These 4 Measures Indicate That Nafpaktos Textile Industry (ATH:NAYP) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Nafpaktos Textile Industry S.A. (ATH:NAYP) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Nafpaktos Textile Industry

What Is Nafpaktos Textile Industry's Net Debt?

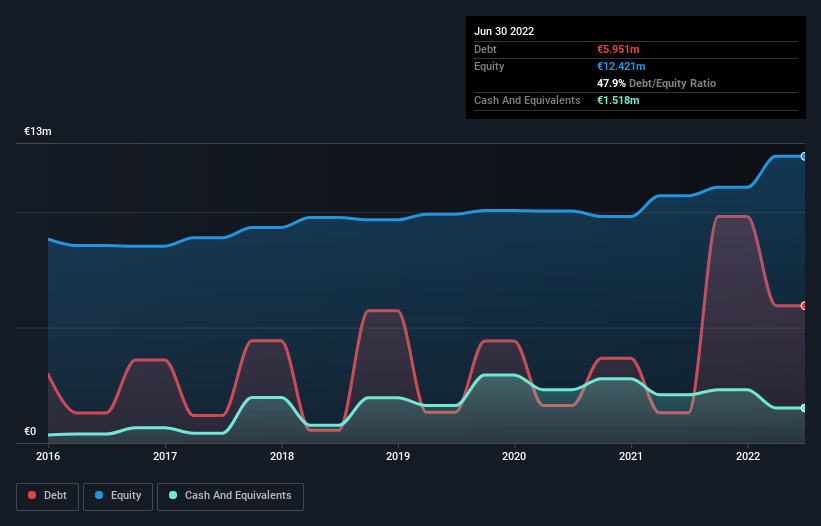

As you can see below, at the end of June 2022, Nafpaktos Textile Industry had €5.95m of debt, up from €1.31m a year ago. Click the image for more detail. However, it also had €1.52m in cash, and so its net debt is €4.43m.

How Strong Is Nafpaktos Textile Industry's Balance Sheet?

We can see from the most recent balance sheet that Nafpaktos Textile Industry had liabilities of €3.93m falling due within a year, and liabilities of €4.39m due beyond that. Offsetting these obligations, it had cash of €1.52m as well as receivables valued at €3.77m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €3.03m.

Nafpaktos Textile Industry has a market capitalization of €12.4m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Nafpaktos Textile Industry's net debt to EBITDA ratio of about 1.9 suggests only moderate use of debt. And its commanding EBIT of 14.1 times its interest expense, implies the debt load is as light as a peacock feather. Importantly, Nafpaktos Textile Industry grew its EBIT by 62% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Nafpaktos Textile Industry will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Nafpaktos Textile Industry saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Nafpaktos Textile Industry is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. When we consider all the elements mentioned above, it seems to us that Nafpaktos Textile Industry is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Nafpaktos Textile Industry has 3 warning signs (and 2 which are significant) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Nafpaktos Textile Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:NAYP

Nafpaktos Textile Industry

Engages in the cotton ginning and production of cotton yarns in Greece.

Adequate balance sheet and fair value.

Market Insights

Community Narratives