Postal Savings Bank of China (SEHK:1658) Valuation in Focus After Earnings Release and Boardroom Changes

Reviewed by Simply Wall St

Postal Savings Bank of China (SEHK:1658) just released its third quarter and nine-month earnings, along with the resignation of board member Mr. Han Wenbo. This combination of financial updates and leadership change has investors taking notice.

See our latest analysis for Postal Savings Bank of China.

After a brisk start to the year, Postal Savings Bank of China’s share price has climbed 26.4% year-to-date, while its 1-year total shareholder return stands at an impressive 30.5%. Recent corporate governance changes and steady earnings updates have fueled fresh momentum as investors adjust their views on risk and growth potential.

If the recent boardroom shifts and share price gains have you rethinking your portfolio, now may be a good time to broaden your search and discover fast growing stocks with high insider ownership.

With the share price up and recent numbers a mixed bag, the real question is whether Postal Savings Bank of China remains undervalued, or if investors have already priced in all of its potential growth.

Price-to-Earnings of 7.8: Is it justified?

Postal Savings Bank of China’s shares are trading on a price-to-earnings (P/E) ratio of 7.8, which is higher than both the Hong Kong bank industry average and the broader peer group. With the last close at HK$5.7, the market seems to be paying a premium for the stock relative to competitors.

The price-to-earnings ratio measures how much investors are willing to pay per dollar of earnings, making it a crucial yardstick for valuing banks and other profit-generating businesses. A higher P/E can reflect market optimism, future growth potential, or, in some cases, overexuberance.

Postal Savings Bank of China’s P/E of 7.8 is notably above the Hong Kong bank industry’s average P/E of 6, and also higher than its peer group average of 7.2. The market currently values the company more richly than its rivals. Compared to its estimated fair price-to-earnings ratio of 6.7, there is further evidence the market might have run ahead of fundamentals. If investor sentiment changes, valuations could revert to lower levels.

Explore the SWS fair ratio for Postal Savings Bank of China

Result: Price-to-Earnings of 7.8 (OVERVALUED)

However, slower net income growth and a modest discount to analyst price targets could pose risks if market optimism fades.

Find out about the key risks to this Postal Savings Bank of China narrative.

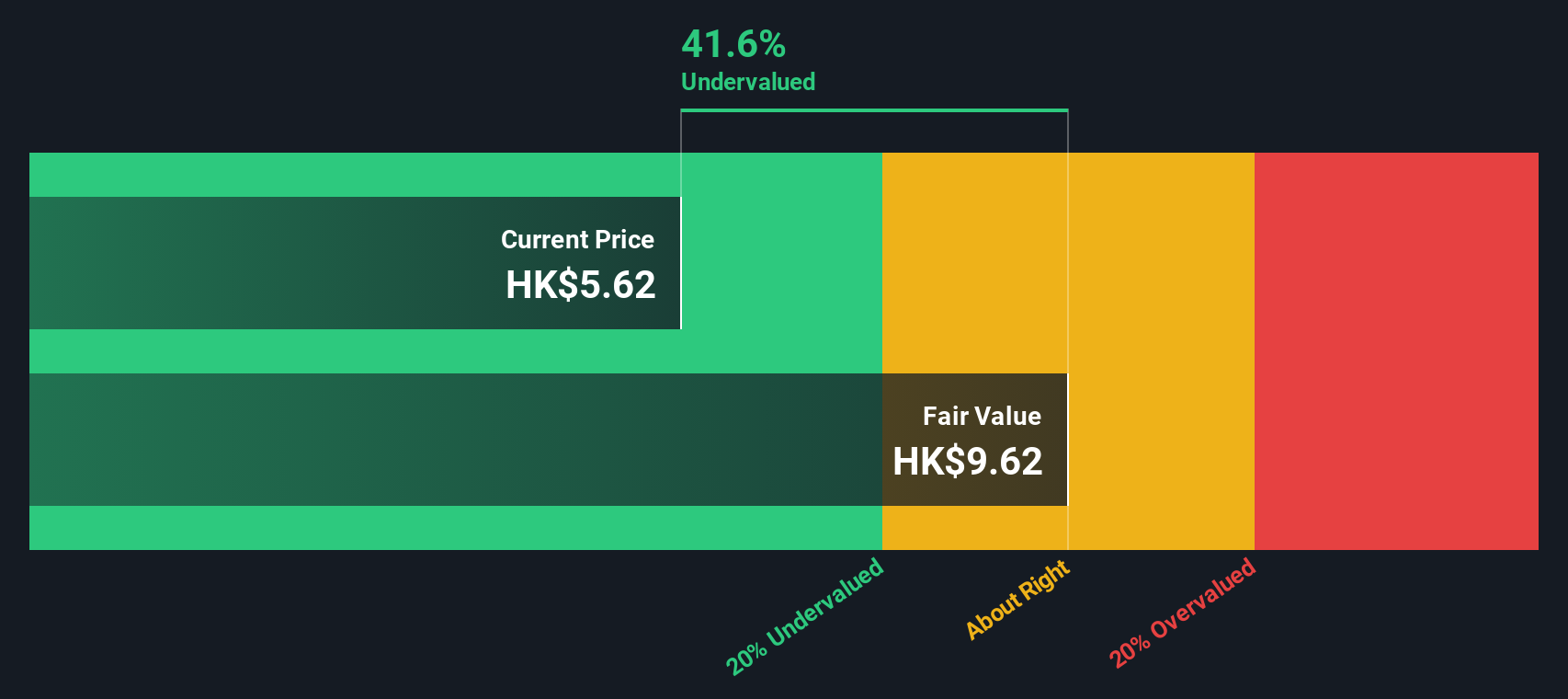

Another View: Discounted Cash Flow Suggests Undervaluation

Looking at the SWS DCF model, a very different picture appears. While the market values Postal Savings Bank of China at HK$5.7 per share, our DCF estimate puts fair value much higher at HK$9.63. This suggests the stock is actually undervalued. Does this long-term cash flow outlook change how the risk looks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Postal Savings Bank of China for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Postal Savings Bank of China Narrative

If you see the story unfolding differently or enjoy hands-on analysis, you can put together your own view in just a few minutes, so Do it your way.

A great starting point for your Postal Savings Bank of China research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more great investment ideas?

Stay ahead of the crowd with smarter stock picks, handpicked to help you capture untapped potential before the mainstream catches on. Don’t hesitate; opportunities like these move fast.

- Unlock growth by tapping into these 857 undervalued stocks based on cash flows, where strong cash flows reveal stocks trading at attractive discounts.

- Boost your income potential with these 17 dividend stocks with yields > 3%, offering generous yields above 3% and a focus on stability.

- Ride the next technological wave and seize your chance with these 25 AI penny stocks already shaping tomorrow’s artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1658

Postal Savings Bank of China

Provides various banking products and services for retail and corporate customers in the People’s Republic of China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives