A Closer Look at Bank of East Asia (SEHK:23) Valuation as It Pilots AI-Driven Innovation

Reviewed by Simply Wall St

Bank of East Asia (SEHK:23) is teaming up with CLPS Incorporation to test Nibot, an artificial intelligence agent designed to automate banking operations and strengthen risk management. The pilot project aims to increase efficiency and support regulatory compliance.

See our latest analysis for Bank of East Asia.

Bank of East Asia’s push into AI-driven automation comes after a rallying 39% year-to-date share price return, reflecting renewed momentum and investor optimism following steady progress in annual revenue and profit. Over the longer term, patient shareholders have enjoyed a 49% total return in the past year and an impressive 90% total return over three years, setting the stock apart among local financials.

If you’re interested in uncovering other swift-growing companies with insider conviction, it is the perfect moment to check out fast growing stocks with high insider ownership.

But with such strong recent returns and BEA’s growing focus on innovation, is there still unrecognized value in the shares? Or has the market already factored in the benefits of future AI-driven growth?

Price-to-Earnings of 8.1x: Is it justified?

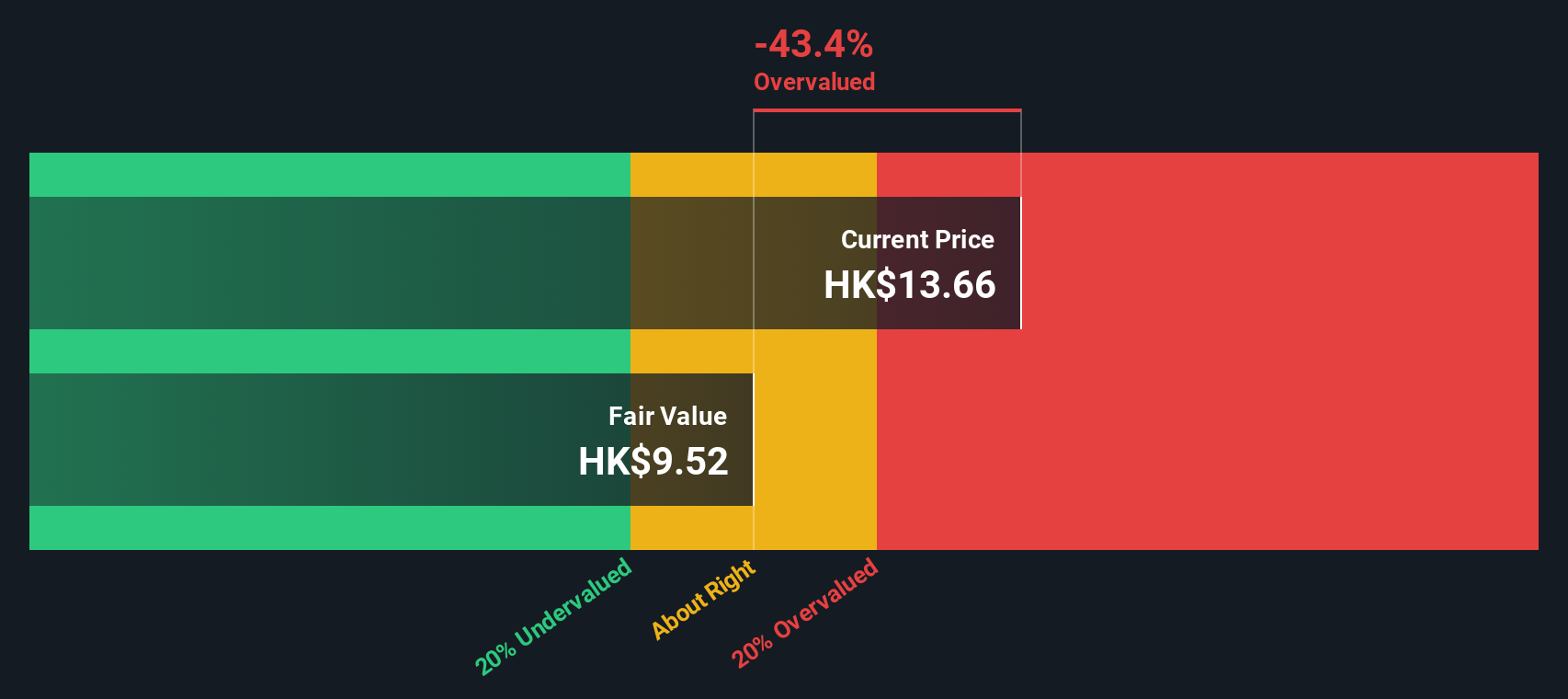

Bank of East Asia's current price-to-earnings ratio of 8.1x is notably higher than the average for Hong Kong banks, signaling that the market is attaching a premium to its shares relative to peers. At a last close price of HK$13.66, this premium may not be easily justified by sector standards.

The price-to-earnings ratio, or P/E, compares a company's market value to its earnings. For banks, it is a key yardstick for how much investors are willing to pay for each dollar of profit, reflecting growth expectations and risk.

With Bank of East Asia's P/E standing above the Hong Kong bank industry average of 6x and a fair P/E estimate of 5.8x, the stock trades at a significant premium even after considering the company's recent growth spurt. If the market begins to align more closely with typical sector valuations or the calculated fair P/E, there could be a shift in sentiment.

Explore the SWS fair ratio for Bank of East Asia

Result: Price-to-Earnings of 8.1x (OVERVALUED)

However, slowing revenue and income growth or a return to average industry valuations could temper optimism and lead to a reappraisal of BEA's outlook.

Find out about the key risks to this Bank of East Asia narrative.

Another View: Discounted Cash Flow Model

Taking a step back from market multiples, our SWS DCF model estimates Bank of East Asia’s fair value at HK$9.52, which is well below the current share price. This suggests the stock could be overvalued if future cash flows do not outpace expectations. However, are these models missing a longer-term opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of East Asia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of East Asia Narrative

If you have a different perspective or want to test your own insights, why not dive into the numbers yourself and craft a unique view in just minutes? Do it your way

A great starting point for your Bank of East Asia research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more smart investment ideas?

Don’t wait for the next big opportunity to pass you by. Try these dynamic ways to spot stocks with strong potential and diversify your investing strategy today.

- Grow your income by seeking out top-performing companies with attractive yields using these 17 dividend stocks with yields > 3%.

- Fuel your portfolio with high-potential robotics, machine learning, and automation companies through these 25 AI penny stocks.

- Get ahead of market shifts by capitalizing on hidden value using these 861 undervalued stocks based on cash flows based on forward-looking cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of East Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:23

Bank of East Asia

Provides various banking and related financial services.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives