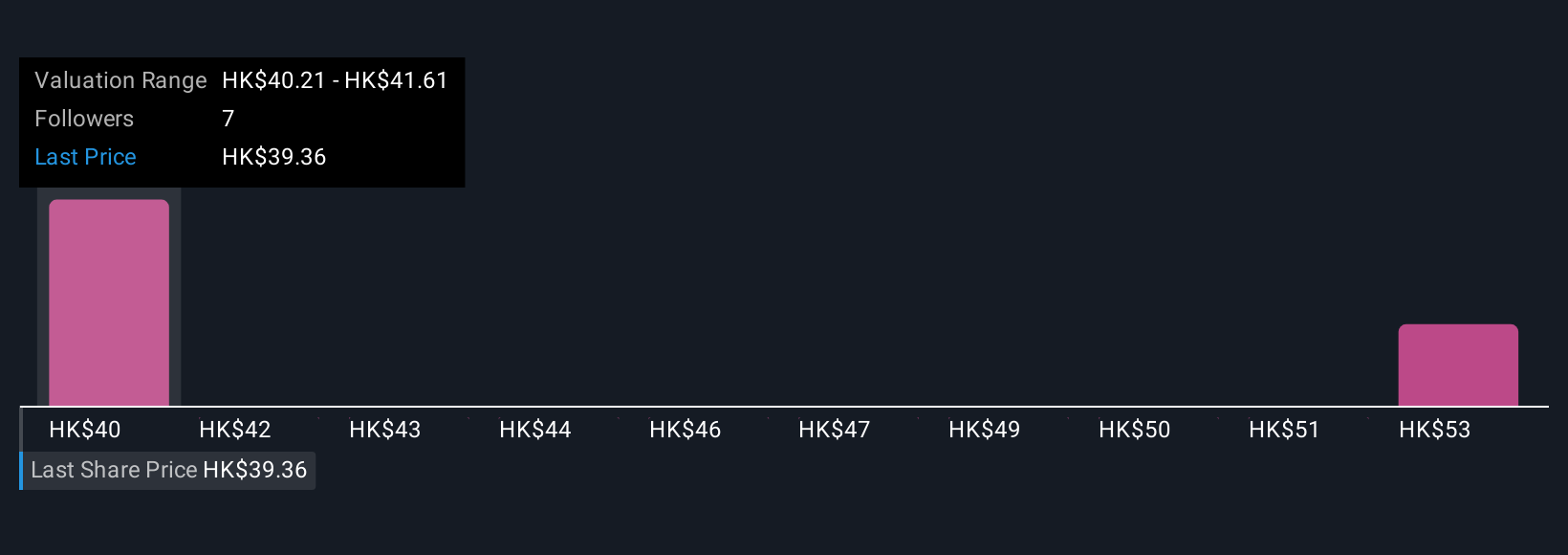

Community fair value estimates for BOC Hong Kong (Holdings) range from HK$38.60 to HK$54.25 across two perspectives in the Simply Wall St Community. While investor opinions are split, risks tied to net interest margin compression could play a significant role in shaping future results, consider a wider variety of forecasts before forming your own view.

Explore 2 other fair value estimates on BOC Hong Kong (Holdings) - why the stock might be worth as much as 39% more than the current price!

Build Your Own BOC Hong Kong (Holdings) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BOC Hong Kong (Holdings) research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BOC Hong Kong (Holdings) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BOC Hong Kong (Holdings)'s overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOC Hong Kong (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2388

BOC Hong Kong (Holdings)

An investment holding company, provides banking and related financial services to corporate and individual customers in Hong Kong, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives