Hang Seng Bank (HKG:11) Has Announced That Its Dividend Will Be Reduced To HK$0.70

Hang Seng Bank Limited (HKG:11) is reducing its dividend to HK$0.70 on the 7th of Junewhich is 36% less than last year. Based on this payment, the dividend yield will be 3.4%, which is lower than the average for the industry.

View our latest analysis for Hang Seng Bank

Hang Seng Bank's Dividend Is Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. The last dividend made up quite a large portion of free cash flows, and this was made worse by the lack of free cash flows. This is a pretty unsustainable practice, and could be risky if continued for the long term.

Looking forward, earnings per share is forecast to rise by 22.5% over the next year. If the dividend continues on this path, the payout ratio could be 56% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

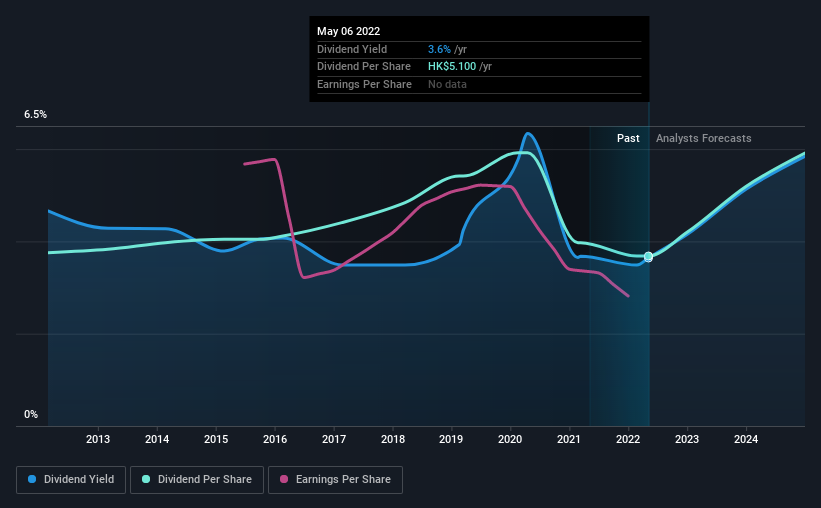

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The first annual payment during the last 10 years was HK$5.20 in 2012, and the most recent fiscal year payment was HK$5.10. Payments have been decreasing at a very slow pace in this time period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. In the last five years, Hang Seng Bank's earnings per share has shrunk at approximately 3.5% per annum. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

Hang Seng Bank's Dividend Doesn't Look Sustainable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Hang Seng Bank has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Hang Seng Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:11

Hang Seng Bank

Provides various banking and related financial services to individual, corporate, commercial, small and medium-sized enterprises, and institutional customers in Hong Kong, the Mainland of China, and internationally.

Proven track record with adequate balance sheet and pays a dividend.